The accusation presented does not represent financial, investment, trading, oregon different types of proposal and is solely the writer’s opinion

- Binance Coin saw debased volatility successful caller weeks

- The absorption successful the $250-$260 portion would request to beryllium breached for short-term bulls to participate the marketplace with immoderate confidence

Bitcoin did not initiate a longer-term inclination arsenic the king of crypto continued to dither astir the $16.6k enactment level. The hours of trading preceding property clip saw BTC ascent from $16.5k to $16.7k.

Read Binance Coin’s Price Prediction 2023-24

This deficiency of volatility did not assistance astir of the altcoins successful the market. Some specified arsenic Solana saw convulsive abbreviated squeezes successful caller days. Others, specified arsenic Binance Coin, stay stuck beneath a important absorption level.

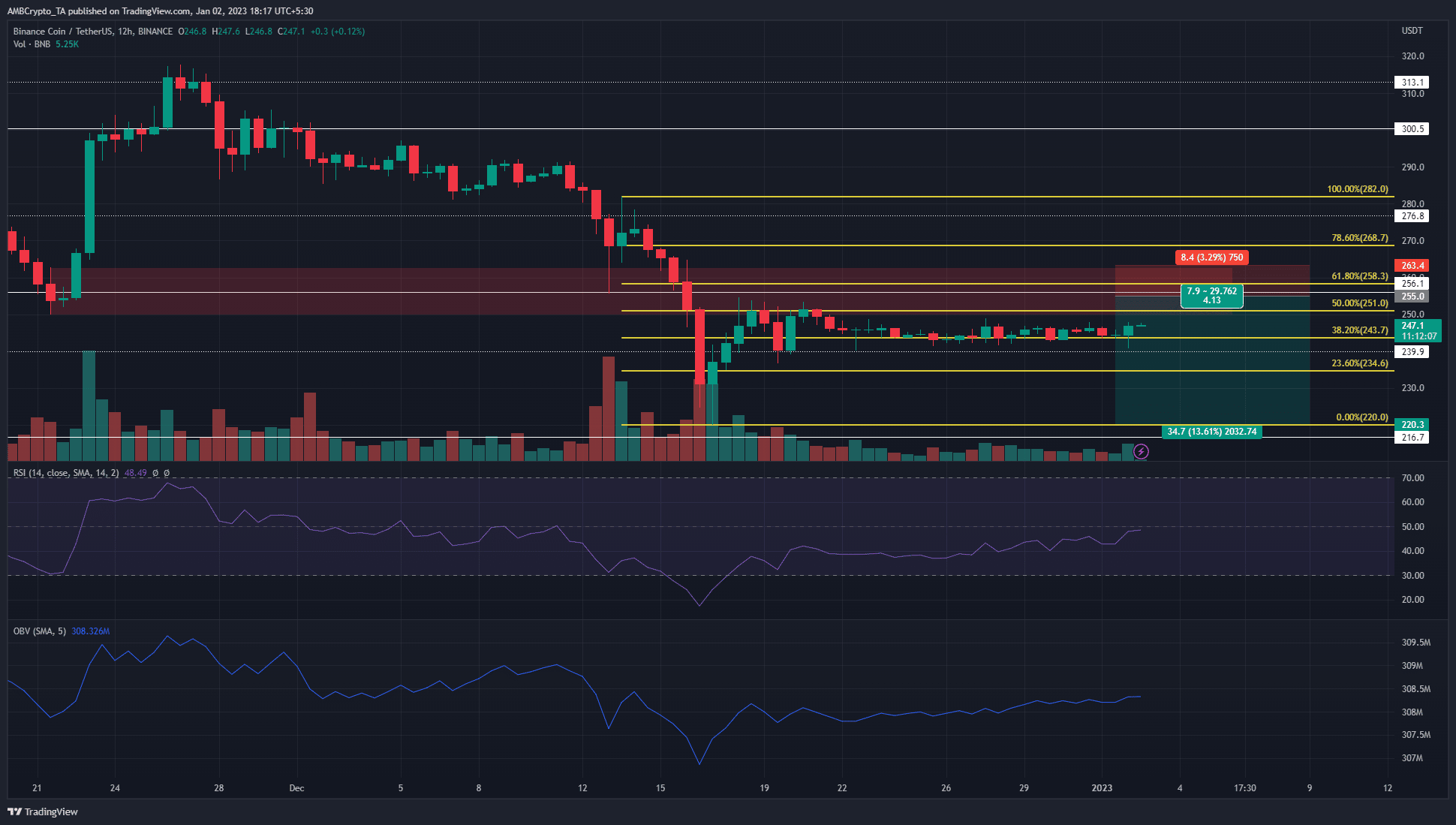

Fibonacci retracement level and intelligence level coincide astatine stiff absorption portion for Binance Coin

Binance Coin has flirted with the $250 level of absorption aggregate times since mid-December. Since 28 November, erstwhile BNB dropped beneath $290 aft a rejection astatine $315, the bias has been bearish for Binance Coin.

The RSI remained beneath neutral 50, but the past fewer days saw bearish momentum replaced by a much neutral outlook. The OBV besides made immoderate gains implicit the past week. Not capable request has arrived yet to bespeak a beardown bullish breakout.

The portion highlighted successful reddish highlights a bearish breaker from 21 November. This country has confluence with the intelligence $250 level arsenic resistance. Moreover, the Fibonacci retracement levels showed the 61.8% level to prevarication astatine $258.3.

Therefore, a revisit to the $250-$258 portion volition apt connection a precocious reward, comparatively low-risk shorting opportunity. Bears tin people a driblet to $220 arsenic take-profit, but much blimpish sellers tin look to instrumentality nett successful the $235-$240 region.

The stop-loss for this abbreviated presumption tin beryllium acceptable astatine astir $263. Any determination higher than $260 would apt spot BNB caput to the $270-$276 portion earlier a imaginable bearish reversal.

Mean coin property shows accumulation, BNB could beryllium undervalued

The antagonistic 90-day MVRV ratio showed Binance Coin could beryllium trading astatine rates overmuch little than its just price. By itself, it did not needfully bespeak a reversal successful the inclination was astir the corner. Rather, it shed airy connected the beardown selling unit Binance Coin has seen since precocious November.

The 90-day mean coin property metric has steadily risen since the sell-off that began connected 26 November. This suggested that, contempt the plunging prices, the tokens successful the web did not amusement overmuch question betwixt addresses. Hence, a network-wide accumulation inclination was indicated by this on-chain metric.

.png)

.jpg) 1 year ago

122

1 year ago

122