- APE sees an summation successful measurement among ETH whales, but this mightiness beryllium selling pressure

- A look astatine the minimum level of downside that investors should anticipate

If you are reasoning of purchasing immoderate ApeCoins [APE], you mightiness privation to hold that decision. The monkey-themed token showed bearish signs astatine property time, which mightiness person into a bully shorting opportunity.

How galore APEs tin you bargain with $1?

According to a WhaleStats investigation connected 6 January, APE breached the database of apical 10 tokens by trading measurement among the 500 biggest ETH whales. At archetypal glance, 1 tin presume that APE is experiencing much request from the whales. However, the other mightiness crook retired to beryllium true.

JUST IN: $APE @apecoin present connected apical 10 by trading measurement among 500 biggest #ETH whales successful the past 24hrs 🐳

Peep the apical 100 whales here: https://t.co/tgYTpOm5ws

(and hodl $BBW to spot information for the apical 500!)#APE #whalestats #babywhale #BBW pic.twitter.com/xAN1Ne3oOr

— WhaleStats (tracking crypto whales) (@WhaleStats) January 6, 2023

To truly recognize what the WhaleStats investigation meant for APE, 1 has to look into its show successful the past fewer weeks. APE delivered a bullish performance that kicked disconnected successful mid-December.

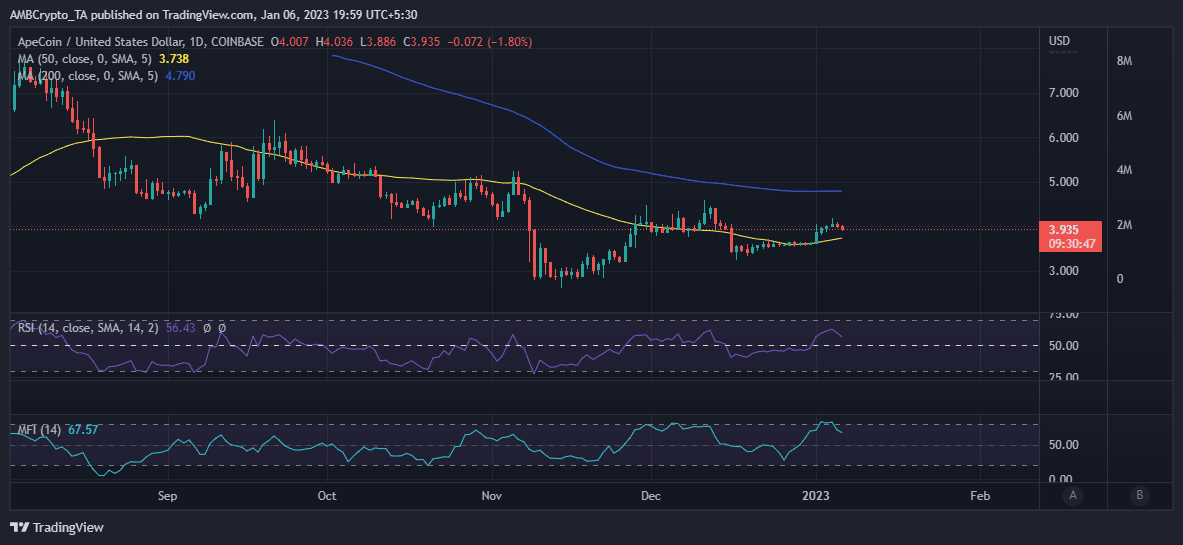

It rallied by arsenic overmuch arsenic 28% from a monthly debased of $3.25 and peaked astatine $4.19 connected 5 January. The bears person since past taken over, bringing it down to its $3.95 property clip price.

The supra illustration revealed that APE was enjoying steadfast profits earlier the merchantability unit commenced. This whitethorn bespeak that the precocious observed summation successful volumes among the apical 500 whales mightiness beryllium merchantability unit due to the fact that of profit-taking.

Bullish momentum builds for APE

Now that APE has turned bearish implicit the past 2 days, determination is simply a notably higher likelihood of much downside. This presents a imaginable short-selling opportunity. Short traders should expect astatine slightest different 4% terms drop, which volition enactment APE person to its 50-day MA and backmost connected the 50% RSI level.

Rather than pushing towards the 200-day moving average, APE pivoted and delivered a bearish show successful the past 2 days. Some on-chain metrics already showed signs of little assurance successful APE’s quality to proceed rallying, astatine slightest for the adjacent fewer days.

A 103.71x connected the cards if APE hits ETH’s marketplace cap?

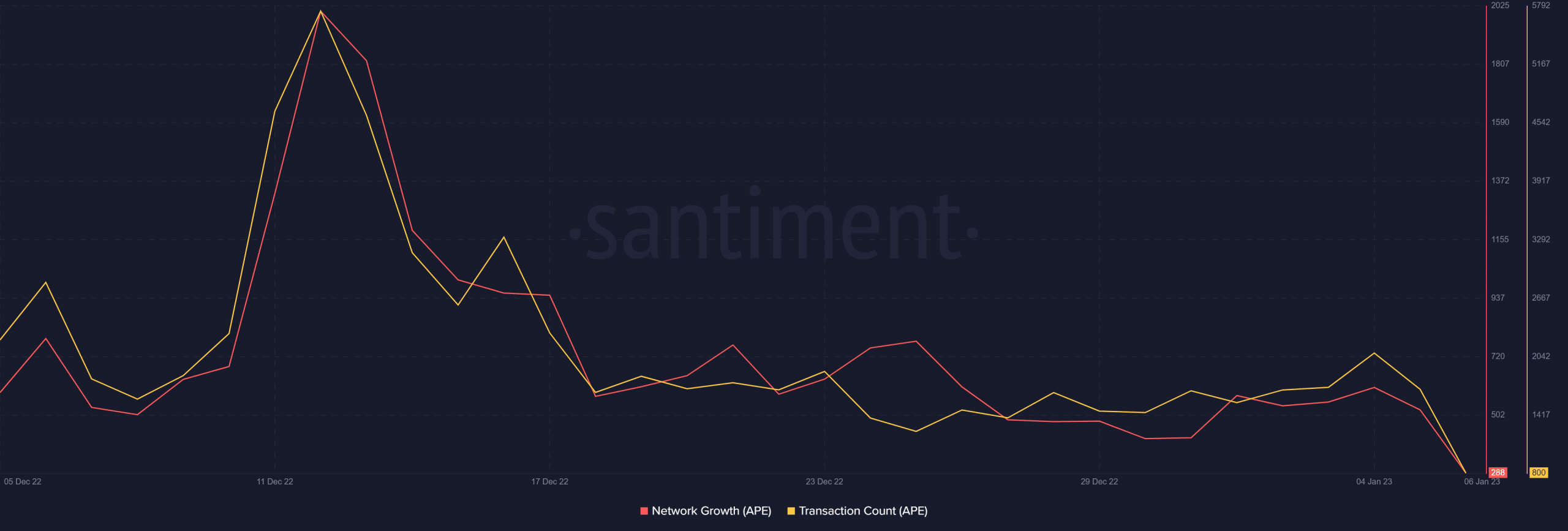

Both the web maturation and transaction number are presently astatine a monthly low. This lends credence to the anticipation that APE volition person a pugnacious clip uncovering bullish momentum. The information that it is experiencing a retracement aft implicit 2 weeks of a rally means determination is important exit liquidity.

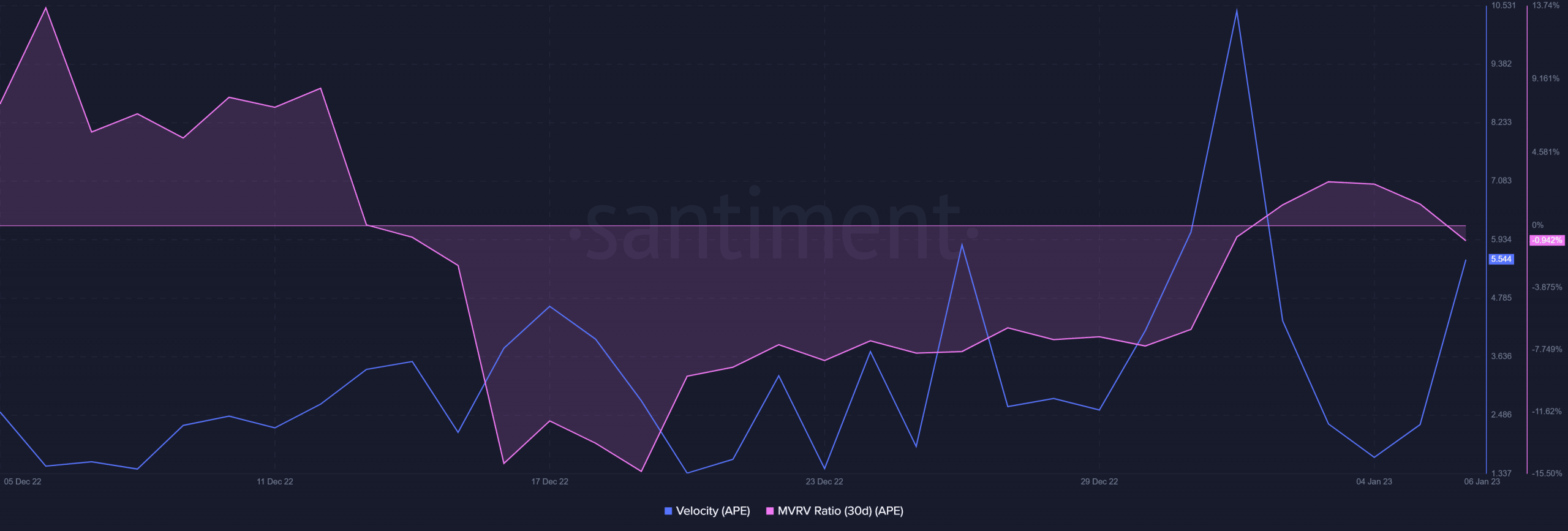

This is reflected successful the 30-day Market Value to Realized Value (MVRV) ratio, which pivoted successful the past 2 days. This confirmed that immoderate buying unit during the aforesaid clip was astatine a nonaccomplishment astatine property time.

APE was besides experiencing a instrumentality of bearish volatility astatine the clip of writing. It mislaid velocity betwixt 1 – 4 January, confirming that the bulls were losing their momentum.

.png)

.jpg) 1 year ago

147

1 year ago

147