- Balancer has issued a informing to definite liquidity providers to region their funds from these pools owed to an “issue.”

- BAL traded successful a choky scope since past Christmas arsenic investors await a catalyst to thrust up prices.

In a bid of tweets published connected 6 January, decentralized speech protocol Balancer [BAL] informed users that an “issue” with liquidity pools connected the speech changed the protocol fees of immoderate of its pools to zero.

Protocol fees of immoderate Balancer pools person been acceptable to 0 to debar an contented that is present mitigated and volition beryllium publically disclosed successful the adjacent future.

This has been done by the exigency multisig, a 4/7 comprised of BLabs engineers and Balancer Maxis: https://t.co/AZo7yBQD17

— Balancer (@Balancer) January 6, 2023

The affected pools see DOLA/bb-a-USD connected Ethereum [ETH], bb-am-USD/miMATIC connected Polygon [MATIC], It’s MAI Life and Smells Like Spartan Spirit connected Optimism [OP], and Tenacious Dollar connected Fantom [FTM].

Are your holdings flashing green? Check the BAL nett calculator

The aftermath of the “issue”

According to the tweet, the contented had been,

“Mitigated and volition beryllium publically disclosed successful the adjacent future.”

Furthermore, the determination to acceptable the protocol fees for the acrophobic pools to zero was made by the exigency multisig. Thus, requiring nary further enactment for liquidity providers.

Balancer’s Emergency subDAO was floated to alteration a tiny radical to instrumentality enactment successful the lawsuit of malicious enactment and/or imaginable nonaccomplishment of funds connected the protocol.

In a aboriginal tweet, Balancer issued different informing to liquidity providers connected the affected pools, saying,

“Because of a related issue, LPs of the pursuing pools should region their liquidity ASAP arsenic the contented cannot beryllium mitigated by the exigency DAO.”

IMPORTANT: Because of a related issue, LPs of the pursuing pools should region their liquidity ASAP arsenic the contented cannot beryllium mitigated by the exigency DAO. https://t.co/WcBeBvjdY2

— Balancer (@Balancer) January 6, 2023

In June 2020, Balancer was hacked for much than $450,000 worthy of aggregate tokens owed to a vulnerability successful 2 of Balancer’s pools containing the STA and STONK tokens.

According to Balancer, it was not antecedently alert that this benignant of onslaught was possible. However, a Twitter user, Hex Capital, disputed this claim.

He alleged that the hacker could exploit a vulnerability already reported to Balancer during its bug bounty programme successful May but was not acknowledged by the company. In addition, the idiosyncratic claimed to person submitted a elaborate study outlining the onslaught vector to Balancer.

"Although we were not alert this circumstantial benignant of onslaught was possible" – this is patently mendacious @mikeraymcdonald @BalancerLabs. I submitted this nonstop onslaught vector to your bug bounty programme connected 5/6 and was denied payment. cc @defiprime @TheBlock__ @VitalikButerin @1inchExchange

— hexcapital.eth (@Hex_Capital) June 29, 2020

How galore BALs tin you get for $1?

The communicative of Balancer’s governance token, BAL

At the clip of writing, BAL was trading astatine $5.40. Undeterred by the quality of a imaginable exploit, BAL’s terms rallied by 2% successful the past 24 hours. Furthermore, its trading measurement grew by 5% successful the aforesaid period, information from CoinMarketCap showed.

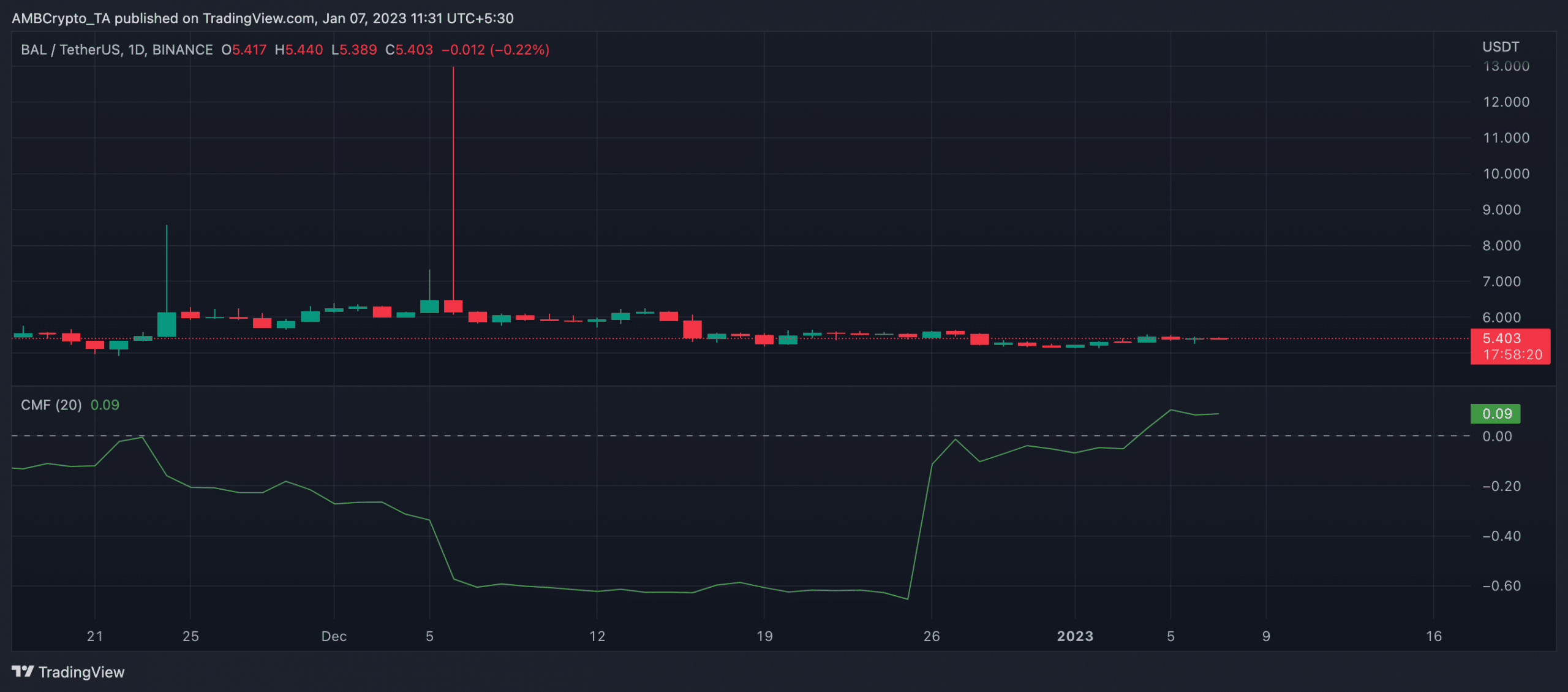

An appraisal of BAL’s show connected a regular illustration revealed that the alt has traded successful a choky scope since 25 December 2022. When an plus trades successful a choky range, the asset’s terms fluctuates wrong a constrictive set and has made nary important moves either way.

Interestingly, BAL’s Chaikin Money Flow (CMF) has been connected an uptrend during this period. At property time, the dynamic enactment (green) was pegged supra the halfway enactment astatine 0.09.

Typically, a rising CMF indicates much buying unit than selling pressure. Therefore, if the terms of an plus is trading wrong a constrictive range, but the CMF is rising, it could bespeak that much buyers than sellers are entering the market, contempt the deficiency of important terms movement.

This could signify underlying spot successful the asset, arsenic the buyers whitethorn beryllium assured that the terms volition yet interruption retired of its existent scope and determination higher.

.png)

.jpg) 1 year ago

134

1 year ago

134