- The $15,000 terms people could beryllium a bully terms bottommost for BTC

- The SOPR 30MA showed that a bottommost enactment mightiness beryllium connected BTC’s horizon

A further diminution to the $15,000 terms scope could people the terms bottommost for starring coin, Bitcoin [BTC], CryptoQuant expert Nakju opined successful a report.

According to Nakju, galore traders often usage BTC’s Coin Days Destroyed (CDD) metric to measure the movements of long-held coins connected the BTC network. These traders besides construe the aforesaid arsenic a merchantability signal.

Are your BTC holdings flashing green? Check the Profit Calculator

However, Nakju opined that the CDD metric could besides correspond volatility alternatively than conscionable beryllium utilized to measure the due clip to sell. Taking a cue from the humanities show of BTC’s CDD, it has acted arsenic a precursor to some large terms plunges and important terms rises.

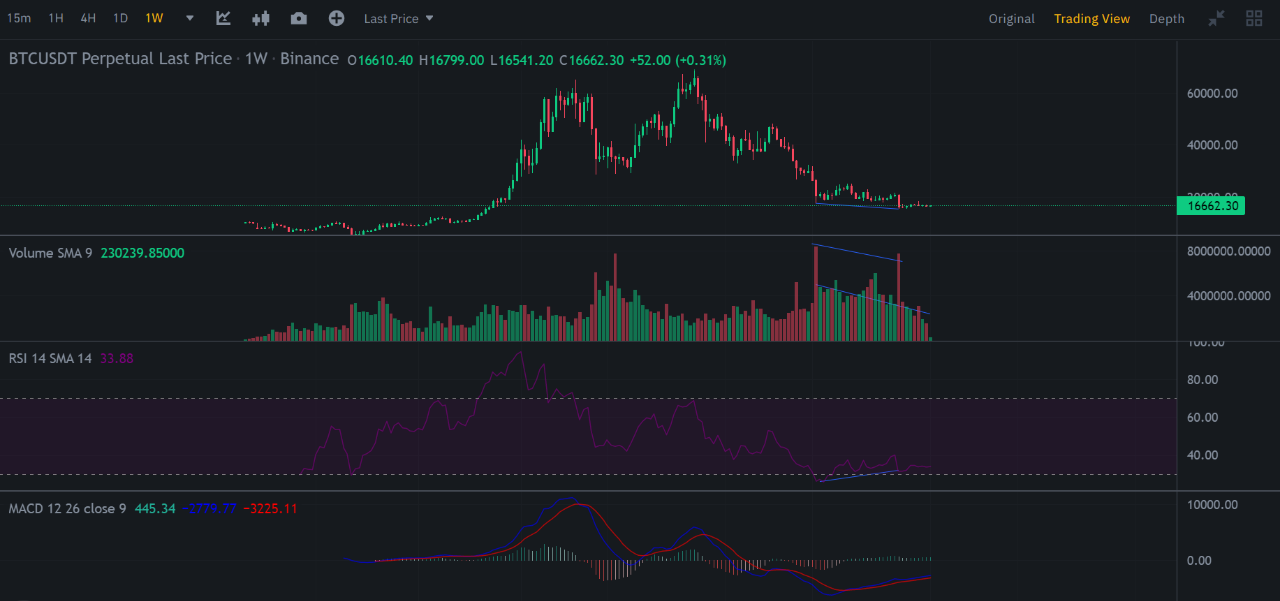

Furthermore, arsenic per Nakju, if BTC’s terms plummets to $15,000, it could play successful favour of investors. He believed that the terms scope could beryllium arsenic a bully illustration of erstwhile BTC would typically log a regular bullish divergence marked by a play of debased trading measurement and an oversold Relative Strength Index (RSI).

According to Nakju, inclination reversals “of immoderate plus occurs erstwhile the measurement of transactions is small.” Hence, the $15,000 terms people mightiness beryllium a terms bottommost to beryllium followed by a semipermanent rally successful BTC’s price.

Another CryptoQuant expert Onchain Edge, recovered that the existent worth of the king coin’s SOPR MA30 was 0.54. This was portion assessing BTC’s Spent Output Profit Ratio (SOPR) connected a 30-day moving average.

According to the analyst, the existent SOPR level acted arsenic a carnivore marketplace bottommost indicator successful erstwhile carnivore cycles successful 2012, 2014, and 2018. Furthermore, Onchain Edge recommended utilizing dollar outgo averaging (DCA) and mounting accumulation targets arsenic BTC gears up to interaction the carnivore market’s bottom.

He besides advised BTC investors to stay bullish successful 2023.

Day traders are not dilly-dallying

As of this writing, BTC traded astatine $16,733.07 per information from CoinMarketCap. An appraisal of the king coin’s show connected a four-hour illustration revealed accrued accumulation by time traders.

As of this writing, the Relative Strength Index (RSI) was successful an uptrend astatine 60.88. Similarly, the Money Flow Index (MFI) was seated supra the 50-neutral people astatine 68.33. This indicated accrued BTC purchases by time traders.

Likewise, the dynamic enactment (green) of BTC’s Chaikin Money Flow (CMF) was pegged supra the halfway enactment astatine 0.22. A CMF worth supra the zero enactment is simply a motion of spot successful the market.

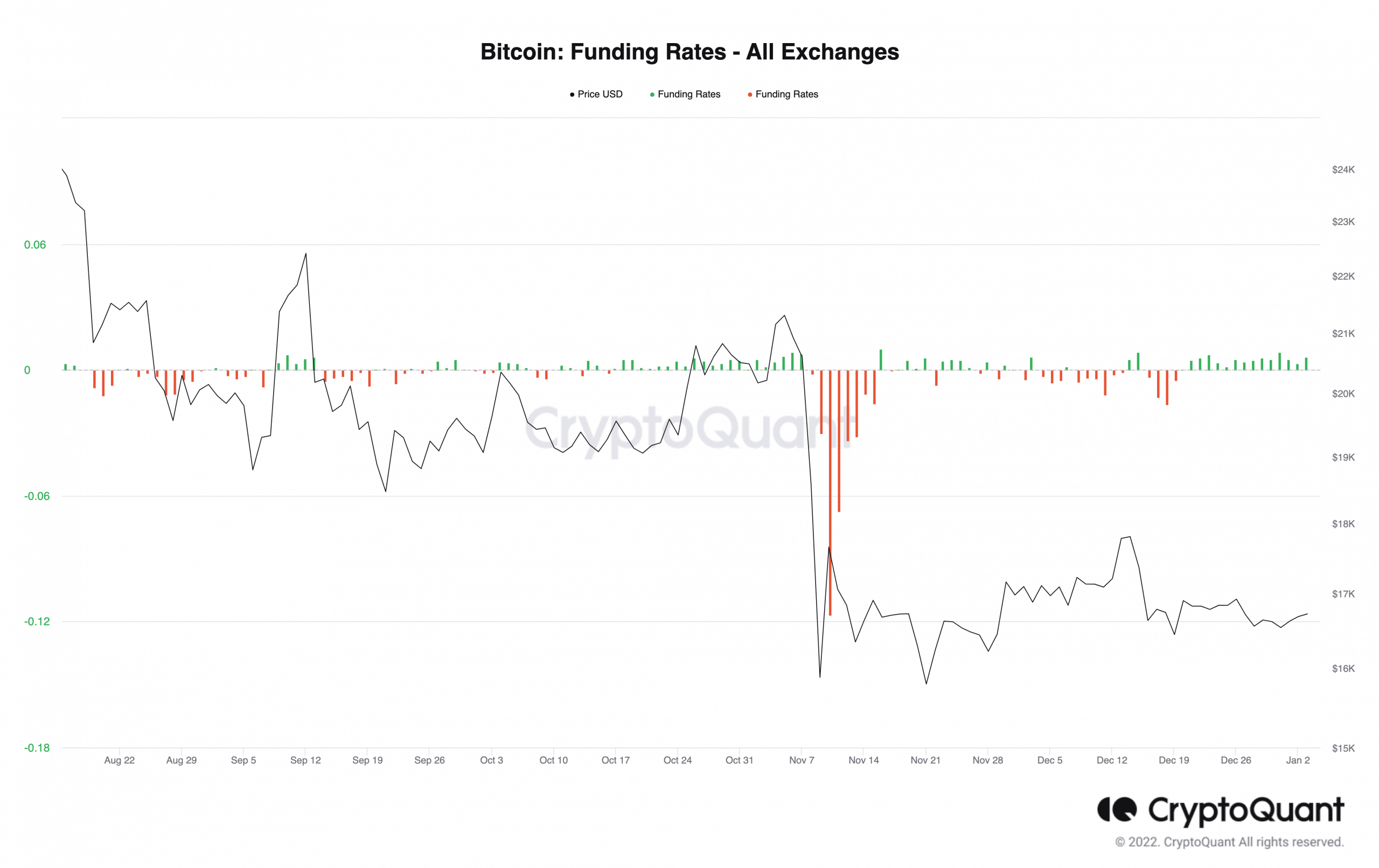

Finally, BTC’s backing rates astatine the clip of penning were affirmative and person been truthful since 21 December 2022, information from CryptoQuant revealed. This meant that long-position traders person since dominated the market, betting successful favour of an upward rally successful BTC’s price.

.png)

.jpg) 1 year ago

114

1 year ago

114