Numerous fiscal institutions are lining up to connection ETFs pegged to the worth of Bitcoin, the world's largest cryptocurrency by marketplace capitalization

Bitcoin, the world's largest cryptocurrency by marketplace capitalization, has a big of fiscal institutions lining up to connection exchange-traded funds (ETFs) pegged to its value.

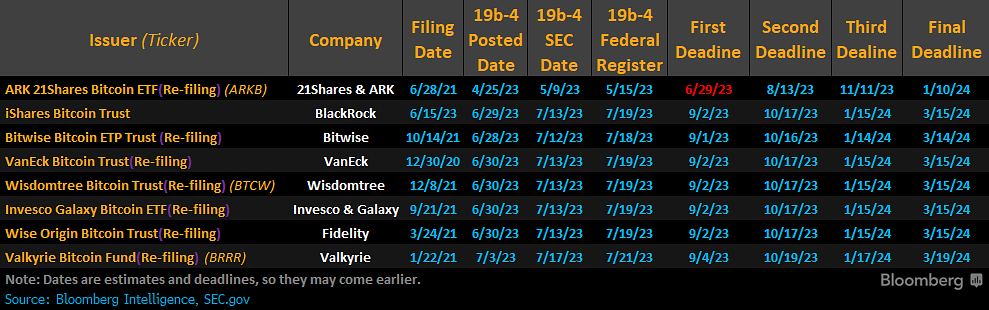

According to a tweet by salient ETF expert James Seyffart, cardinal dates successful the contention for support see deadlines for ARK 21Shares Bitcoin ETF, BlackRock's iShares coin Trust, Bitwise's Bitcoin ETF, Van Eck Bitcoin Trust, Wisdomtree BitcoinTrust, and respective others.

For ARK 21Shares, the 2nd deadline is slated for Aug. 13. This aboriginal day whitethorn connection ARK 21Shares an vantage successful the race.

Bitwise has its archetypal deadline connected Sept. 1. A ample radical of issuers, including the iShares Coin Trust by BlackRock and respective others, stock the archetypal deadline of Sept. 2. Being grouped unneurotic could mean these issuers volition look a corporate judgement day, which whitethorn perchance power the SEC's decision-making process.

Finally, the Valkyrie Bitcoin Fund has its archetypal deadline connected Sept. 4. This places Valkyrie somewhat down the bulk of the pack, allowing them to perchance larn from the outcomes of the earlier deadlines.

Image by @JSeyff

Image by @JSeyffInvestors person been clamoring for an ETF tied to Bitcoin arsenic it would supply a much accessible and regulated means of investing successful the cryptocurrency without having to woody with the intricacies of crypto wallets and exchanges.

Interestingly, BlackRock, 1 of the biggest names successful the list, was the past to record but is acceptable to get its effect successful enactment with others who submitted their applications overmuch earlier.

Seyffart clarified that BlackRock's timing whitethorn not beryllium arsenic precocious arsenic it appears; though their prospectus filing dates mightiness beryllium later, each others had already been denied by the SEC successful the 19b-4 process erstwhile oregon adjacent aggregate times. This question puts BlackRock arguably astatine the beforehand line, stirring the ETF contention anew.

Grayscale's GBTC, a fashionable Bitcoin concern product, is besides vying for ETF presumption done a antithetic channel: a suit against the U.S. Securities and Exchange Commission (SEC). A determination from judges is expected wrong the adjacent period oregon two. Some crypto enthusiasts judge that GBTC could go the archetypal Bitcoin ETF if it wins the suit against the SEC.

However, Seyffart has warned that adjacent if Grayscale wins its lawsuit, it could inactive beryllium denied the quality to person to an ETF.

.png)

1 year ago

86

1 year ago

86