- A look astatine on-chain metrics indicated that BTC’s terms mightiness diminution further successful 2023

- Many BTC holders person failed to spot profits connected their investments since FTX collapsed

An appraisal of 2 on-chain metrics revealed that Bitcoin’s [BTC] holders mightiness look a pugnacious twelvemonth successful 2023 arsenic antagonistic sentiment continued to way the king coin. Trading astatine $16,941.08 astatine property time, the BTC traded wrong the $16,500 and $16,900 since past December, per information from CoinMarketCap.

Read Bitcoin’s [BTC] Price Prediction 2023-24

CryptoQuant expert Gigisulivan assessed BTC’s Stock to Flow Reversion and opined that BTC’s terms mightiness dip further beneath the $16,700 terms people astatine immoderate constituent successful the existent carnivore market.

Gigisulivan predicted that BTC mightiness effort to commercialized successful the $20,000 to $22,000 terms scope pursuing the merchandise of favorable Consumer Price Index information (CPI) adjacent week. However, this suggested that BTC holders should not expect much, the expert concluded by adding that,

“Just a thought, considering 2023 could beryllium worse than 2022 erstwhile we cognize what benignant of recession we are getting.”

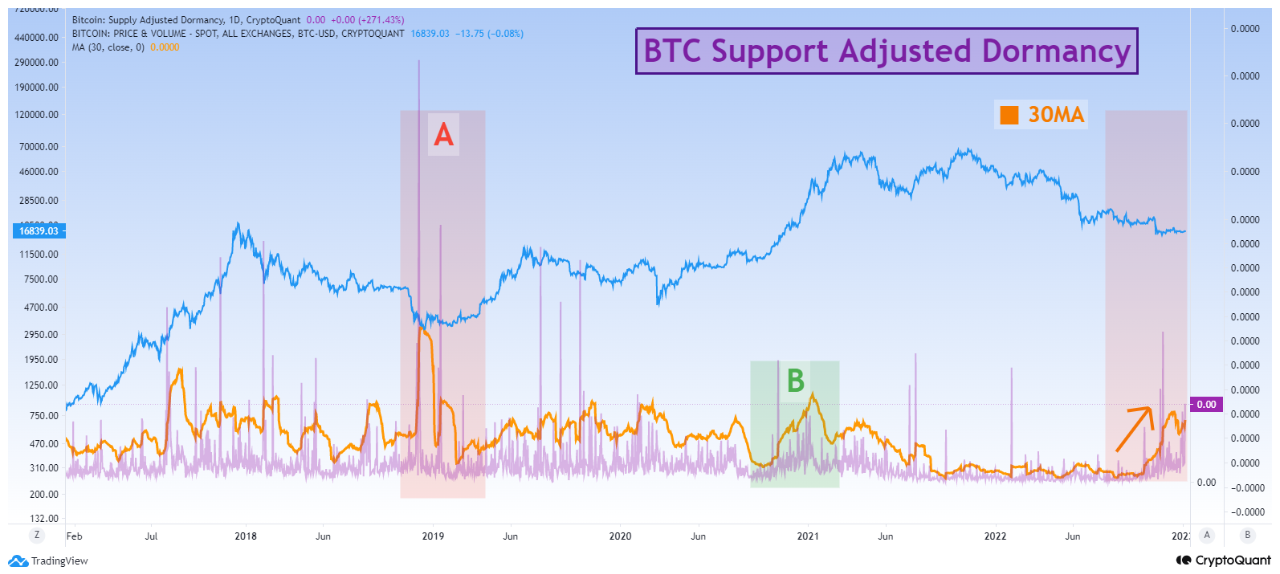

Another CryptoQuant analyst, Yonsei_dent, recovered that antagonistic sentiment continued to turn arsenic the semipermanent holders of Bitcoin intensified their coin distribution. Yonsei_dent considered BTC’s Support Adjusted Dormancy indicator and recovered that it has been connected an uptrend since the mediate of December.

Commenting connected the interaction of the continued emergence successful BTC’s dormancy from a marketplace inclination standpoint, Yonsei_dent considered humanities cues from BTC’s show successful the carnivore marketplace of 2018 and recovered that it indicated an summation successful sell-offs to hedge against further losses connected investments.

Bitcoin losers number their losses

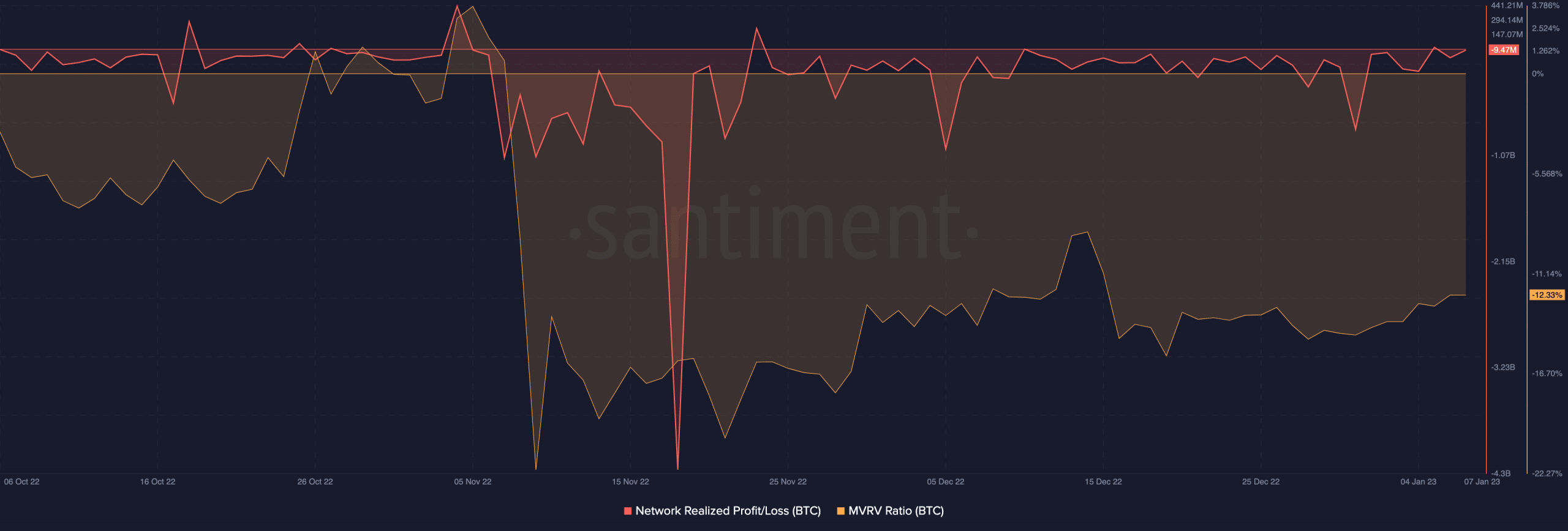

With lingering antagonistic sentiment since the fallout of FTX, BTC holders person since been plunged into losses. An appraisal of the king coin’s Network Realized Profit/Loss ratio (NPL) revealed that the metric has been antagonistic since the aftermath of the FTX debacle.

Are your holdings flashing green? Check the BTC Profit Calculator

An asset’s NPL measures the wide nett oregon nonaccomplishment of the asset’s network, based connected the terms astatine which each portion of the crypto plus was past traded. A antagonistic NPL ratio suggests that the web arsenic a full has realized a loss.

At property time, BTC’s NPL ratio stood astatine -9.47 million, information from Santiment revealed.

Further, pursuing a akin trend, BTC’s Market-Value-To-Realized-Value ratio (MVRV) has since been negative. A antagonistic MVRV ratio indicates that the marketplace worth of the crypto plus acrophobic is little than the worth astatine which it has precocious been traded.

This showed that Bitcoin has since been undervalued, and astir radical that person sold ever since logged losses.

.png)

.jpg) 1 year ago

135

1 year ago

135