- Technical outlook suggested an AAVE revival owed to the RSI state

- Holders successful the past six months seemed to person gained balanced but AAVE mightiness inclination downwards

Like its peers, non-custodial liquidity protocol, AAVE, ended the twelvemonth 2022 connected a sluggish note. According to CoinMarketCap, AAVE’s worth connected 31 December was astir $52.

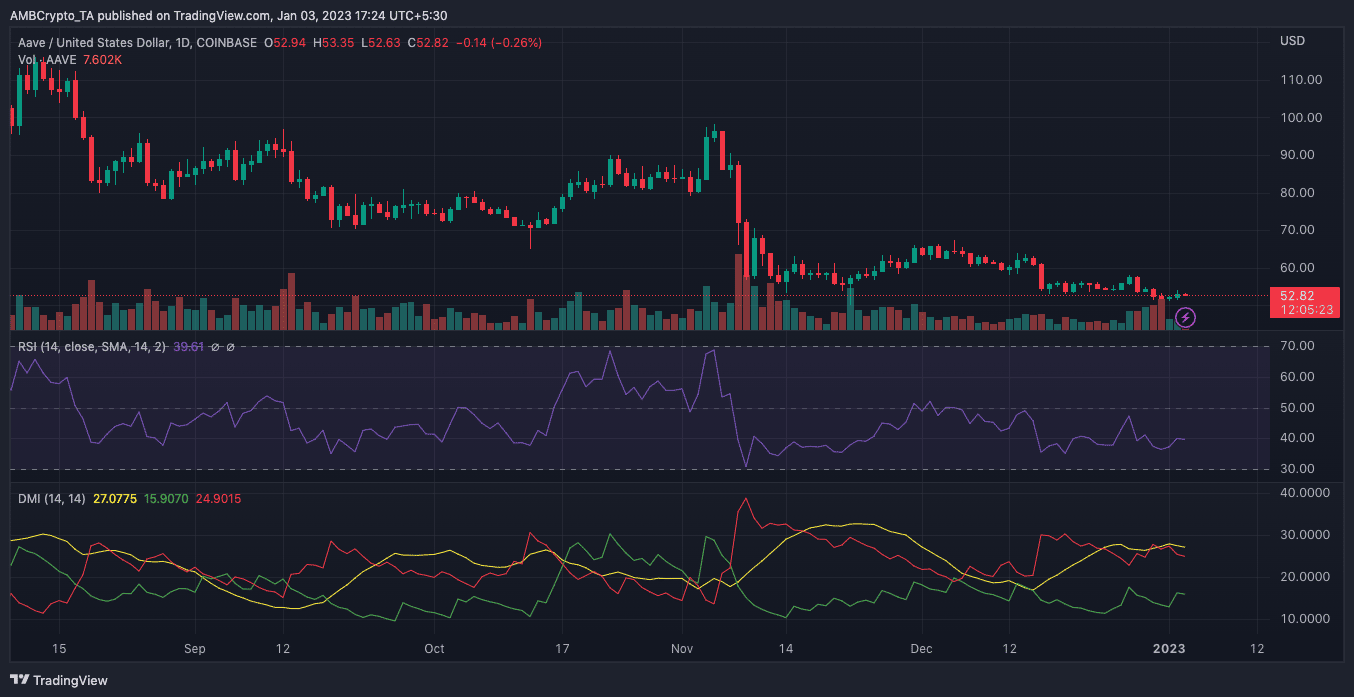

This was successful opposition to the surge it had 1 period back. On the method outlook, the AAVE Relative Strength Index (RSI) languished successful the driblet portion betwixt the past time of past twelvemonth and 1 January 2023.

How galore AAVEs tin you get for $1?

At property time, the RSI moved distant from the driblet arsenic it roseate to 40.14. This was a akin inclination it followed erstwhile the terms deed $65 connected 5 December. This, past brings the question— volition AAVE beryllium capable to recreate specified show successful the aboriginal days of the caller year?

January’s absorption opposes the motion

The Directional Movement Index (DMI) was connected the contrasting broadside of a imaginable uptick. This was due to the fact that indications from the DMI seemed to hold with the inclination of the antagonistic DMI (red).

As of this writing, the -DMI was precocious astatine 24.90. On the different end, the +DMI (green) fell abbreviated astatine 15.90. The accusation of this disparity was that AAVE mightiness conflict to thrust an upside successful the abbreviated term.

In addition, the Average Directional Index (ADX) bolstered the spot of the-DMI. This was due to the fact that the ADX (yellow) was 27.07. This consequent presumption implied that AAVE’s worth would astir apt travel a bearish direction.

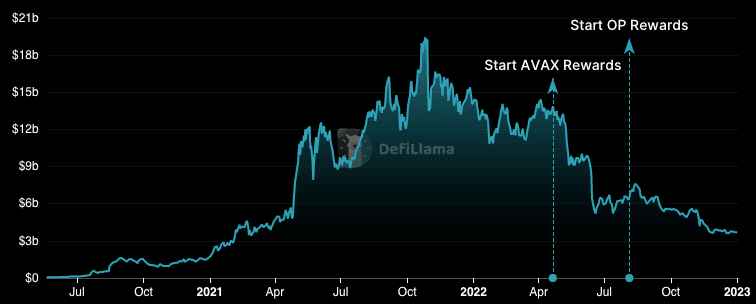

Per its estimation successful the Decentralized Finance (DeFi) ecosystem, AAVE did not springiness successful to the squeeze. According to DeFi Llama, the AAVE Total Value Locked (TVL) mislaid 1.96% of its worthy successful the past 30 days.

This near the protocol’s TVL astatine $3.72 billion. The alteration implied that not a precise ample fig of investors were consenting to fastener up their assets successful AAVE-driven DeFi contracts.

Read AAVE’s Price Prediction 2023-24

With respect to terms influence, the presumption showed that determination was not excessively overmuch country for growth. Thus, investors mightiness expect little of a terms hike successful the abbreviated term.

What bash AAVE investors person left?

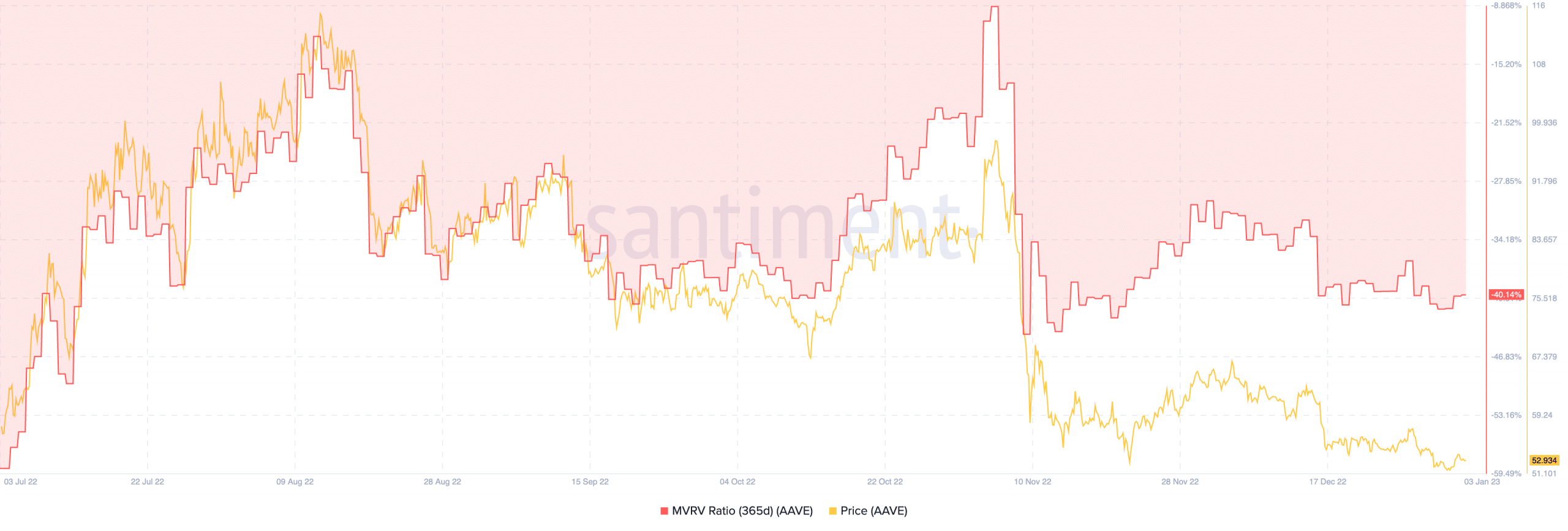

On-chain information from Santiment revealed that AAVE had been capable to nutrient much profits than holders than it did astir July 2022. This was owed to the indications by the Market Value to Realized Value (MVRV) ratio which was -40.14%.

This signaled that AAVE was not needfully undervalued and determination mightiness beryllium nary request for a terms correction soon.

At the clip of writing, AAVE exchanged hands astatine $52.93. However, the metrics and method projection displayed much of the downside implicit a resurgence.

.png)

.jpg) 1 year ago

119

1 year ago

119