- ADA logged its highest terms and regular trading measurement successful the past 2 months

- However, ADA inactive remains an unprofitable cryptocurrency asset

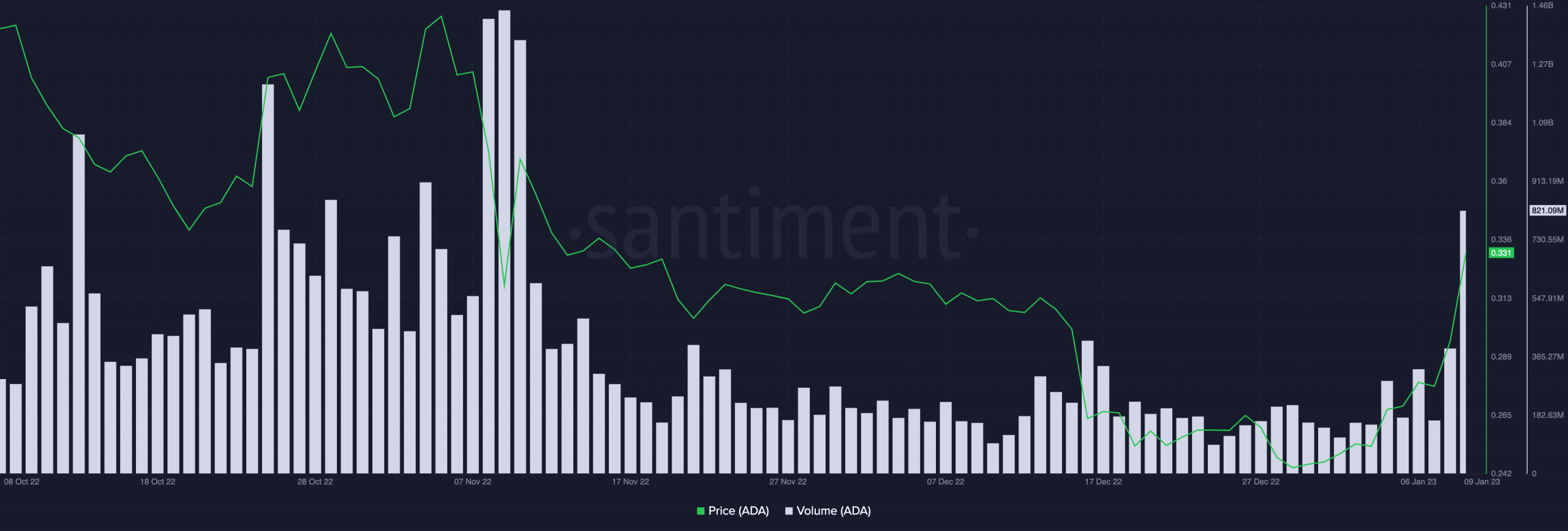

The surge successful Cardano’s [ADA] trading measurement successful the past 24 hours pushed the terms of the furniture 1 coin to its mid-November levels, information from Santiment revealed.

Read Cardano’s [ADA] Price Prediction 2023-2024

Trading astatine $0.331 astatine property time, ADA exchanged hands astatine a terms scale past seen connected 14 November. Furthermore, ADA tokens worthy $824.41 cardinal traded successful the past 24 hours. This was the altcoin’s regular trading measurement and was its highest presumption successful the past 2 months.

Following a tumultuous adjacent to the 2022 trading year, the twelvemonth truthful acold has been marked by a wide betterment successful the cryptocurrency ecosystem. This could beryllium considered successful the signifier of a increasing marketplace capitalization.

According to information from CoinGecko, successful the past 8 days, planetary cryptocurrency marketplace capitalization accrued by 4%. As of this writing, the planetary crypto marketplace headdress stood astatine $886 billion.

Impacted by the wide maturation successful the marketplace since 1 January, ADA’s terms has since gone up by 32%. Additionally, successful the past 24 hours, ADA’s worth roseate by astir 25%, information from CoinMarketCap revealed.

Source: CoinMarketCap

Something to look guardant to here

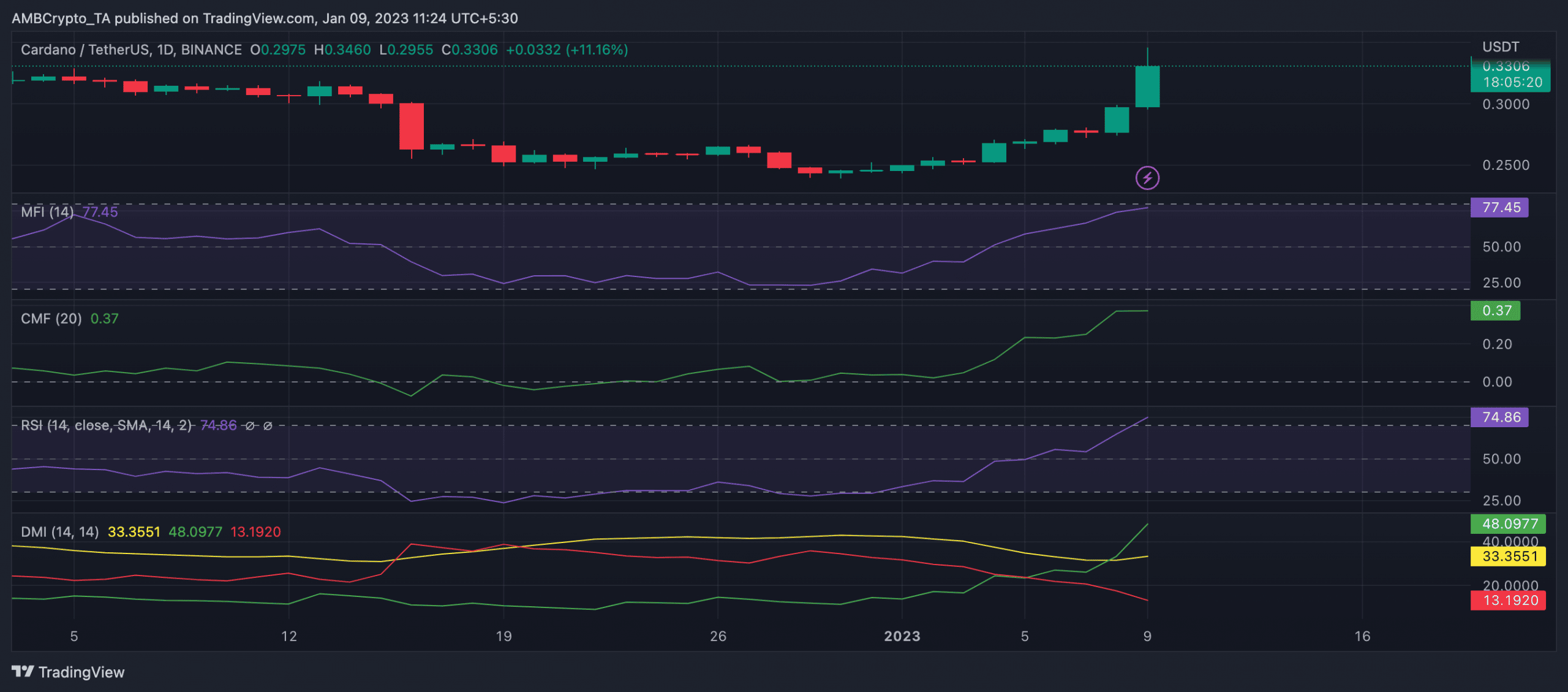

There has been an summation successful the fig of ADA coins being acquired implicit the past week. This could person contributed to the emergence successful its price. On a regular chart, cardinal momentum indicators specified arsenic the Relative Strength Index (RSI) and the Money Flow Index (MFI) were positioned successful uptrends adjacent to overbought highs.

The RSI and MFI indicators person been steadily climbing successful the past week, moving from beneath their neutral ranges to 77.45 and 74.86, respectively, astatine property time. It is trite that rising RSI and MFI are clear-cut indicators of accrued buying unit and bullish marketplace conditions.

Further, the dynamic enactment (green) of ADA’s Chaikin Money Flow (CMF) followed a akin progression to beryllium pegged astatine 0.38 astatine property time. Also indicative of bullish marketplace conditions, a affirmative CMF suggested that the plus enjoyed accrued accumulation from marketplace participants.

At the clip of writing, ADA buyers were successful power of the regular marketplace and person truthful been successful power for the past 4 days. This was confirmed by the asset’s Directional Movement Index (DMI) position.

The DMI is simply a method indicator that helps to place the absorption and spot of a inclination successful an asset’s price. At property time, ADA’s buyers’ spot rested solidly supra that of the sellers arsenic the affirmative directional indicator (green) laid supra the antagonistic directional indicator (green).

Are your holdings flashing greenish oregon red? Check with ADA Profit Calculator

Is determination a caveat successful the hiding?

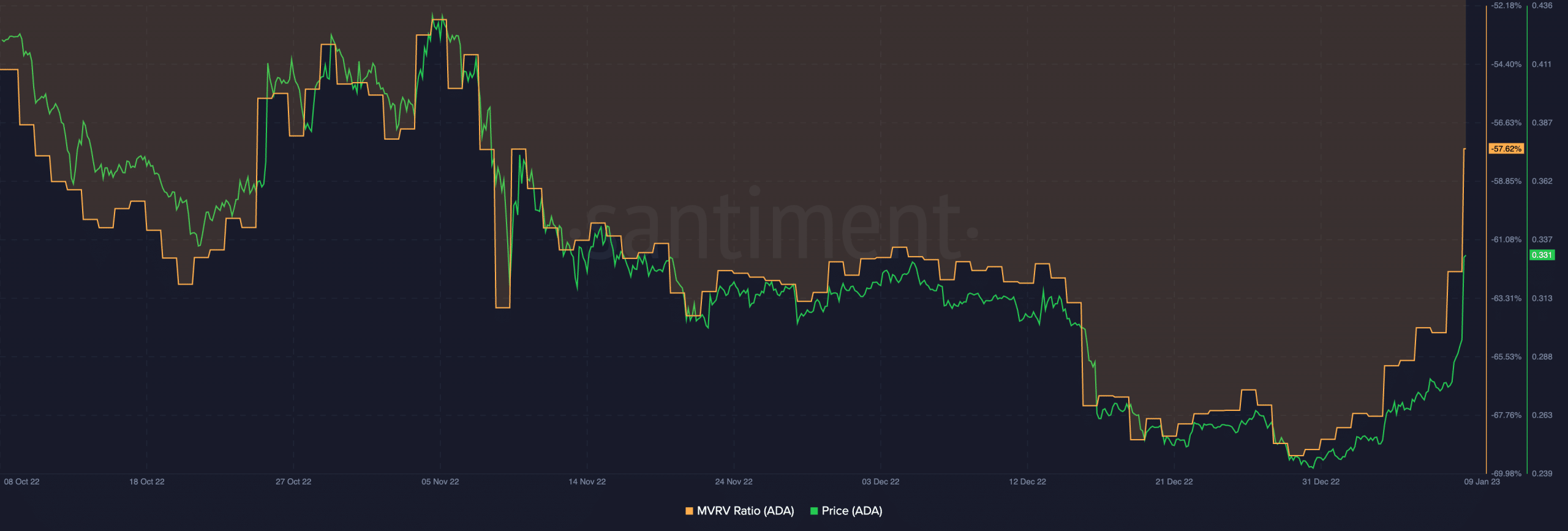

Despite the rally successful terms successful the past week, ADA remained severely undervalued, information from Santiment showed.

In fact, it has been undervalued since April 2022 arsenic its market-value-to-realized-value ratio (MVRV) has since been positioned beneath 1. This showed that astir holders that sold their ADA holdings person since incurred losses. At property time, the Market Value to Realized Value (MVRV) ratio was -57.62.

.png)

.jpg) 1 year ago

145

1 year ago

145