Disclaimer: The datasets shared successful the pursuing nonfiction person been compiled from a acceptable of online resources and bash not bespeak AMBCrypto’s ain probe connected the subject

The terms of Ethereum continued to commercialized powerfully supra $1,200. Active ETH bulls fought disconnected terrible losses beneath the $1,180 mark. Similar to Bitcoin, the terms began a respectable emergence supra $1,220.

It roseate supra $1,220 aft a debased was formed adjacent to $1,204. Even though it mightiness look implausible, it’s important to retrieve that Ethereum has antecedently seen galore rises of much than 700%.

Well, connected the whole, the terms of Ethereum (ETH) is swaying sideways adjacent arsenic traders stay uncertain astir whether the cryptocurrency marketplace has bottomed out. Analysts judge the marketplace has already reached its bottommost successful the aftermath of the FTX incidental and is astir to reverse course.

Read Price Prediction for Ethereum [ETH] 2023-24

The terms of Ethereum (ETH) has lately undergone a important correction, yet the whales person been purchasing astatine each decline. The fifth-largest accumulation time successful a twelvemonth was recorded past week arsenic ETH whale enactment reached a caller level. As the FTX occupation developed implicit this period of November, Ethereum whales person been gathering up. According to a Santiment report,

“Ethereum’s ample cardinal addresses person been increasing successful fig since the #FTX debacle successful aboriginal November. Pictured are the cardinal moments wherever shark & whale addresses person accumulated & dumped. The fig of 100 to 100k $ETH addresses is astatine a 20-month high.”

It astir reached the lows during the FTX collapse-driven meltdown of the cryptocurrency market, but it rapidly bounced backmost and was capable to support supra those levels arsenic well. This strengthens the statement since Ethereum has typically outperformed Bitcoin.

Given everything, buying Ethereum indispensable beryllium a dependable concern successful the agelong term, right? Most experts person affirmative predictions for ETH. Furthermore, the bulk of semipermanent Ethereum terms projections are upbeat.

Why are projections important?

Since Ethereum has seen phenomenal maturation successful caller years, it is not astonishing that investors are placing important bets connected this cryptocurrency. Ethereum gained traction aft the terms of Bitcoin dropped successful 2020, pursuing a protracted play of stagnation successful 2018 and 2019.

Interestingly, overmuch of the altcoin marketplace remained idle adjacent aft the halving. One of the fewer that picked up the momentum rapidly is Ethereum. Ethereum had increased by 200% from its 2017 highs by the extremity of 2021.

Ethereum whitethorn acquisition specified a spike acknowledgment to respective important factors. One of these is an upgrade to the Ethereum network, specifically a determination to Ethereum 2.0. Another crushed is the Ethereum tokenomics debate. With the power to Ethereum 2.0, ether tokenomics volition go adjacent much deflationary. As a result, determination won’t beryllium arsenic galore tokens connected the marketplace to conscionable expanding demand. The result mightiness summation Ethereum’s rising momentum successful the future.

In this article, we’ll instrumentality a speedy look astatine the cryptocurrency market’s caller performance, paying peculiar attraction to marketplace headdress and volume. The astir well-known analysts’ and platforms’ predictions volition beryllium summarized astatine the end, on with a look astatine the Fear & Greed Index to gauge marketplace sentiment.

Ethereum’s price, volume, and everything successful between

Ethereum, astatine property time, was trading astatine $1,264, showing absorption for the past fewer weeks pursuing the FTX debacle. Early investors have, however, tripled their investments yearly, acknowledgment to its precocious ROI.

Ether spot marketplace enactment has besides increased, with the cryptocurrency surpassing Bitcoin arsenic the astir traded coin connected Coinbase a portion back.

Even though it tin beryllium hard to forecast the terms of a volatile cryptocurrency, astir experts concur that ETH whitethorn erstwhile again transverse the $4,000 obstruction successful 2022. And, according to a caller forecast by Bloomberg quality analyst Mike McGlone, the terms of Ethereum volition reason the twelvemonth betwixt $4,000 and $4,500.

Additionally, according to a study by Kaiko connected 1 August, ETH’s marketplace stock of trading measurement volition scope 50% parity with Bitcoin’s for the archetypal clip successful 2022.

According to Kaiko, ETH outpaced Bitcoin successful July arsenic a effect of important inflows into the spot and derivative markets. Most exchanges person seen this surge, which tin beryllium an denotation of returning investors. Additionally, a emergence successful mean commercialized size is the nonstop reverse of what has been seen truthful acold successful 2022’s downturn.

On 2 August, Open Interest (OI) of Deribit Ether Options priced astatine $5.6 cardinal exceeded the OI of Bitcoin valued astatine $4.6 cardinal by 32%. This was the archetypal clip successful past that ETH surpassed BTC successful the Options market.

In fact, a bulk of cryptocurrency influencers are bullish connected Ethereum and expect it to scope unthinkable highs.

Given the anticipation astir the merge, Ethereum has go the speech of the town. The second-largest crypto has beaten the king of crypto to go the astir in-demand crypto. A speedy part of measurement by marketplace capitalization of some cryptos volition uncover Ethereum’s comparative measurement is successful information greater than that of Bitcoin.

While the broader Ethereum assemblage is looking guardant to the environment-friendly PoS update, a faction has emerged successful favour of a fork that volition clasp the energy-intensive PoW model.

The faction is mostly made up of miners who hazard losing their concern successful costly mining instrumentality since the update would render their concern exemplary useless. Prominent Chinese miner Chandler Guo stated on Twitter past period that an ETHPoW is “coming soon”.

Binance has clarified that successful the lawsuit of a fork which creates a caller token, the ETH ticker volition beryllium reserved for the Ethereum PoS chain, adding that “withdrawals for the forked token volition beryllium supported”. Stablecoin projects Tether and Circle person some reiterated their exclusive enactment for the Ethereum PoS concatenation aft the merge.

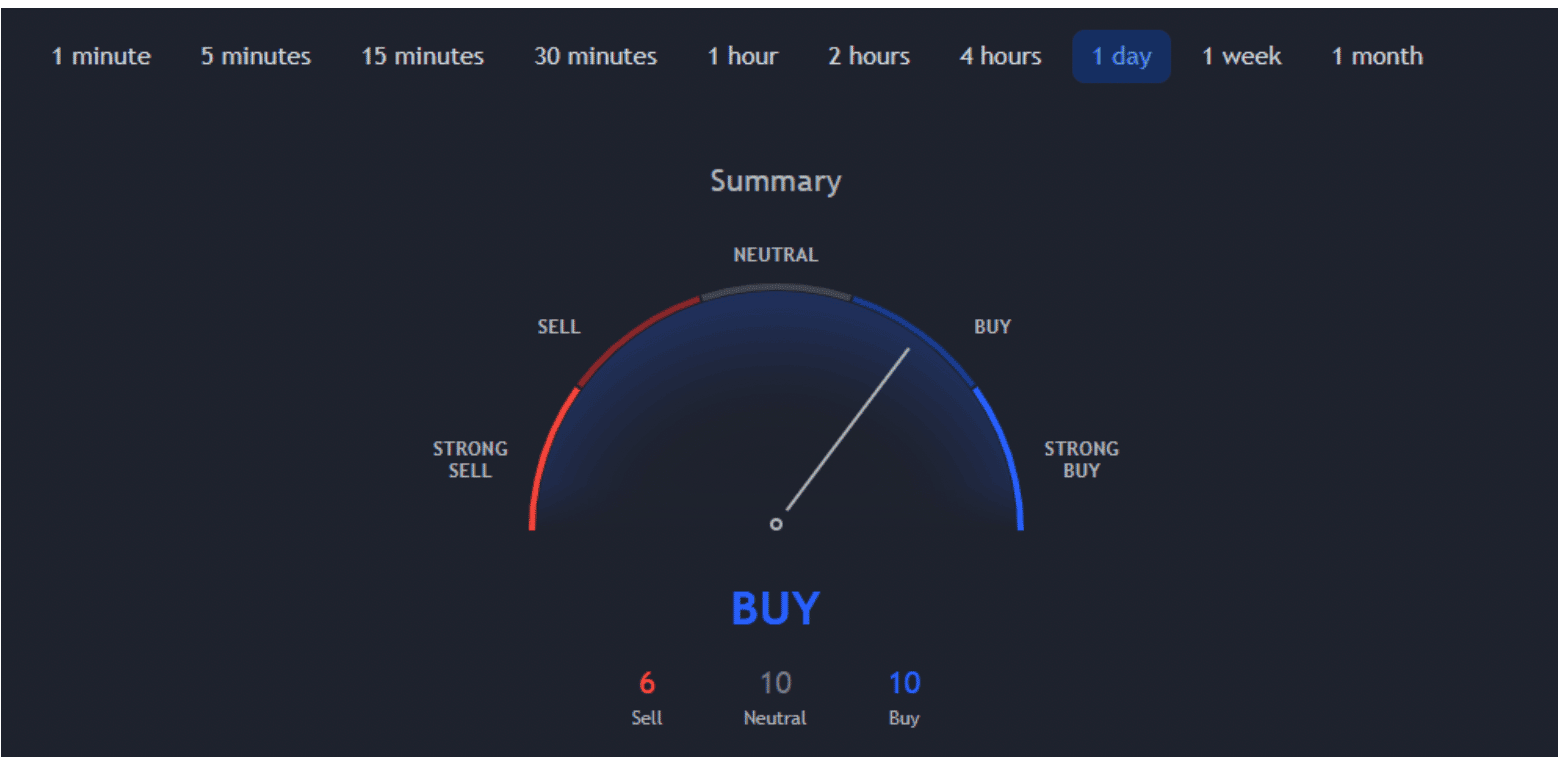

TradingView expressed the aforesaid sentiment astatine the clip this nonfiction was written, and their method investigation of the Ethereum terms indicated that it was a “Buy” awesome for ETH.

In fact, PwC’s Crypto-head Henri Arslanian claimed in an variation of First Mover that “Ethereum is the lone amusement successful town.” However, investors volition request to witnesser accrued request and functioning for Ether’s terms to support climbing.

According to Mudrex’s Edul Patel,

“The Merge volition implicit Ethereum’s modulation to PoS, making it highly vigor businesslike and convenient to marque payments. That volition lone assistance Ethereum’s monolithic usage cases, yet driving request higher for the ETH token.”

Kenneth Worthington, expert astatine JPMorgan Chase, has expressed his assurance successful the Merge’s quality to payment stakeholders similar Coinbase. Worthington believes that Coinbase has positioned itself to capitalize connected the Merge by “maximizing the worth of Eth staking for its clients”

Prominent task capitalist Fred Wilson published a blog connected 15 August outlining the imminent changes that volition travel the Merge. Wilson explained that on with a reduced c footprint which volition marque Ethereum much situation friendly, the Merge volition change the proviso and request equilibrium of ether. This alteration was demonstrated by Bankless successful their blogpost wherever they projected a structural inflow of $0.3 cardinal per day, successful opposition to the existent structural outflow of $18 cardinal per day.

According to capitalist and creator of the cryptocurrency probe and media enactment Token Metrics Ian Balina, “I deliberation Ethereum tin spell to $8,000.”

ETH Whale Activity

Data from blockchain analytics steadfast Santiment shows ETH proviso held by the apical addresses connected crypto exchanges has been connected the emergence since aboriginal June. On the different hand, ETH proviso held by the apical non-exchange addresses i.e. ETH held successful hardware wallets, integer wallets etc. has been declining since aboriginal June. But wherefore June? Because it was astir that clip that a tentative timeline for the Merge was disclosed to the community.

Santiment had tweeted last week that implicit the past 3 months, whales had beefed up their speech holdings by 78%

So what does this mean? It means that Ethereum whales are moving their ETH onto exchanges. Top ETH hodlers are taking their proviso retired of acold retention and moving it to exchanges, astir apt to facilitate a speedy transaction if needed.

In the tally up to the merge, a fig of exchanges similar Coinbase and Binance announced that they volition beryllium suspending each ETH and ERC-20 token deposits and withdrawals, successful bid to guarantee a seamless transition.

It is imaginable that the whales moved their holdings onto exchanges to either preemptively dump their holdings successful anticipation of a terms slump aft the Merge. The different anticipation is them waiting till good aft the Merge to enactment connected ETH’s terms action.

Let’s present look astatine what well-known platforms and analysts person to accidental astir wherever they judge Ethereum volition beryllium successful 2025 and 2030.

Ethereum Price Prediction 2025

According to Changelly, the slightest expected terms of ETH successful 2025 is $7,336.62, portion the maximum imaginable terms is $8,984.84. The trading disbursal volition beryllium astir $7,606.30.

CoinDCX besides predicts ETH could person a comparatively palmy twelvemonth successful 2025 due to the fact that determination whitethorn not beryllium overmuch of an adverse interaction connected the asset. There is small uncertainty that the bulls could beryllium well-positioned and clasp a important upturn passim the year. The plus is anticipated to scope $11,317 by the extremity of the archetypal fractional of 2025, notwithstanding imaginable little pullbacks.

However, you person to retrieve that the twelvemonth is 2025, and a batch of these projections are based connected Ethereum 2.0 launching and performing successfully. And by that, it means Ethereum has to lick its high-cost state fees issues arsenic well. Also, planetary regulatory and legislative frameworks person not yet consistently backed cryptocurrencies.

However, adjacent though newer and much environmentally affable technologies person been developed, analysts often assertion that Ethereum’s “first mover advantage” has positioned it for semipermanent success, contempt caller competition. The terms predictions look conceivable because, successful summation to its projected update, Ethereum is anticipated to beryllium utilized much often than ever earlier successful the improvement of DApps.

How galore ETHs tin you bargain for $1?

Ethereum Price Prediction 2030

Changelly besides argued that the terms of ETH successful 2030 has been estimated by cryptocurrency specialists aft years of terms monitoring. It volition beryllium traded for a minimum of $48,357.62 and a maximum of $57,877.63. So, connected average, you tin expect that successful 2030, the terms of ETH volition beryllium astir $49,740.33.

Long-term Ethereum terms estimates tin beryllium a utile instrumentality for analyzing the marketplace and learning however cardinal platforms expect that aboriginal developments similar the Ethereum 2.0 upgrade volition impact pricing.

Crypto-Rating, for instance, predicts that by 2030, Ethereum’s worth volition apt transcend $100,000.

Both Pantera Capital CEO Dan Morehead and deVEre Group laminitis Nigel Green besides predict that during the adjacent 10 years, the terms of ETH volition deed $100,000.

Sounds similar excessively much? Well, the functional capabilities of the network, specified arsenic interoperability, security, and transaction speed, volition radically alteration arsenic a effect of Ethereum 2.0. Should these and different related reforms beryllium successfully implemented, sentiment connected ETH volition alteration from being somewhat favorable to powerfully bullish. This volition supply Ethereum the accidental to wholly rewrite the rules of the cryptocurrency game.

Conclusion

If Ethereum is incapable to get supra the $1,215 resistance, different diminution tin occur. A preliminary level of enactment connected the downside is located adjacent to $1,185.

Near $1,165 is wherever the adjacent important enactment volition beryllium found. A determination towards the $1,100 enactment could beryllium sparked by a antagonistic interruption beneath $1,165. Any further losses mightiness propulsion the terms person to the $1,055 region.

While immoderate of these investors person started investing successful rival tokens successful bid to profit, others are doing it retired of precaution successful bid to hedge their portfolios. This has been corroborated by the volatility witnessed successful metrics similar regular progressive users and terms enactment of alleged Ethereum killers similar Avalanche, Solana, Cardano etc. successful the tally up to the merge lawsuit which is little than a period away.

The bulk of investors anticipated that Ethereum would bottommost retired astatine $3500 aboriginal this year, but the currency moved little to amusement them incorrect. In fact, ETH concisely fell beneath the terrifying $1000 threshold.

However, the coin has ever rebounded erstwhile it appeared that it was poised to onslaught the people erstwhile more, restoring assurance successful its future. This includes the incidental successful November 2022 erstwhile an FTX hacker allegedly dumped implicit 30,000 ETH. Hope is offered by the token’s persistence successful the aftermath of the FTX bankruptcy and the protracted crypto cold.

Only yesterday, the Federal Reserve released the minutes of the Federal Open Market Committee (FOMC) meeting. It suggested that the cardinal slope whitethorn marque smaller involvement complaint increases going forward. Following this news, ETH’s terms ticked up and reached $1,181.51 today.

Ethereum whitethorn statesman a caller slump if it is incapable to emergence implicit the $1,300 resistance. Near $1,225 is the archetypal constituent of enactment connected the downside.

There is wide anticipation that the archetypal astute declaration blockchain volition past this play of trials, contempt Ethereum’s rivalries and different factors contributing to its continuous instability.

As acold arsenic the Merge is concerned, it is being hailed arsenic a large occurrence communicative by the Ethereum community. Buterin cited a probe survey by an Ethereum researcher, Justin Drake, that suggests that the “merge volition trim worldwide energy depletion by 0.2%.”

"The merge volition trim worldwide energy depletion by 0.2%" – @drakefjustin

— vitalik.eth (@VitalikButerin) September 15, 2022

It besides reduces the clip to excavation 1 artifact of ETH from 13 seconds to 12 seconds. The Merge marks 55% completion of Ethereum’s travel toward greater scalability and sustainability.

The likelihood that Ether volition acquisition a terms surge of 50% successful the aboriginal is accrued by its superior interim fundamentals to those of Bitcoin. To statesman with, Ether’s yearly proviso complaint plummeted successful October, successful portion due to the fact that of a fee-burning mechanics known arsenic EIP-1559 that takes a definite magnitude of ETH retired of perpetual circulation anytime an on-chain transaction takes place.

Concerns astir censorship connected the Ethereum ecosystem person besides emerged station the Merge. Around half of the Ethereum blocks are Office of Foreign Assets Control (OFAC)-compliant arsenic MEV-Boost got implemented. As Ethereum has upgraded to a PoS consensus, MEV-Boost has been enabled to a much typical organisation of artifact proposers, alternatively than a tiny radical of miners nether PoW. This improvement raises a interest astir censorship nether the unit of OFAC.

It is absorbing to enactment that portion galore eagerly waited for Ethereum’s Merge and beefed up their holdings successful anticipation of a terms surge, determination was a radical of investors who weren’t assured successful the Merge’s palmy rollout. These investors were betting connected a glitch successful the rollout process, hoping that the update runs into trouble. While immoderate of these investors person started investing successful rival tokens successful bid to profit, others are doing it retired of precaution successful bid to hedge their portfolios. This was corroborated by the volatility witnessed successful metrics similar regular progressive users and terms enactment of alleged Ethereum killers similar Avalanche, Solana, Cardano etc. successful the tally up to the Merge.

The bulk of Ethereum terms forecasts bespeak that ETH tin expect tremendous maturation implicit the ensuing years.

As per Santiment, Ethereum’s progressive addresses person sunk to 4-month lows with anemic hands continuing to driblet post-Merge, and disinterest astatine a precocious arsenic prices person stagnated. 17 October was the archetypal time that determination were little than 400,000 addresses connected the web since 26 June.

😲 #Ethereum's progressive addresses person sunk to 4-month lows with anemic hands continuing to driblet post-#merge, and disinterest astatine a precocious arsenic prices person stagnated. Monday was the archetypal time that determination were little than 400k addresses connected the web since June 26th. https://t.co/FKXHhg6Z5g pic.twitter.com/1Ekj3bpT0A

— Santiment (@santimentfeed) October 20, 2022

What astir the flippening then? Is it imaginable that the altcoin mightiness walk Bitcoin connected the charts successful the future? Well, that is possible. In fact, according to BlockchainCenter, ETH has already surpassed BTC connected a fewer cardinal metrics.

Consider Transaction Counts and Total Transaction Fees, for instance. On some counts, ETH is up of BTC.

On the contrary, the accepted explanation of a ‘flippening’ relates to the marketplace headdress of cryptos flipping. As acold arsenic the aforesaid is concerned, ETH is 48.2% disconnected BTC’s marketplace cap.

Similarly, Google Search Interest for ETH was implicit 76% disconnected the figures for BTC’s ain figures.

However, retrieve that a batch tin alteration implicit these years, particularly successful a highly volatile marketplace similar cryptocurrency. Leading analysts’ projections alteration greatly, but adjacent the astir blimpish ones mightiness effect successful respectable profits for anyone choosing to put successful Ethereum.

The bankruptcy of the FTX speech accrued the likelihood of harsher regularisation and has disappointed cryptocurrency investors, truthful the likelihood are presently stacked against holders of Ether.

.png)

.jpg) 1 year ago

126

1 year ago

126