- As per the latest update, ETH’s Shanghai upgrade is expected to rotation retired successful March 2023

- ETH’s improvement enactment witnessed a surge since the opening of 2023

Ethereum’s [ETH] Shanghai upgrade that is expected to spell connected the level successful March 2023 would alteration the withdrawal of staked ETH. As per the latest developer conference, the rotation retired would people an extremity to a two-year hold by validators who tin lone deposit ETH and not retreat it.

“As the lone large codification alteration successful Shanghai, staked ETH withdrawals are presently being tested connected a developer-focused trial network. Developers purpose to motorboat nationalist testnets for the Shanghai/Capella upgrade adjacent period and tentatively docket a mainnet motorboat for the upgrade sometime successful March 2023.”

The developers besides assured that they are not going up with additional Ethereum Improvement Proposals (EIPs) from Shanghai to instrumentality to the timeline for staked ETH withdrawals.

Read Ethereum’s [ETH] terms prediction 2023-2024

Apart from the much- anticipated EIP-4895 upgrade which volition let validators to unstake ETH, different improvements are expected. These see the simplification of state fees and improvements successful web throughput.

Stakes are high

As per information from Staking Rewards, much than 16 cardinal ETH person been staked since the Beacon concatenation was introduced. This represented 14% of the full supply.

The fig of validators besides witnessed a stead summation implicit the past fewer days. The gross from ETH staking has jumped by 20% aft it fell steeply successful mid-December.

However, Ethereum had the lowest staking ratio erstwhile compared with different large chains. At conscionable astir 14%, the king of altcoins trailed down different assets, specified arsenic Cardano [ADA] and Solana [SOL], which were supra 70%.

Holders look astatine improvement activity

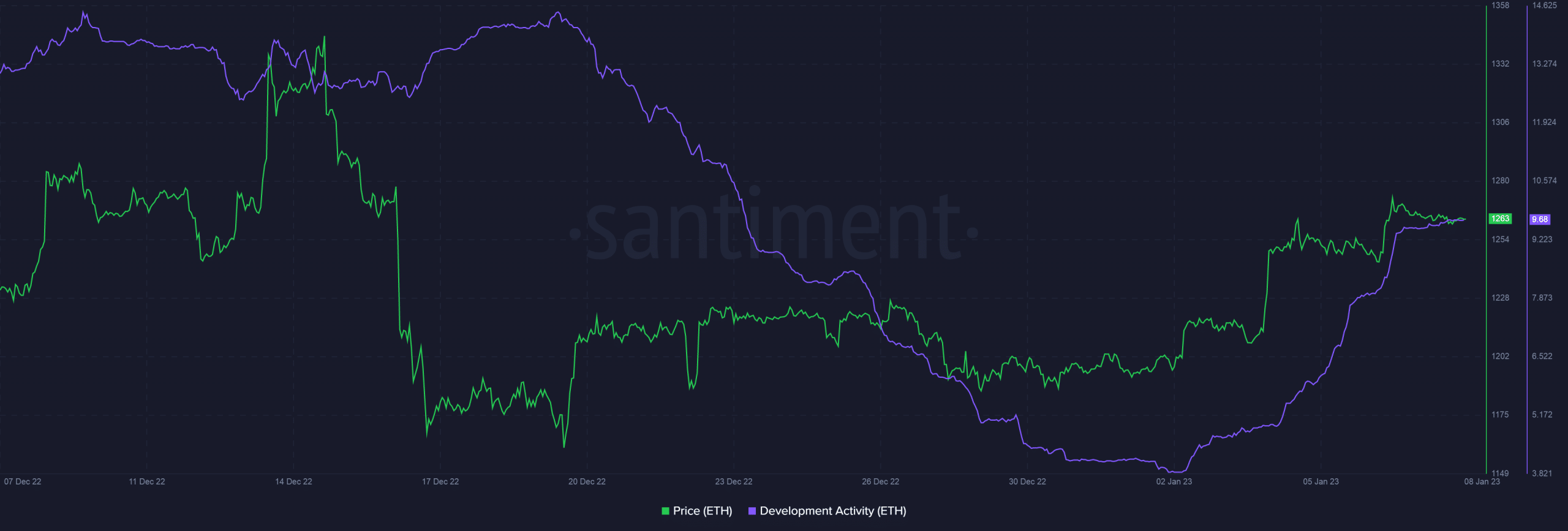

As per Santiment, improvement enactment has picked up decisively since the commencement of the twelvemonth which reflected the platform’s committedness to its targets. The terms has evidently followed the uptick successful improvement activity.

However, on-chain indicators didn’t compliment the maturation successful improvement activity. The Network worth to transactions (NVT) ratio chased the higher values, arsenic per Glassnode.

This suggested that the coin was overvalued and marketplace headdress did not warrant web activity. The transaction number dipped aft peaking successful December.

Furthermore, the involvement among large addresses stayed level passim the past fewer days. This could beryllium owed to the prolonged play of debased volatility that has gripped the wider crypto market.

Are your holdings flashing green? Check the ETH Profit Calculator

Cardano has competition

Interestingly, Ethereum has been connected the receiving extremity of immoderate precise crisp digs by Cardano [ADA] laminitis Charles Hoskinson. Hoskinson has spared nary accidental to mock ETH’s staking algorithm and its quality to let stakers to retreat ETH.

I didn't recognize @ScottAdamsSays wrote comics astir Ethereum's staking exemplary pic.twitter.com/tClkRBTfAs

— Charles Hoskinson (@IOHK_Charles) December 23, 2022

Cardano has aggressively tried to presumption itself arsenic the alternate of Ethereum, frankincense allowing users to retreat their ADA from staking pools anytime.

.png)

.jpg) 1 year ago

188

1 year ago

188