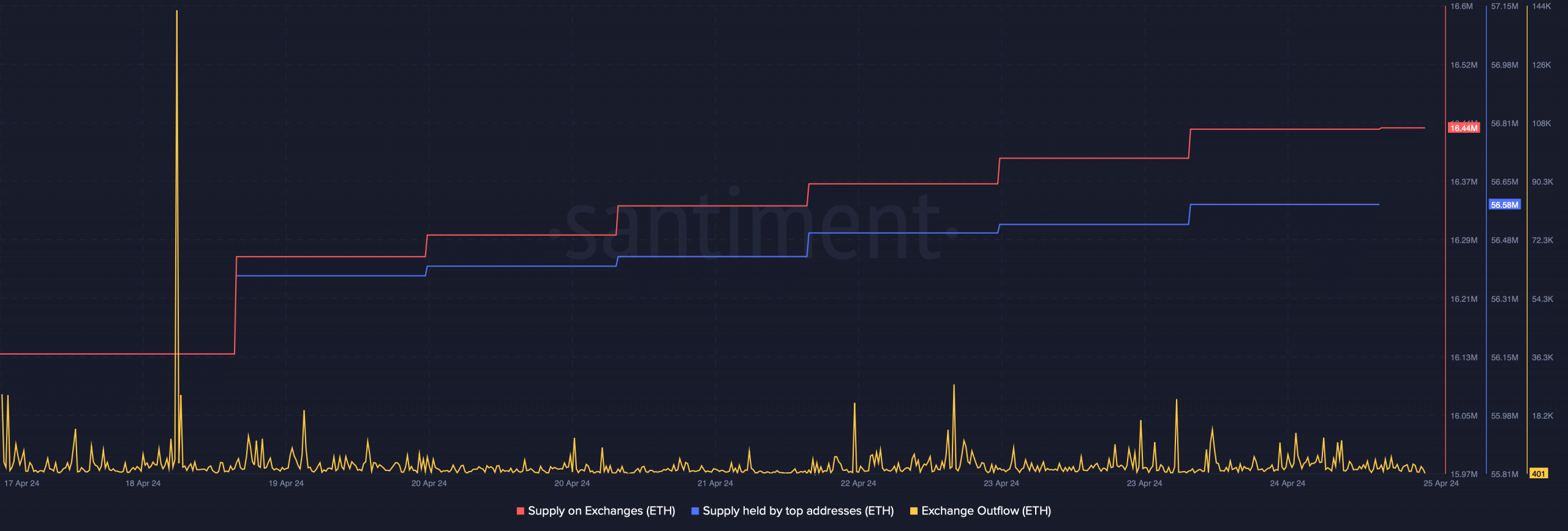

- Ethereum’s Supply connected Exchanges accrued successful the past fewer days.

- ETH was down by implicit 2%, and indicators looked bearish.

Ethereum [ETH] has witnessed a sizeable magnitude of outflow from exchanges implicit the past week. This happened portion its terms enactment was bullish.

However, the marketplace turned bearish successful the past 24 hours. Did this person a antagonistic interaction connected ETH’s outflow?

Ethereum’s outflow surged!

Ethereum’s terms rested comfortably supra the $3k people arsenic its terms rallied by much than 6% successful the past 7 days.

While that happened, investors stockpiled ETH, hinting that they expected the token’s terms to emergence further successful the coming days.

Titan of Crypto, a fashionable crypto analyst, precocious posted a tweet highlighting this fact.

As per the tweet, crypto exchanges witnessed an outflow of implicit 260,000 ETH, equivalent to much than $781 million, wrong the past 7 days.

Additionally, Justin Sun besides accumulated ETH. As per a caller tweet from Lookonchain, a wallet that perchance belongs to Sun withdrew 15,389 ETH, worthy $49.78 million, from Binance again.

The wallet earlier had bought 147,442 ETH, worthy $469.9 cardinal astatine $3,179 since the 8th of April.

However, the past 24 hours witnessed a alteration successful marketplace sentiment arsenic astir cryptos’ prices dropped. According to CoinMarketCap, ETH was down by implicit 2%.

At property time, the king of altcoins was trading astatine $3,165.53 with a marketplace capitalization of implicit $386 billion.

Is ETH’s terms driblet affecting buying pressure?

Since the token’s terms dropped, AMBCrypto checked its metrics to find whether this had immoderate interaction connected buying pressure.

Our investigation of CryptoQuant’s data revealed that ETH’s nett deposit connected exchanges was precocious compared to the past 7 days’ average. This signaled that investors person started to merchantability ETH.

The token’s speech outflow declined successful the past fewer days. Additionally, the information that investors were selling Ethereum was further proven by its supply-on-exchange graph arsenic it went up.

Notably, the terms diminution didn’t impact whale accumulation. This seemed to beryllium the lawsuit arsenic ETH’s proviso held by apical addresses continued to emergence past week.

Going forward

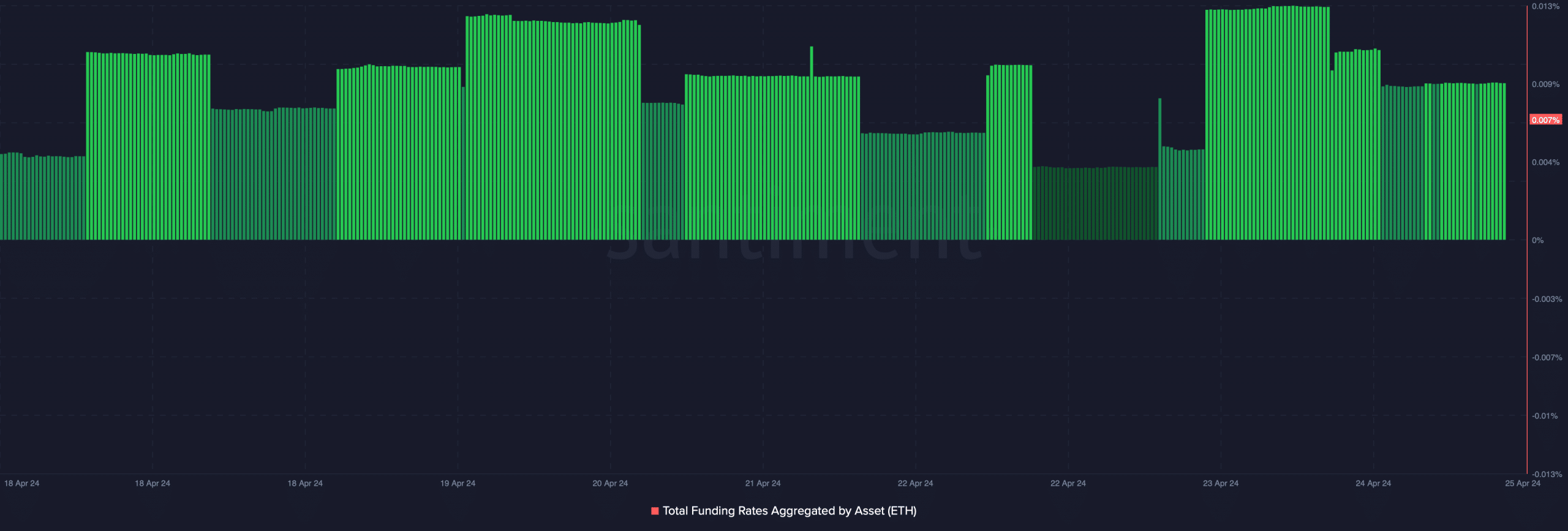

AMBCrypto past analyzed ETH’s derivatives metrics and method indicators to spot if the emergence successful selling unit could further interaction its price. The token’s Funding Rate increased.

Read Ethereum’s [ETH] Price Prediction 2024-25

Generally, prices thin to determination the different mode than the Funding Rate. This question suggested a continued terms driblet for ETH.

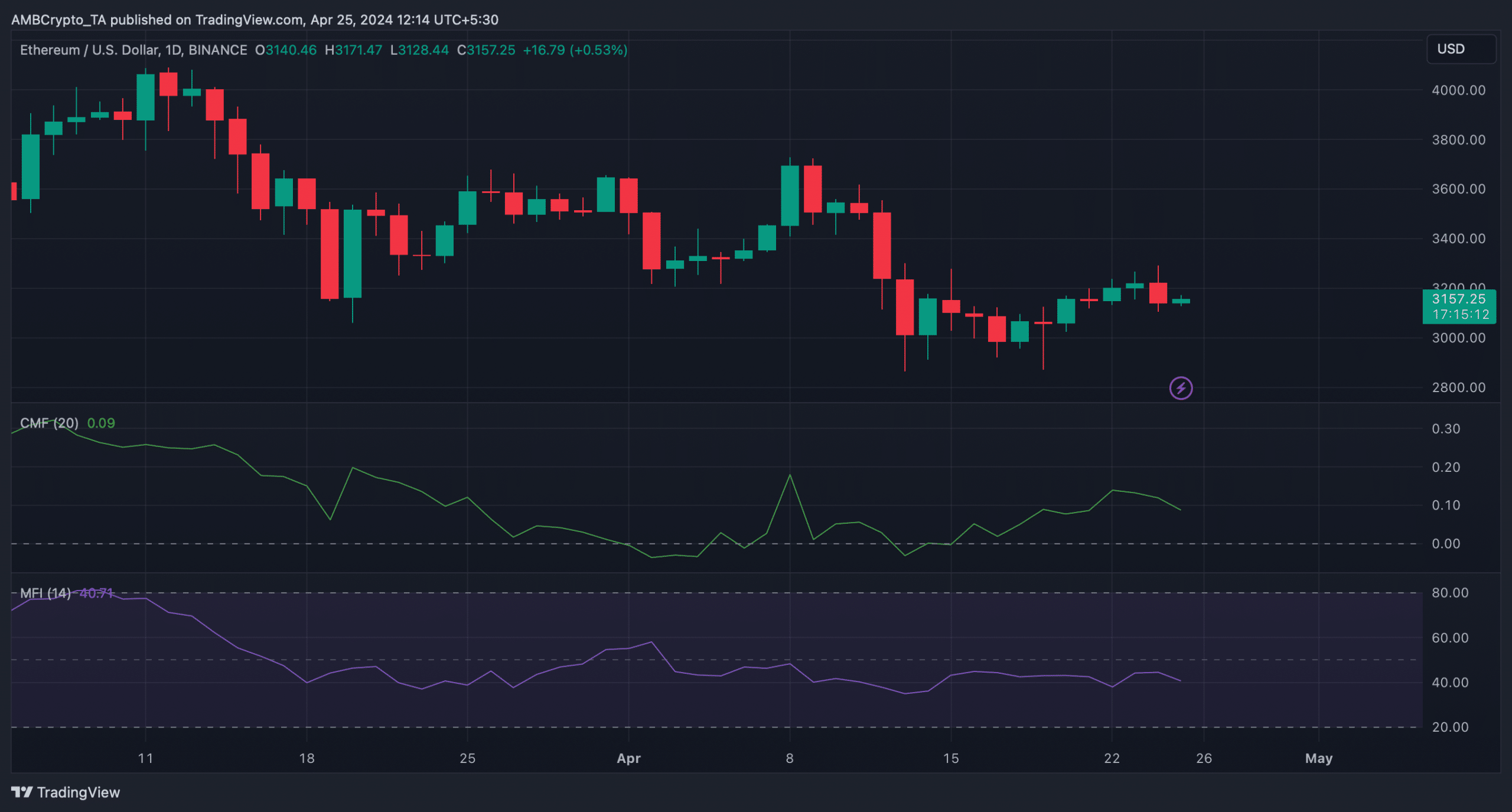

Technical indicators besides looked bearish. For instance, some ETH’s Chaikin Money Flow (CMF) and Money Flow Index (MFI) started to decline, showing a continued terms driblet successful the coming days.

.png)

.jpg) 3 weeks ago

33

3 weeks ago

33