Navigating the satellite of Bitcoin and cryptocurrencies, successful general, has been a unsmooth rollercoaster successful 2022. That section is present closed and we person present entered into caller unchartered territory. Every crypto enthusiast and their canine are present wondering whether 2023 volition bring bully tidings oregon whether it volition crook retired worse than 2022.

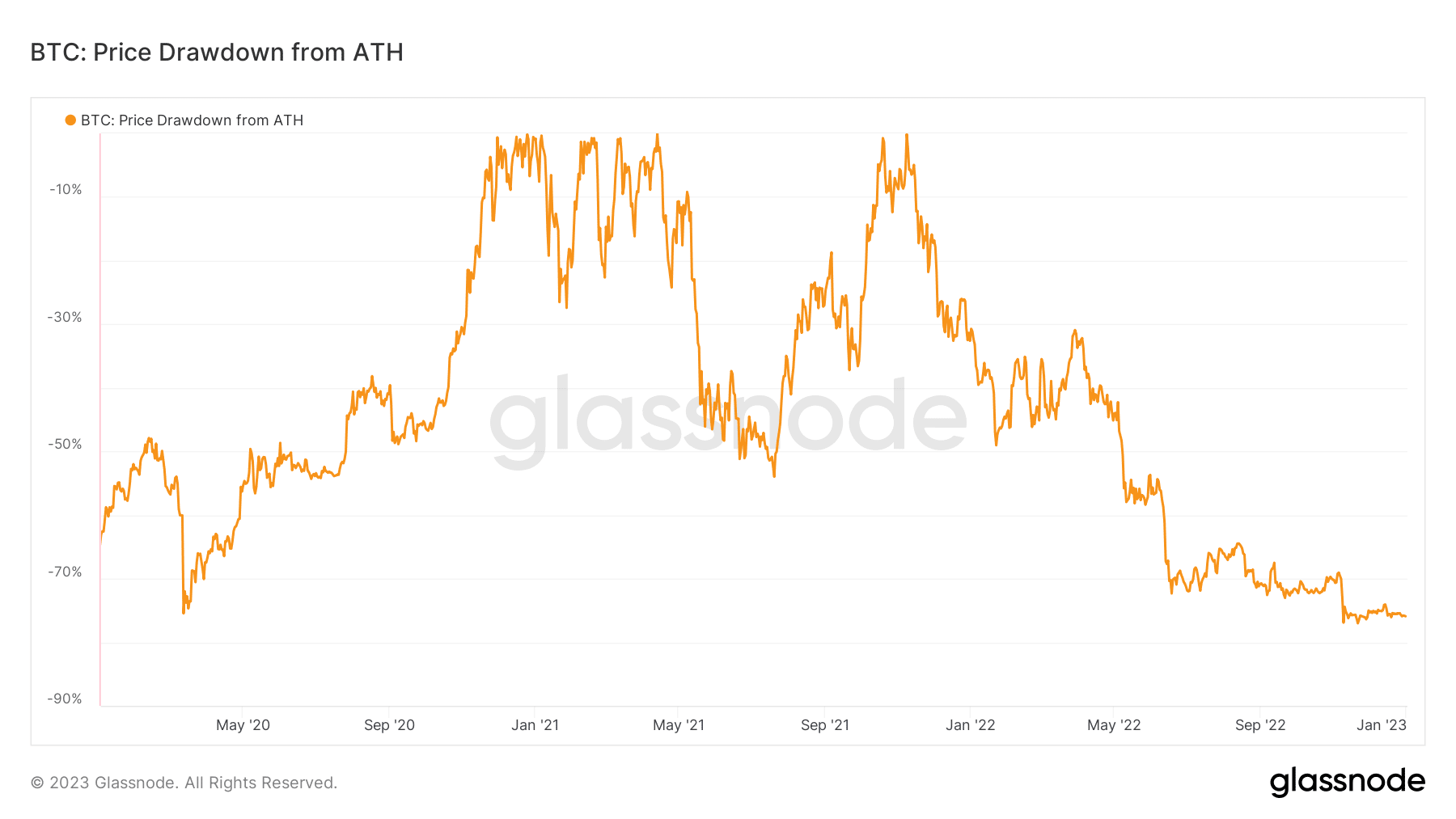

While abbreviated and semipermanent projections are common, Bitcoin’s show successful 2022 demonstrated a immense scope of unpredictability. Perhaps a recap of its show whitethorn assistance enactment things into perspective. At its existent terms level, Bitcoin is drawn down by astir 75.92% from its all-time high.

It is important to instrumentality enactment of wherever astir of this drawdown has occurred. It’s from astir November 2021 to the extremity of 2022. Why is this important? Well, mostly due to the fact that of the clip play successful which it occurred.

The economical position and Bitcoin’s correlation with risk-on assets

If we cross-reference the commencement of the Bitcoin carnivore marketplace and the U.S. Federal Reserve commenced quantitative tightening, we spot a pattern. And this is wherever the ostentation nexus comes in.

Numerous factors and events successful the past 3 years stressed the planetary system and pushed large economies successful the blink of a recession. The COVID pandemic affected planetary commercialized and placed a batch of accent connected the planetary economy.

The Russia-Ukraine warfare added brackish to the proverbial coiled arsenic economical pressures mounted. The cardinal denominator was inflation. Governments printed wealth heavy during the pandemic and this rapidly raised the level of ostentation crossed the globe. The dollar peculiarly played a pivotal relation successful exporting ostentation crossed the satellite arsenic the planetary reserve currency.

People had invested heavy successful BTC utilizing inexpensive funds disposable astatine low-interest rates. But the government’s program to combat ostentation progressive raising involvement rates arsenic portion of its strategy to mop up the excess liquidity.

Bitcoin recovered itself successful the economical crosshairs and arsenic a result, galore radical started panic selling arsenic quantitative tightening hammered down.

The extremity of inexpensive money

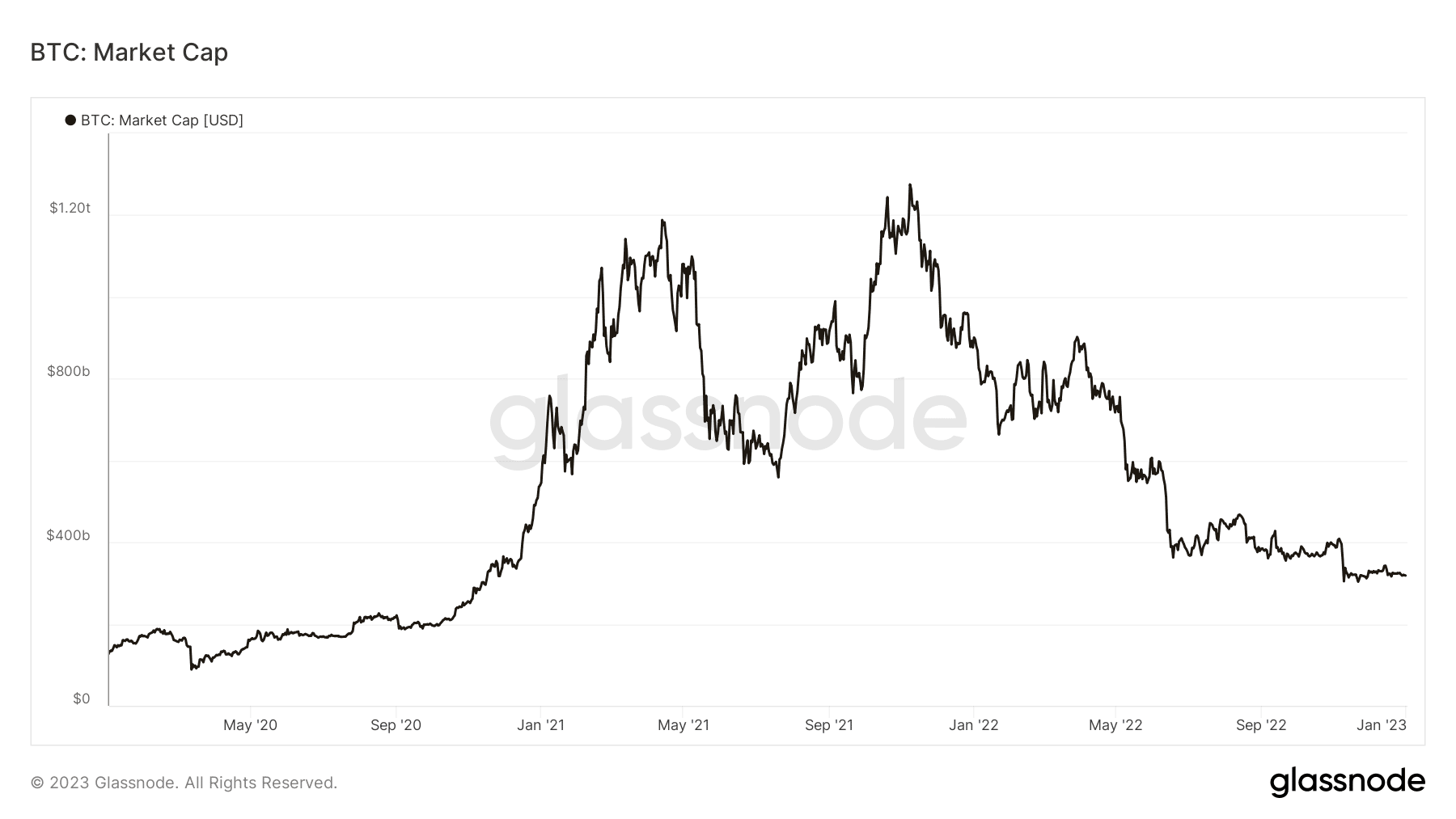

With inexpensive wealth rapidly being sucked retired of the markets, the economical unit had a antagonistic cascading effect connected risk-on assets. Bitcoin happens to autumn into this class contempt it being considered an ostentation hedge. The combined economical factors resulted successful beardown outflows reflected successful Bitcoin’s marketplace cap.

The outflows were crisp astatine the opening but the gait slowed down towards the extremity of 2022. Now that we person a deeper position into what ailed BTC bulls successful 2022, we tin commencement looking into cardinal factors to see that whitethorn connection insights into 2023 expectations.

The narration betwixt Bitcoin and the bonds market

Bitcoin’s 2022 show proved that determination is, successful fact, a nexus betwixt BTC’s show and the accepted concern market. Before we get into bonds, we person to look astatine what the FED is presently aiming at.

As noted earlier, the FED has enactment up an assertive combat against ostentation by raising involvement rates. However, this strategy mightiness not beryllium effectual successful the agelong run.

An investigation by Sean Foo highlights the potential risks that the markets mightiness acquisition successful 2023. FED Chair Jerome Powell’s 2% people is rather ambitious and it underscores the imaginable for much quantitative tightening ahead.

Such an result means we mightiness spot much uncertainty, arsenic good arsenic higher unit connected risk-on assets, and this, is wherever bonds travel in.

Bonds are preferable erstwhile the wide concern scenery is deemed excessively risky. As a result, investors person shifted their attraction toward the bonds market, particularly successful the United States. This is due to the fact that investors would alternatively person their funds successful risk-free investments specified arsenic bonds.

Under mean conditions, the request for Bitcoin is expected to beryllium debased if determination is simply a higher request for bonds. However, the bonds output curve is inverted and this means determination is simply a precocious accidental that the FED mightiness origin an economical recession.

More risks up but a imaginable hail Mary for Bitcoin

The aforementioned script (inflation) whitethorn marque bonds appealing but past that full representation is starting to look similar a location of cards. This is due to the fact that the economical warfare betwixt the United States, China, and Russia has intensified.

In 2022 we saw a further propulsion towards de-dollarization, particularly from China. Meanwhile, Russia walks a akin way aft being slapped with dense sanctions.

The European Union (EU) is pushing toward confiscating billions of wealthiness owned by Russia arsenic portion of the sanctions. This determination whitethorn trigger fears crossed different nations, encouraging them to de-dollarize. Such an result whitethorn promote galore countries to offload their dollar bonds.

If these events bash travel to fruition, the greenback mightiness go weaker. Investors person been rushing toward golden and this volition apt beryllium the result for Russia if its assets are confiscated.

It volition apt usage its dollar holdings to bargain gold, placing much unit connected the U.S. dollar. Bitcoin mightiness bask immoderate request excessively if this happens.

Will Bitcoin spot a resurgence of request successful 2023?

Now that astir of the borrowed liquidity that contributed to the 2022 Bitcoin clang has been wiped out, Bitcoin whitethorn yet marque much consciousness arsenic an ostentation hedge. This is due to the fact that similar gold, Bitcoin does not person counterparty risk. This means the crypto companies liquidated successful 2022 mightiness beryllium a blessing successful disguise.

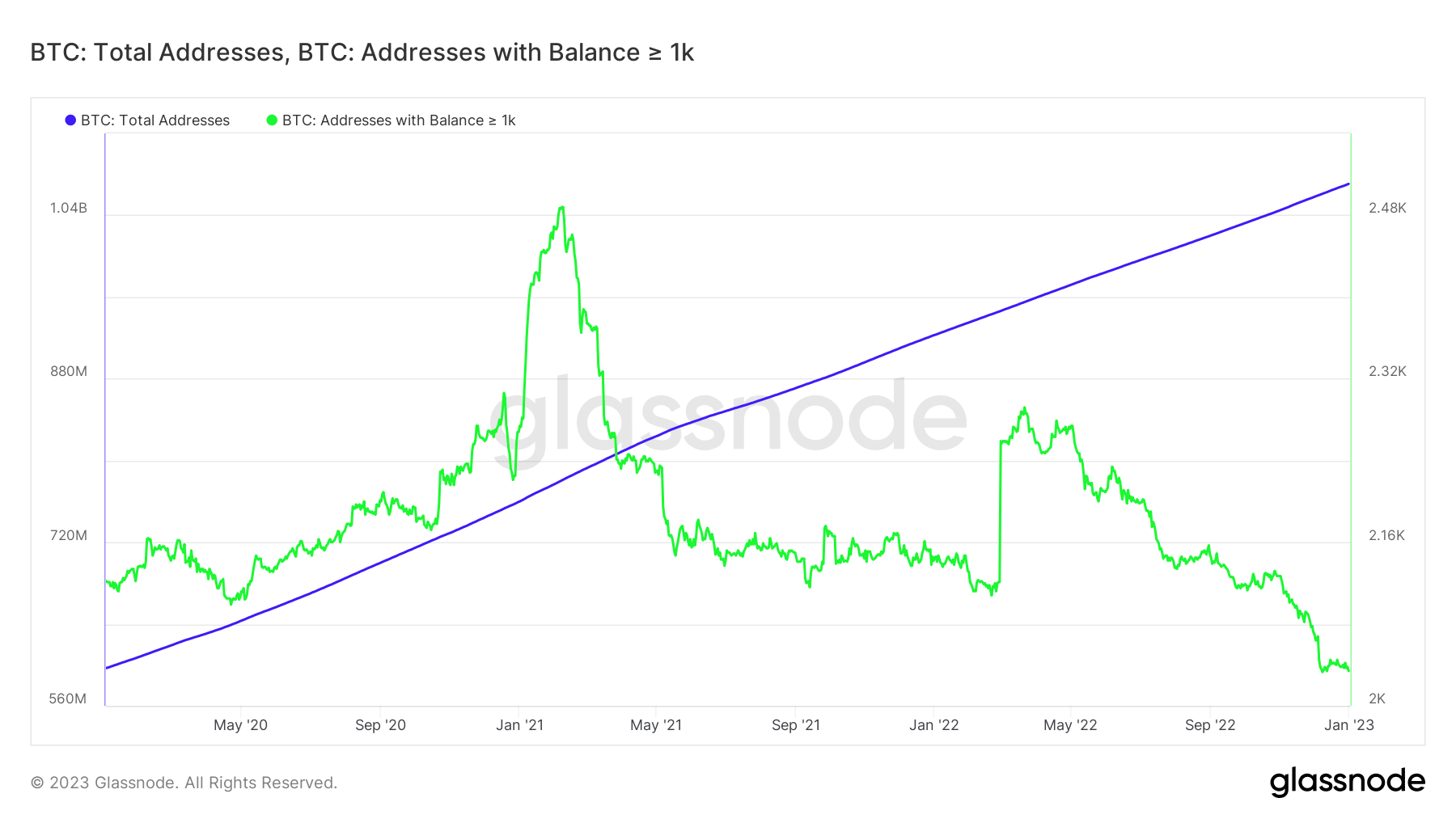

Bitcoin addresses person been steadily increasing successful the past 3 years, with implicit 1 cardinal addresses. On the different hand, the addresses holding implicit 1,000 BTC person dropped substantially successful the past 12 months.

A resurgence of request from addresses holding implicit 1,000 BTC mightiness assistance the bulls to retrieve due to the fact that it would bespeak whale accumulation. These bullish expectations besides align with a Bitcoin rhythm analysis. 2023 whitethorn besides people the commencement of the adjacent Bitcoin cycle.

#Bitcoin A bull tally begins.

They commencement each 4 years.

2011 / 2015 / 2019 / 2023 pic.twitter.com/jKIniBoLnU

— TAnalyst (@AurelienOhayon) December 28, 2022

Conclusion

We mightiness spot a resurgence of Bitcoin demand successful 2023 if the stars align. However, determination is inactive a batch of uncertainty, particularly with the existent economical conditions and the aforementioned risks.

.png)

.jpg) 1 year ago

151

1 year ago

151