- MakerDAO has a caller connection to instrumentality immoderate parameter changes.

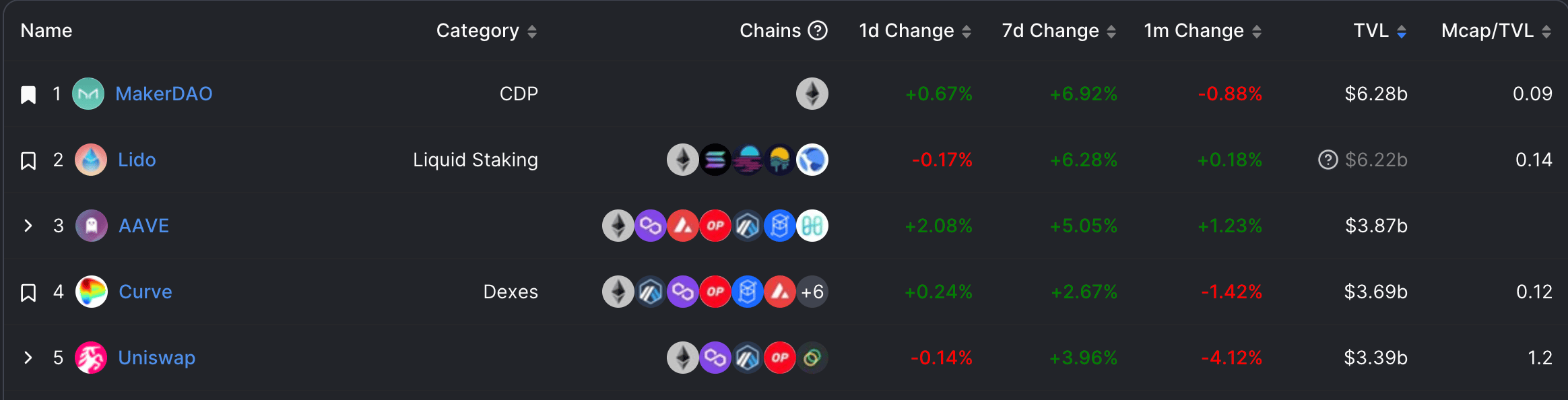

- The protocol has displaced Lido to regain its presumption arsenic the starring DeFi protocol.

In a caller proposal, the Open Market Committee of the MakerDAO governance squad is seeking assemblage support to instrumentality immoderate parameter changes to the cognition of the decentralized concern protocol (DeFi) successful airy of caller events successful the lending vertical of the DeFi ecosystem.

Read MakerDAO’s [MKR] Price Prediction 2023-2024

According to the proposal, owed to the wide diminution successful liquidity for smaller assets and Avi Eisenberg’s marketplace manipulations that led to the siphoning of $114 cardinal retired of decentralized crypto speech (DEX) Mango Markets, less long-tail assets are present accepted arsenic collateral successful the crypto lending world.

Long-tail assets are cryptocurrencies that person been successful circulation for respective months oregon years but person debased oregon nary trading volume. Rather than discarding these crypto assets, DeFi protocols interval pools utilizing them, thereby generating liquidity into this class of assets.

Per the caller proposal, MakerDAO’s Aave-DAI Direct Deposit Module (Aave D3M) is being projected to beryllium reactivated with a constricted indebtedness ceiling, and the Compound v2 D3M indebtedness ceiling would beryllium increased.

Stability fees for the protocol’s WSTETH-B vault benignant would besides beryllium normalized. Additionally, fees connected the USDP PSM would beryllium raised to forestall an summation successful exposure.

According to the Open Market Committee, if implemented, these changes are expected to effect successful an yearly gross summation of astir 525,000 DAI and an summation successful COMP rewards for the Maker treasury from the Compound D3M.

MakerDAO regains presumption arsenic the DeFi king

Lido Finance, a apical liquid ETH staking platform, concisely overtook MakerDAO arsenic the DeFi protocol with the highest full worth locked (TVL) astatine the commencement of the year. In the past week, this caused a important summation successful the worth of Lido’s governance token LDO.

Are your MKR holdings flashing green? Check the nett calculator

However, arsenic of this writing, per information from DeFiLlama, Maker has regained its presumption arsenic the starring DeFi protocol with a TVL of $6.27 billion. So acold this year, MakerDAO’s TVL has grown by 4%.

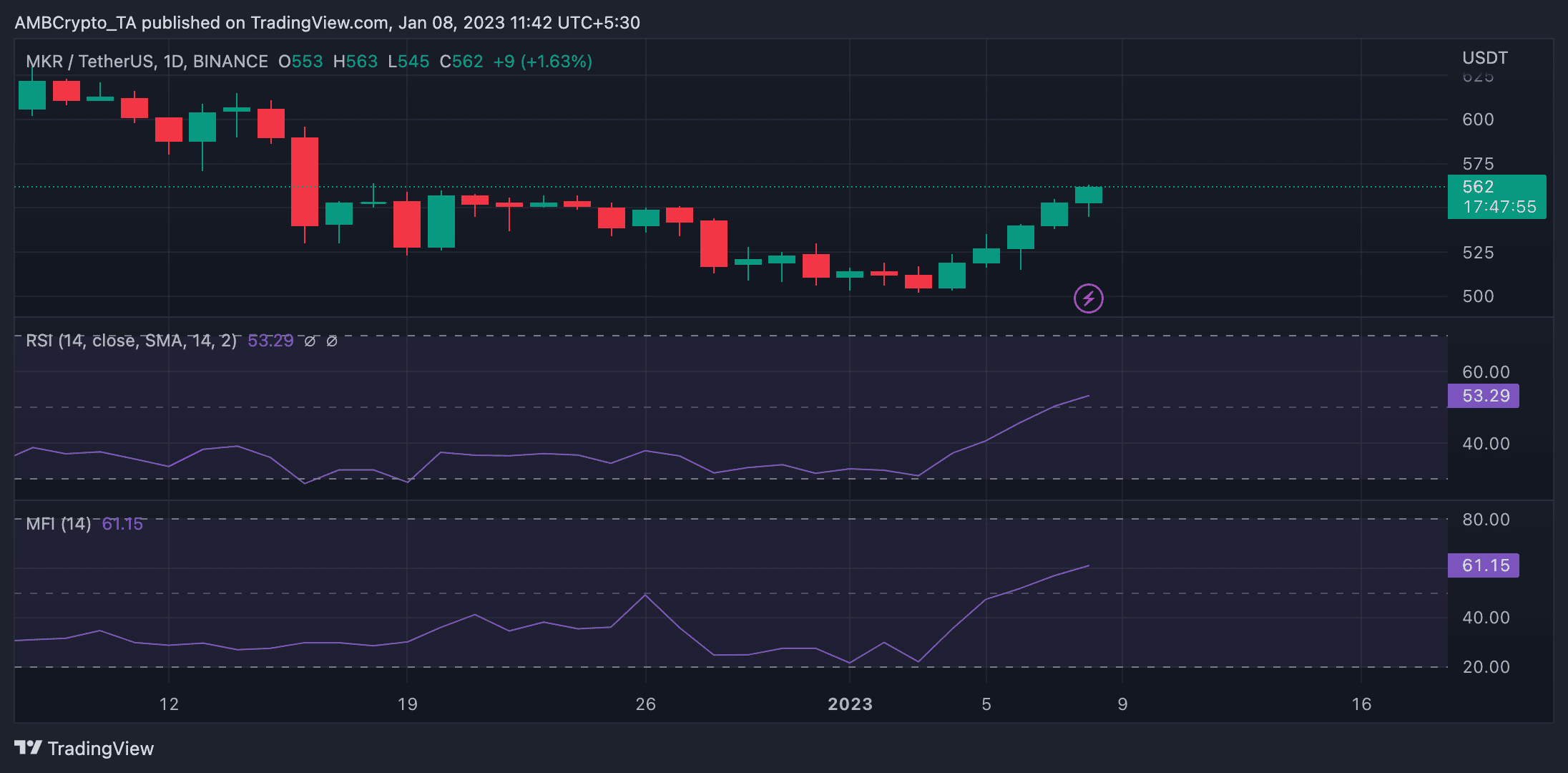

The protocol’s governance token MKR has besides recorded immoderate maturation successful its price. Exchanging hands astatine $558.98 astatine property time, its worth has gone up by 10% since the opening of the year, information from CoinMarketCap revealed.

The terms maturation is attributable to a dependable emergence successful MKR accumulation since the twelvemonth started. An appraisal of MKR’s terms movements connected a regular illustration revealed that the alt’s Relative Strength Index (RSI) and Money Flow Index (MFI) person been successful an uptrend since 3 January.

At property time, they were spotted supra their neutral lines astatine 53.29 and 61.15 respectively.

.png)

.jpg) 1 year ago

300

1 year ago

300