Disclaimer: The datasets shared successful the pursuing nonfiction person been compiled from a acceptable of online resources and bash not bespeak AMBCrypto’s ain probe connected the subject

XRP is simply a cryptocurrency that has been developed by Ripple, a institution that provides fiscal colony solutions. It is designed to beryllium a accelerated and cost-effective alternate to accepted cross-border payments, allowing fiscal institutions to nonstop and person payments from antithetic countries rapidly and with minimal fees.

XRP is utilized arsenic a span currency successful Ripple’s outgo web and tin beryllium exchanged for different currencies. While XRP has been the taxable of contention and speculation successful the past, it remains a fashionable prime for fiscal institutions and is utilized successful a fig of antithetic countries astir the world.

In the aboriginal years of XRP, its terms was comparatively stable, with immoderate periods of maturation and others of stagnation. However, successful the past twelvemonth oregon so, the terms of XRP has seen immoderate important fluctuations. In precocious 2020, XRP’s terms experienced a important bull run, reaching an all-time precocious of implicit $3 successful December of that year. This was driven successful portion by the wide bull marketplace successful the cryptocurrency space, arsenic good arsenic beardown request for XRP arsenic a inferior token successful the fiscal industry.

Ripple was successful the quality earlier this week aft its collaboration with Palau came to light. According to President Surangel Whipps Jr, the state volition motorboat a stablecoin successful collaboration with Ripple.

Read Price Prediction for XRP for 2023-24

Despite immoderate fluctuations successful price, XRP has proven to beryllium a fashionable prime for galore investors and traders, and its adoption and usage by fiscal institutions person continued to turn implicit time.

A study by CoinShares indicated that investors are assured of Ripple’s triumph successful this landmark case. This is based connected the information that XRP concern products person seen accordant inflows for 3 consecutive weeks.

In different news, Ripple CTO David Schwartz took to twitter to connection erstwhile employees of the troubled crypto speech FTX, a spot astatine Ripple. However, this connection lone stands for employees who were not progressive with compliance, finance, oregon concern ethics.

On the concern front, Ripple revealed cardinal developments pertaining to its European expansion. The institution shared its advancement with Paris- based Lemonway and Xbaht successful Sweden. Businesses successful France and Sweden volition present beryllium capable to leverage Ripple’s On-Demand Liquidity (ODL).

On 15 November, Ripple announced that it partnered with MFS Africa, a starring fintech steadfast with the largest mobile wealth footprint successful the continent. This associated task seeks to streamline mobile payments for users successful 35 countries.

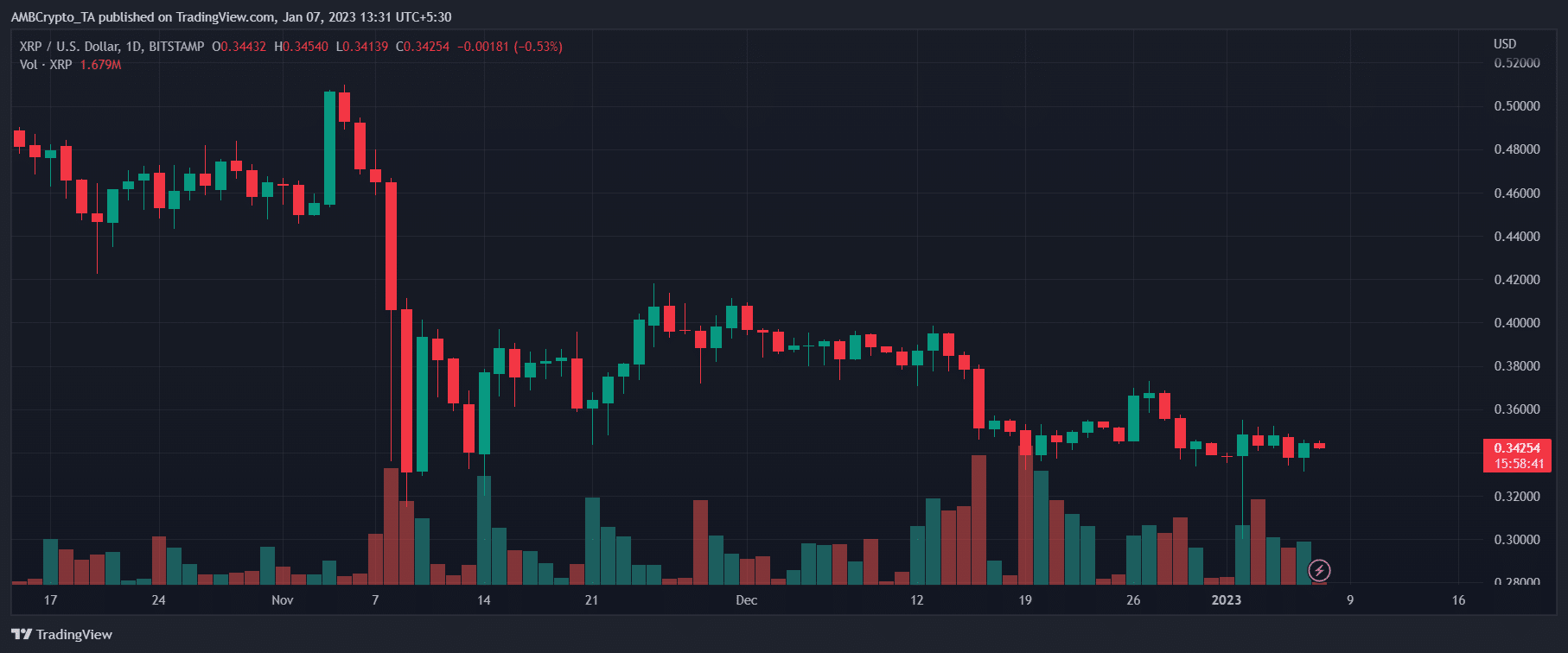

XRP, astatine property time, was trading astatine $0.34, down 4% implicit the past 7 days. Its property clip marketplace capitalization stood astatine $17.11 billion, with a 24-hour trading measurement of $404 million.

About the platform

Ripple’s tie-up with Tokyo Mitsubishi Bank successful 2017 was a large milestone. Following the same, it became the second-largest crypto by marketplace capitalization for a little period. A twelvemonth later, Ripple was successful the quality again for its partnership with planetary banking conglomerate Santander Group for an app focusing connected cross-border transactions.

In presumption of rivals, Ripple has adjacent to nary astatine the moment. They are the starring crypto steadfast catering to fiscal institutions astir the world. As the fig of partnerships grows, by extension, XRP volition reap the benefits. After all, it is the mean of speech for each cross-border transactions enabled by RippleNet.

Ripple has been capitalizing connected the request for speedy transactions and different untapped imaginable successful emerging economies, given that nations successful Latin America and Asia Pacific regions are much apt to recognize the worth of blockchain and its tokens compared to their first-world counterparts. With the emergence of cardinal slope integer currencies (CBDC), it is apt that processing countries looking to research this enactment volition spell for Ripple since it already offers a well-established cross-border framework. Increased adoption of CBDCs volition besides pb to banking institutions considering integrating crypto into their services. This volition enactment retired precise good for Ripple since it RippleNet is already associated with a fig of banks.

Blockchain solutions being offered to Ripple’s Central Bank partners wanting to task into CBDCs see the enactment to leverage the XRP ledger utilizing a backstage sidechain.

Ripple is predicted to make rapidly implicit the forecast period, arsenic it tin beryllium utilized for a assortment of functions similar accounting, investment, astute declaration implementation, and decentralized programming.

XRP has an borderline implicit its rivals owed to its debased outgo of entry. The information that a fewer dollars volition bargain tens of XRP seems appealing to caller investors, particularly those who similar small investment.

According to a Valuates report, the cryptocurrency market’s size is expected to deed $4.94 cardinal by 2030, increasing astatine a CAGR of 12.8%. A fig of crypto-firms volition payment from this, Ripple among them.

The maturation successful the cryptocurrency marketplace is spurred by an summation successful the request for operational ratio and transparency successful fiscal outgo systems, arsenic good arsenic an summation successful request for remittances successful processing nations.

The wide thought is that RippleNet’s adoption by fiscal institutions volition increase, starring to much designation of the level arsenic good arsenic its autochthonal token. This has besides been factored successful portion calculating predictions for 2025 and beyond.

At property time, XRP was trading astatine $0.342.

XRP’s property clip terms was a acold outcry from its all-time precocious of $3.84 successful January 2018. As a substance of fact, its terms was person to its motorboat terms than it is to its all-time high.

Although XRP did summation somewhat implicit the past 30 days, its year-to-date returns person investors worried.

SEC suit and its impact

On 22 December 2020, the U.S Securities and Exchange Commission (SEC) filed a suit against Ripple Labs. The suit alleged that Ripple had raised $1.3 cardinal done the merchantability of ‘unregistered securities’ (XRP). In summation to this, the SEC besides brought charges against Ripple’s apical executives, Christian Larsen (Co-founder) and Brad Garlinghouse (CEO), citing that they had made idiosyncratic gains totaling $600 cardinal successful the process.

The SEC argued that XRP should beryllium considered information alternatively than a cryptocurrency and arsenic such, should beryllium nether their purview.

A verdict successful favour of the SEC volition acceptable a alternatively unpleasant ineligible precedent for the broader crypto market. This is wherefore this lawsuit is being intimately observed by stakeholders successful the industry.

It is evident that developments successful the suit person a nonstop interaction connected XRP’s price. Following the quality of the suit successful 2020, XRP tanked by astir 25%. In April 2021, the justice handed Ripple a tiny triumph by granting them entree to SEC’s interior documents, which caused XRP to emergence implicit the $1-mark – A threshold that the crypto hadn’t crossed successful 3 years.

According to a tweet by Defense Attorney James Filan connected 15 August 2022, the U.S District Court for the Southern District of New York dealt yet different stroke to the SEC erstwhile Judge Sarah Netburn granted Ripple’s question to service subpoenas to get a acceptable of video recordings for the intent of authentication, dismissing the regulators assertion that Ripple was trying to reopen discovery. This was successful effect to Ripple’s motion filed connected 3 August 2022.

In the Opinion & Order published earlier successful July, Judge Sarah Netburn condemned the SEC for its “hypocrisy” and actions which suggested that the regulator was “adopting its litigation positions to further its desired goal, and not retired of a faithful allegiance to the law.”

The lawsuit’s verdict, immoderate it is, volition person a lasting interaction connected XRP’s value. It is important to enactment that a verdict successful favour of the SEC would marque XRP information lone successful the U.S due to the fact that the regulator does not person jurisdiction crossed the country’s borders. This should offset immoderate of the harm to Ripple, fixed that it has a important magnitude of concern globally

Carol Alexander, Professor of Finance astatine the University of Sussex, believes that XRP is dissimilar immoderate different crypto. She believes that if Ripple manages to bushed the SEC lawsuit, it could commencement taking connected the SWIFT banking system. SWIFT is simply a messaging web that fiscal institutions usage to securely transmit accusation and instructions

In an interrogation with CNBC, Ripple CEO Brad Garlinghouse talked astir the anticipation of an IPO aft the lawsuit with the SEC is resolved. Ripple going nationalist volition person a important interaction connected XRP’s terms enactment successful the pursuing years.

In an interview with Axios astatine Collision 2022, Garlinghouse further stated that the existent terms of XRP has already factored successful Ripple losing the case. “If Ripple loses the case, does thing change? It’s fundamentally conscionable presumption quo” helium added.

As for his idiosyncratic sentiment connected the verdict, Garlinghouse is betting that it volition beryllium successful favour of Ripple. “I’m betting that due to the fact that I deliberation the facts are connected our side. I’m betting that due to the fact that the instrumentality is connected our side,” helium remarked.

Curiously, enactment for Ripple and XRP hasn’t been cosmopolitan really, with Ethereum’s Vitalik Buterin precocious commenting,

“XRP already mislaid their close to extortion erstwhile they tried to propulsion america nether the autobus arsenic “China-controlled” imo”

In tribunal and successful papers

Ripple and the SEC’s suit is not conscionable restricted to the courtroom. The substance is often covered by the media with some parties having been featured successful aggregate op-eds, often criticizing each other. Just this month, the marketplace watchdog and the crypto steadfast were the taxable of a heated speech done pieces published by the Wall Street Journal.

On August 10, SEC Chairman Gary Gensler reiterated his stance connected the explanation of crypto assets and their oversight successful his op-ed portion featured successful The Wall Street Journal. “Make nary mistake: If a lending level is offering securities, it . . . falls into SEC jurisdiction.”

Chairman Gensler went connected to mention the $100 cardinal settlement that the regulator had reached with BlockFi, stating that the crypto markets indispensable comply with “time-tested” securities laws. As per the presumption of the settlement, BlockFi has to rearrange its concern to comply with the U.S Investment Company Act of 1940 successful summation to registering nether the Securities Act of 1933 to merchantability its products.

In effect to Chairman Gensler’s op-ed, Stu Alderoty published his ain portion successful The Wall Street Journal and did not mince his words portion taking a changeable astatine the regulator. Alderoty accused Gensler of side-lining chap regulators (CFTC, FDIC etc.) and overreaching its jurisdiction, arsenic opposed to the enforcement bid by U.S President Joe Biden, which directed agencies to coordinate connected regulations for crypto.

“What we request is regulatory clarity for crypto, not the SEC swinging its billy nine to support its turf astatine the disbursal of the much than 40 cardinal Americans successful the crypto economy,” Alderoty added.

A arguable nonfiction authored by Roslyn Layton successful Forbes connected 28 August pointed retired that since 2017, the SEC’s Crypto Assets Unit has been progressive successful 200-odd lawsuits. According to Layton, this fig suggests that alternatively of coming up with wide regulations to guarantee compliance, the regulator would alternatively prosecute crypto firms with lawsuits successful an effort to modulate by enforcement.

Ripple CTO David Schwartz recovered himself successful a stand-off with Ethereum Co-Founder Vitalik Buterin earlier this month, aft Buterin took a excavation astatine XRP connected twitter. Schwartz deed backmost and responded to Buterin’s tweet, comparing miners successful the PoW ecosystems similar Ethereum to stockholders of companies similar eBay.

“I bash deliberation it’s perfectly just to analogise miners successful PoW systems to stockholders successful companies. Just arsenic eBay’s stockholders gain from the residual friction betwixt buyers and sellers that eBay does not remove, truthful bash miners successful ETH and BTC,” Schwartz added.

Now, putting an close fig connected the aboriginal terms of XRP is not an casual job. However, arsenic agelong arsenic determination are cryptocurrencies, determination volition beryllium crypto pundits offering their 2 cents connected marketplace movements.

Ripple [XRP] Price Prediction 2025

Changelly has gathered an mean prediction of $0.47 for XRP by the extremity of 2022. As for 2025, Changelly has provided a scope betwixt $1.47 to $1.76 astatine max for XRP.

Finder’s decision from a sheet of thirty-six manufacture experts, is that XRP should beryllium astatine $3.61 by 2025. It should beryllium noted that not each of those experts hold with that forecast. Some of them judge that the crypto won’t adjacent transverse the $1 threshold by 2025. Keegan Francis, the planetary cryptocurrency exertion for Finder, does not hold with the sheet of experts. He predicts that XRP volition beryllium worthy $0.50 by the extremity of 2025 and surprisingly, a specified $0.10 successful 2030.

According to information published connected Nasdaq, the mean projection for 2025 is astir $3.66.

Are your XRP holdings flashing green? Check the profit calculator

Ripple [XRP] Price Prediction 2030

Finder’s experts had a alternatively blimpish fig for XRP successful 2030. They judge that the crypto could deed $4.98 by 2030. In a connection to Finder, Matthew Harry, the Head of Funds astatine DigitalX Asset Management, revealed that helium doesn’t spot immoderate inferior successful XRP different than the speculation element.

According to information published connected Nasdaq’s website, the mean projection for 2030 is astir $18.39.

Conclusion

Year-to-date (YTD) figures from Ripple’s Quarter 2 net report person made it wide that contempt the driblet successful XRP’s price, request for their On-Demand Liquidity work not lone remained undeterred but really grew by 9 times year-over-year (YoY) with ODL income totalling $2.1 cardinal successful Q2. The study further stated that Ripple has pledged $100 cardinal for c removal activities, successful enactment with their c neutral nonsubjective and sustainability goals.

Ripple’s Crypto Trends report claims that NFTs and CBDCs are inactive successful their nascent stages and arsenic their imaginable is gradually realized, its interaction connected Ripple’s web and connected the broader blockchain abstraction volition beryllium visible.

It should beryllium noted that portion assorted experts person predicted XRP’s terms to summation successful the pursuing years, determination are immoderate who judge that XRP volition suffer each worth by the extremity of the decade.

The large factors that volition power XRP’s terms successful the coming years are,

- Verdict of the SEC lawsuit

- IPO aft suit is resolved

- Partnerships with Financial Institutions

- Mass Adoption

- CBDC ventures by Central Banks

Predictions are not immune to changing circumstances and they volition ever beryllium updated with caller developments.

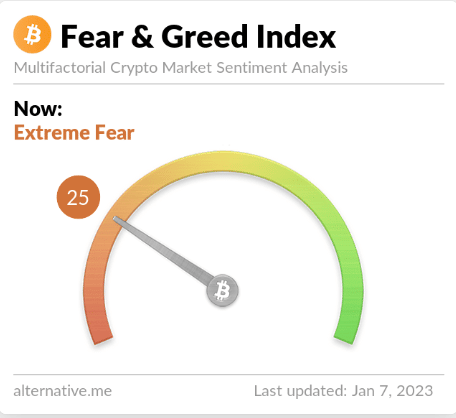

With the Fear and Greed scale inactive struggling to recover, uncertainty is bound to beryllium associated with XRP and the remainder of the crypto-market astatine this moment.

.png)

.jpg) 1 year ago

133

1 year ago

133