Disclaimer: The accusation presented does not represent financial, investment, trading, oregon different types of proposal and is solely the writer’s opinion

- Solana’s driblet beneath $9.6 could trigger a authorities of panic successful the market

- Solana’s Open Interest excessively flashed bearish signs

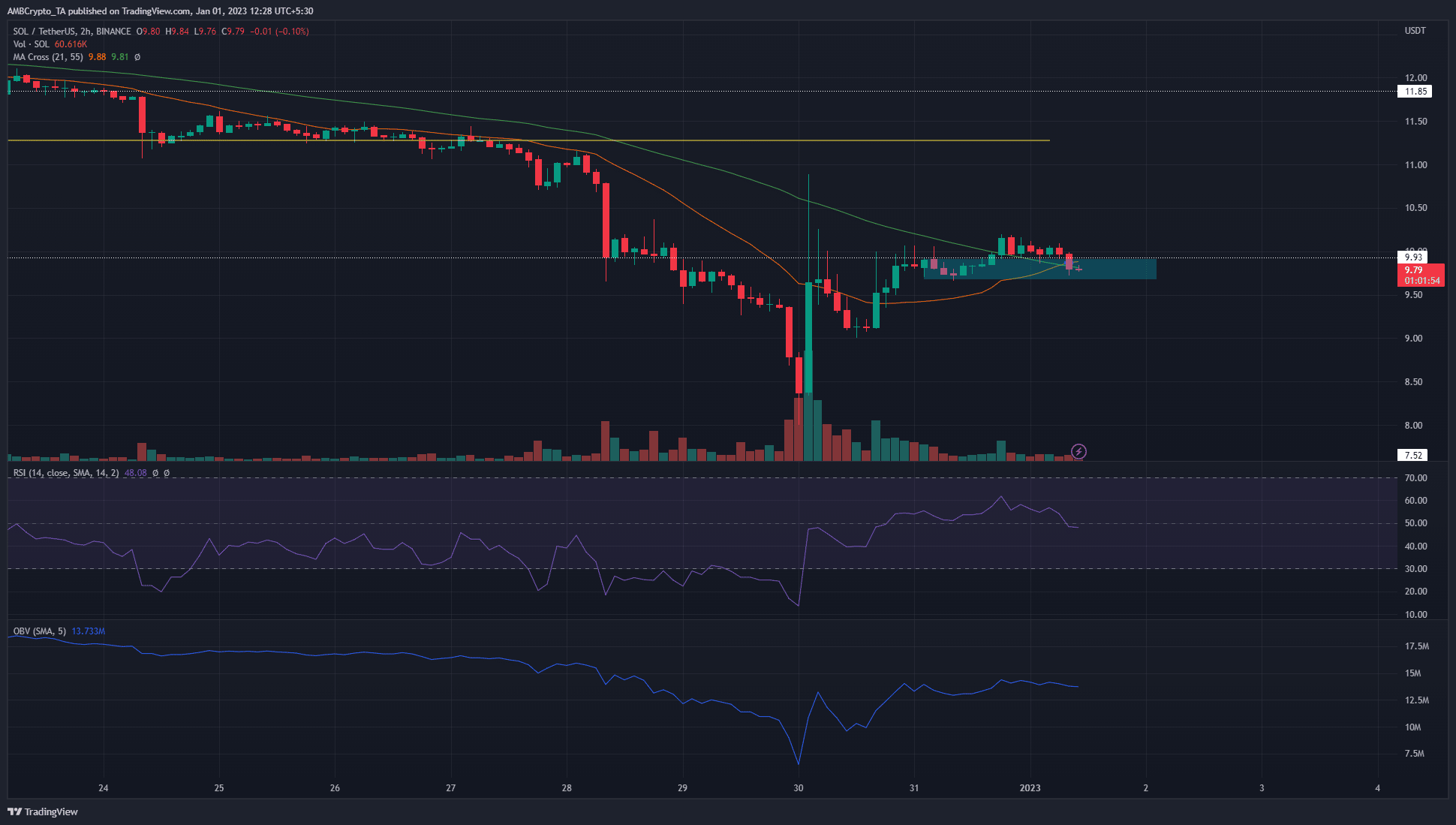

Bitcoin [BTC] dipped beneath the $16.6k enactment level erstwhile much but did not bespeak a inclination had developed. Solana [SOL] reclaimed an country of enactment that extended from $9.7 to $9.9. Furthermore, method indicators showed immoderate short-term bullish momentum.

An 86.33x hike connected the cards IF SOL hits Bitcoin’s marketplace cap?

A driblet beneath $9.6 could trigger fearfulness successful the Solana marketplace yet again, and induce different question of selling successful the coming days.

$10.16 and $9.68 are the short-term levels to ticker retired for

On 28 December, Solana crashed to trial the $9.93 level arsenic support. It was capable to bounce to $10.16, and adjacent reached arsenic precocious arsenic $10.38 connected the aforesaid day. The terms enactment connected that time indicated that sellers were successful power of the $10 area. Solana fell to $8 connected 30 December.

Right aft this drop, Solana buyers went ballistic aft a Vitalik tweet and a ample fig of abbreviated positions got liquidated. In the past mates of days, the terms hasn’t managed to breach the $10.16 mark.

Even though the Relative Strength Index (RSI) climbed supra neutral 50, the inference was not a bullish revival, but alternatively immoderate short-term upward momentum.

The On-Balance Volume (OBV) has besides risen implicit the past mates of days. Solana faces immense selling unit successful the $10-$10.15 area, arsenic good arsenic the $10.76-$11.11 area. Lower timeframe traders tin look to bargain if $10.16 was flipped to support, targeting $10.75.

On the different hand, a determination backmost beneath the $9.6-$9.7 country would apt spot SOL driblet to $8 oregon further implicit the adjacent week.

The emergence successful Open Interest suggested wealth was flowing into the market

The Open Interest began to emergence aft the terms mislaid the $9.9 enactment level, which indicated beardown bearish sentiment. The monolithic abbreviated compression that sent SOL backmost to $10.8 saw astir $3 cardinal worthy of abbreviated positions liquidated successful a azygous four-hour candle.

Are your SOL holdings flashing green? Check the Profit Calculator

After this event, the Open Interest climbed further higher portion the terms weakly crept up toward $10.15. It was unclear whether abbreviated positions were entering the marketplace oregon whether the bulls had immoderate sway.

The Long/Short ratio showed sellers had a infinitesimal advantage. A driblet beneath $9.6 could discourage the bulls erstwhile more, forcing them to adjacent agelong positions and adding to the selling pressure.

.png)

.jpg) 1 year ago

125

1 year ago

125