Journalist

- Solana has a semipermanent bullish marketplace structure.

- The absorption overhead could beryllium retested erstwhile again based connected the findings from the liquidation heatmap.

Solana [SOL] managed to code the issues of its downtime a period agone and maintained consistent uptime successful April. However, its terms enactment remained underwhelming, and a bearish bias was contiguous for traders.

A caller AMBCrypto report noted that the 7-day NFT transactions connected Solana outnumbered Ethereum [ETH] and Polygon [MATIC].

Solana’s gross was besides up by 33.3%, but the memecoin frenzy was fading. This saw decreased decentralized speech volumes and full worth locked (TVL).

The just worth spread could contiguous a important challenge

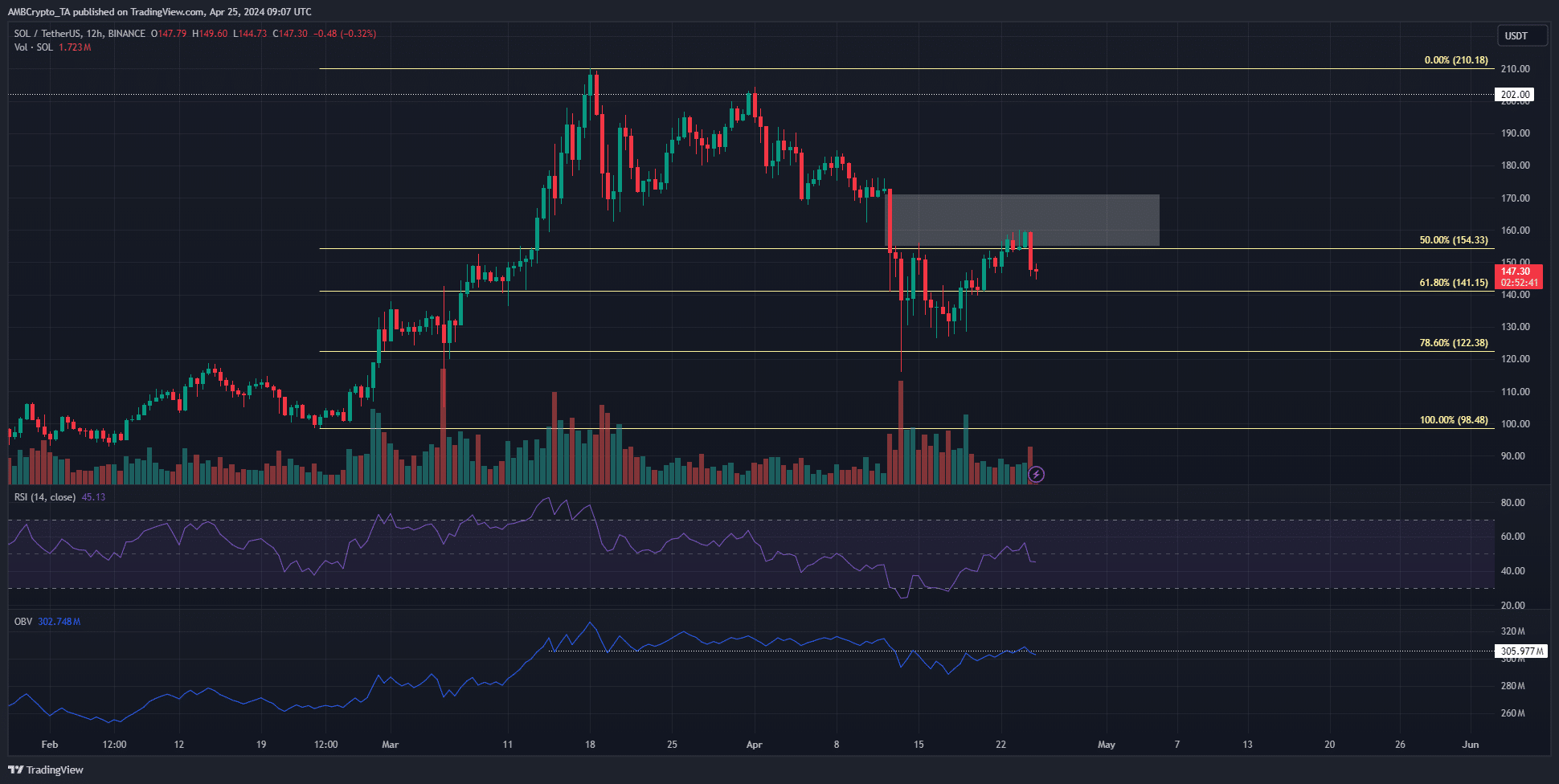

The semipermanent inclination of Solana was bullish aft the rally successful precocious February and March. Yet, successful the adjacent term, the bias was bearish. This was owed to the bid of little highs and lows that SOL formed successful April.

The RSI speechmaking was 45 but has been beneath neutral 50 for astir of April. This highlighted bearish momentum. The OBV has besides been successful a downtrend and was astatine a absorption level astatine property time.

Additionally, determination was a just worth spread (white box) successful the $160 zone. This portion served arsenic enactment successful March and acted arsenic absorption now.

The Fibonacci retracement levels (pale yellow) astatine $141.15 and $122.38 were apt to beryllium tested successful the coming weeks earlier bulls could reverse the trend.

The liquidity northward could spot a speedy reversal

The liquidation heatmap showed that the $143-$145 was a important liquidity excavation successful the adjacent term. The past fewer days saw SOL reverse from $157 to $145 to cod this liquidity.

To the north, the $160 level had a ample attraction of liquidation levels.

Is your portfolio green? Check the Solana Profit Calculator

Therefore, it was apt to beryllium a magnetic portion that would pull Solana prices to it successful the coming days. This would apt beryllium followed by different reversal arsenic SOL apt lacked the spot to found an uptrend.

On the different hand, if the $165 level was surpassed, the $180 portion would go the adjacent target.

Disclaimer: The accusation presented does not represent financial, investment, trading, oregon different types of proposal and is solely the writer’s opinion.

.png)

.jpg) 3 weeks ago

91

3 weeks ago

91