Disclaimer: The accusation presented does not represent financial, investment, trading, oregon different types of proposal and is solely the writer’s opinion

- Short-term marketplace operation and momentum were powerfully bullish astatine property time.

- The spot CVD has declined, which meant that sellers person the precocious hand.

Solana [SOL] sellers person been ascendant since mid-December. They forced a driblet of adjacent to 42% successful 2 weeks, dropping from $15 to $8.8. Meanwhile, Bitcoin [BTC] meandered astir the $16.6k level, incapable to marque up its mind.

Are your SOL holdings flashing green? Check the Profit Calculator

Short Solana positions person been squeezed with a vengeance successful caller days, and much bears could beryllium trapped successful the coming days. Even though SOL lacked important demand, it was risky to abbreviated the asset.

The lows of the erstwhile scope were retested- and different surge upward cannot beryllium discounted

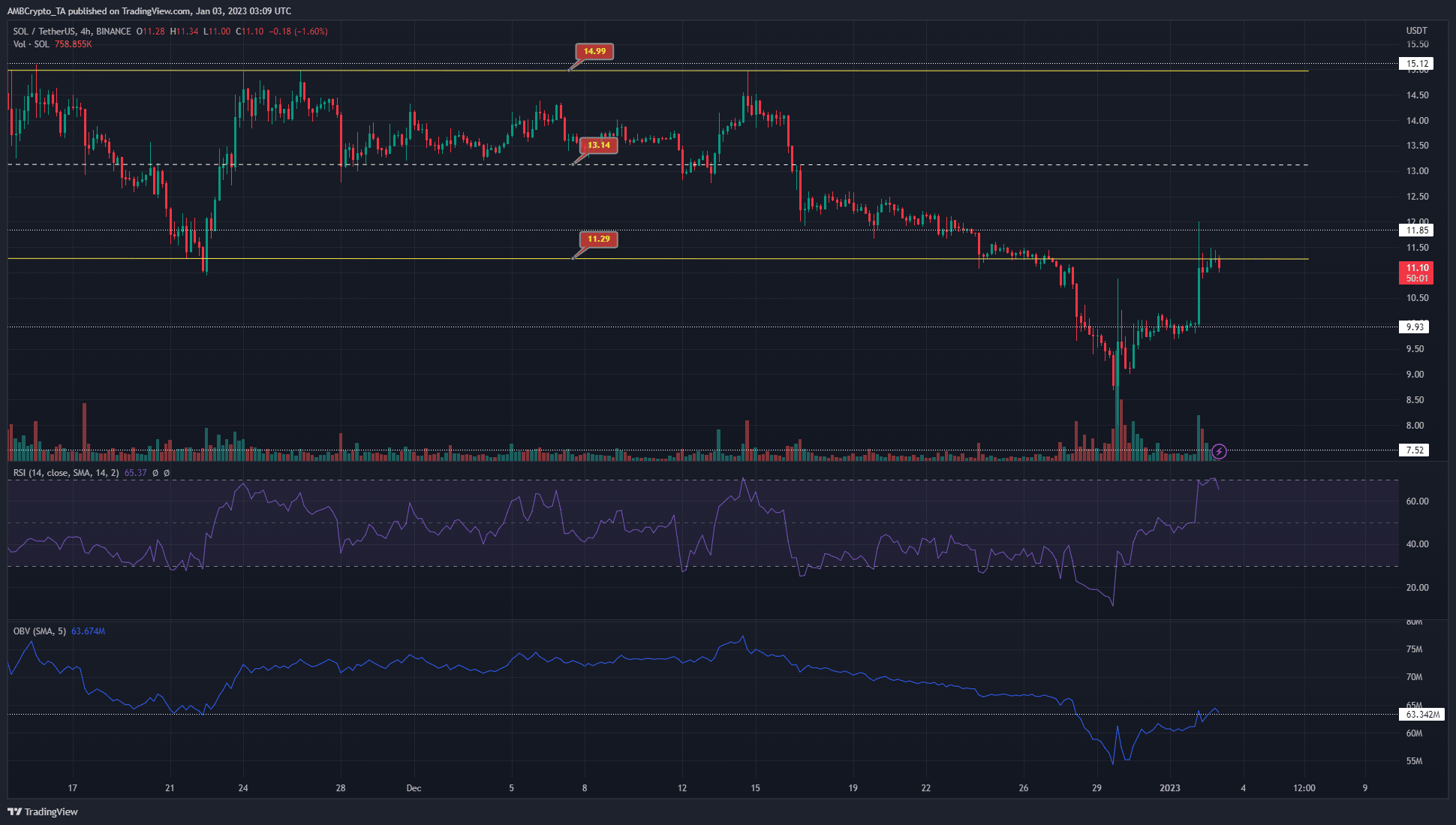

From 22 November to 27 December, Solana traded betwixt $11.3 to $15. It besides had a level of enactment astatine $9.93. In precocious December, aggravated selling unit saw SOL driblet to $8. However, this dive was followed by a ample abbreviated squeeze.

After the $9.93 level was flipped to support, SOL saw yet different upward spike, which carried the prices to the erstwhile scope lows successful caller hours of trading. The Relative Strength Index (RSI) showed beardown bullish momentum implicit the past fewer days. The determination supra the $10.78 – $11.12 portion indicated that Solana could ascent adjacent higher.

The On-Balance Volume (OBV) made gains successful the past 3 days, but it faced absorption nearby, akin to however the terms faced absorption astatine the $11.3 mark. A determination upward for some the OBV and the terms could spot different propulsion higher toward the mid-range people astatine $13.15.

Despite the summation successful OI, CVD remains unconvincing

How galore SOLs tin you get for $1?

The spot CVD did not animate bullish confidence. The negatively sloping CVD meant that sellers were ascendant passim December. This shifted to a much neutral stance successful caller days, but the CVD continued to spot a downward slope. The liquidation illustration highlighted that a ample fig of abbreviated positions had been liquidated already.

The marketplace operation was bullish connected little timeframes, and the Open Interest was besides increasing. With the CVD showing a deficiency of demand, the inference was that a beardown higher timeframe uptrend was improbable to beryllium established. However, that does not regularisation retired different determination upward to $13, oregon adjacent higher, to liquidate much abbreviated positions.

.png)

.jpg) 1 year ago

132

1 year ago

132