- Volatility, oregon the deficiency of it, tin service arsenic a instrumentality for analyzing marketplace trends

- The downtrend of Bitcoin is mostly done, but 1 much limb downward could beryllium painful

Bitcoin [BTC] investors person faced immoderate hard times passim 2022. Investors and traders who witnessed the Celsius, Terra, and FTX crises (among truthful galore different events) person seen past unfold earlier their eyes.

All of this past is laid bare connected the terms charts, and it is imaginable that we tin hole for the worst-case script by studying these charts. Look to the past to recognize the future, arsenic idiosyncratic celebrated astir apt erstwhile said.

Read Bitcoin’s [BTC] Price Prediction 2023-24

The periods erstwhile volatility vanishes are worthy noting. For assets similar Bitcoin, a autumn successful volatility often heralds a monolithic determination astir the corner. One of the simpler tools to measurement however volatile an plus is connected the terms charts is the Bollinger Bands.

Bollinger Bands width indicator findings

Bollinger Bands is simply a instrumentality developed by John Bollinger. It has 2 bands plotted with 1 modular deviation supra and beneath the terms (based connected the past 20 periods). These bands set based connected the volatility of the terms of the underlying asset.

When the Bollinger Bands’ width decreases, it indicates a play of little volatility oregon contraction connected the terms charts. This mostly highlights a play of accumulation earlier a beardown determination upwards, particularly connected higher timeframes. However, it tin besides bespeak phases of distribution, earlier different determination downward, erstwhile buyers are exhausted.

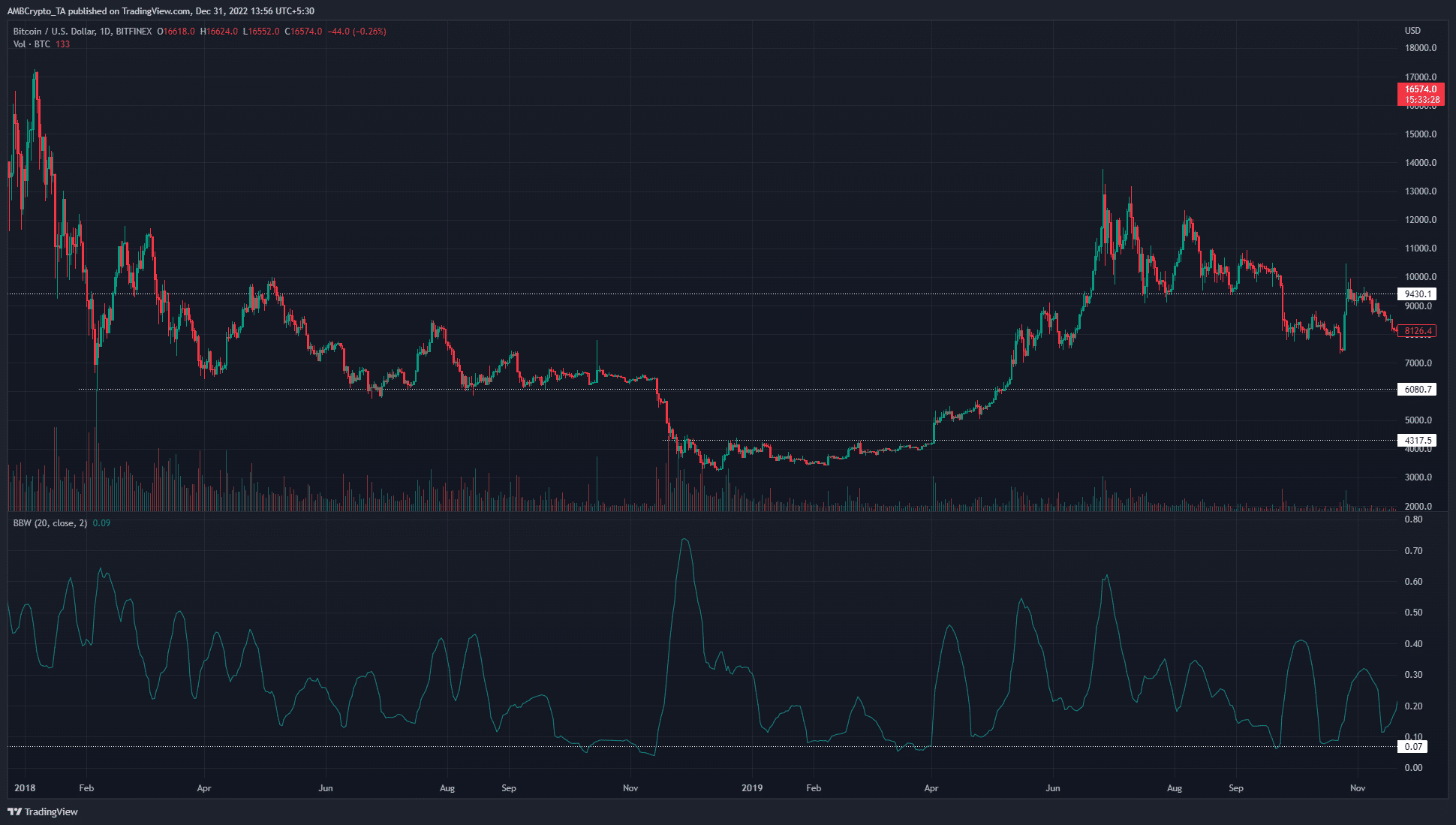

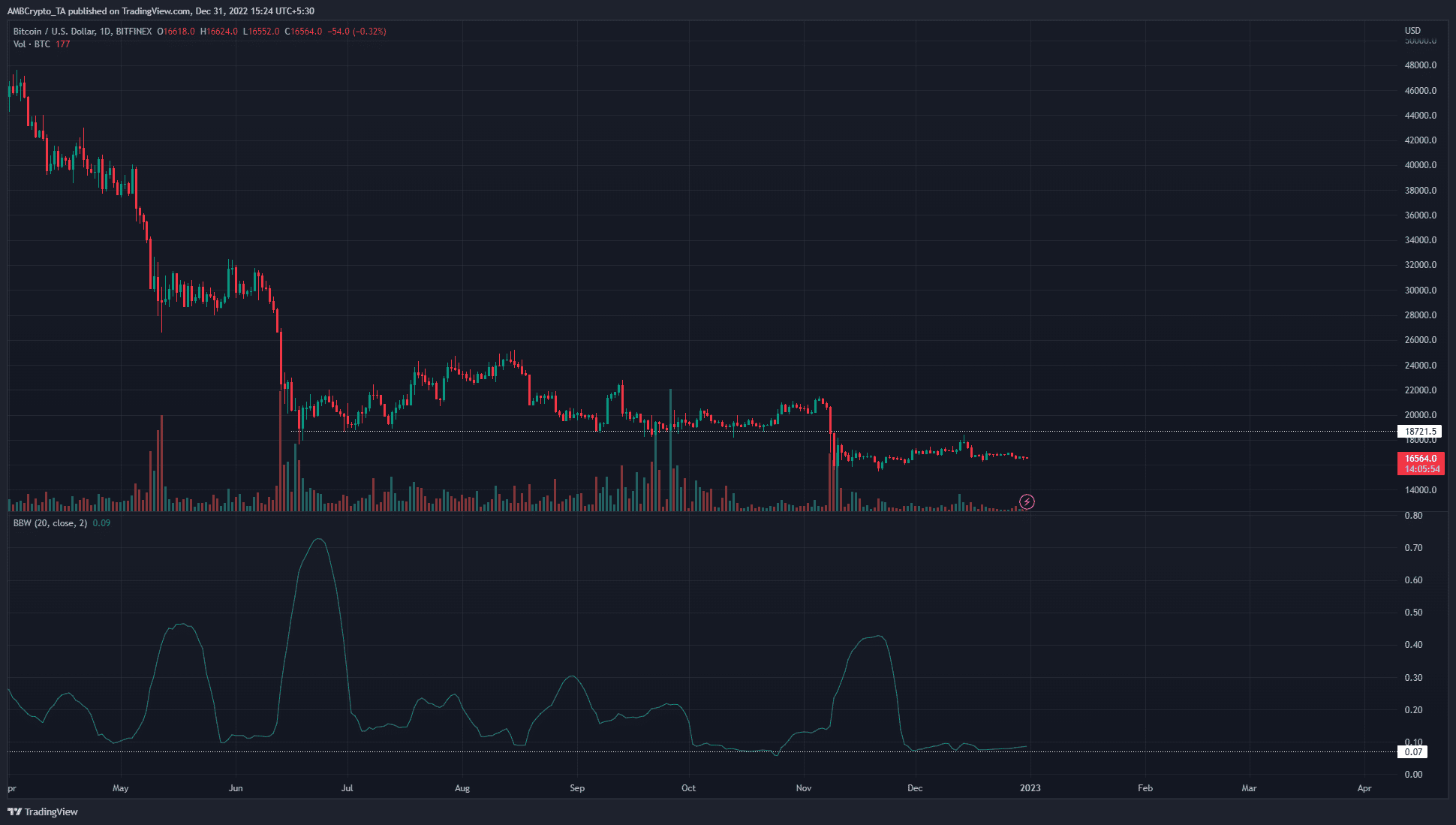

On the regular timeframe, the Bollinger Bands width indicator showed a speechmaking of 0.09 astatine property time. It had receded to a debased of 0.07 connected 1 December and 0.06 connected 25 October. Previously, the BB width indicator touched these values connected the regular timeframe of 8 October, 2020.

Other dates successful 2020, specified arsenic 26 August (0.07), 15 July (0.04), and 21 September, 2019 (0.06), besides saw highly debased values registered.

Northward expansions followed reduced volatility

History does not repeat, but it does rhyme. All method investigation is based connected patterns that repetition themselves, implicit and implicit again. The October, August, and July contractions successful 2020 came close earlier the caller bull tally wherever Bitcoin ripped arsenic precocious arsenic $69k.

However, Bitcoin was successful the depths of a carnivore marketplace wintertime astatine the clip of writing. Throughout 2023, Bitcoin mightiness not embark connected a beardown higher timeframe trend, arsenic was seen successful precocious 2020 until mid-2021.

Therefore, determination is the request to find points successful clip erstwhile volatility dried retired aft Bitcoin had retraced astir of its gains from a bull run. This occurred successful precocious 2018 and aboriginal 2019.

The supra illustration showcases the precocious 2017 rally to $19.5k, and the consequent retracement successful 2018. During the downtrend, the volatility was astir dormant successful September and October 2018.

The BB width indicator showed values of 0.08 and 0.09 consistently. However, different steep driblet from $6k to $3,3k followed. From December 2018 to March 2019, the bulls fought for their lives to propulsion prices backmost supra $4.3k.

Finally, erstwhile this absorption was broken, a rally to $13k ensued. Hindsight tells america that this was not a existent bull marketplace rally. Still, it was an awesome move, northbound of 220% successful nether 90 days, erstwhile the $4.3k level was broken.

Therefore, the inference was that debased volatility does not automatically construe into a semipermanent bottom. At the clip of writing, Bitcoin has mislaid the $18.7k level, and different driblet toward $10k could occur, conscionable similar it did backmost successful precocious 2018.

This rally reached a highest astatine $13.7k successful June 2019 and receded successful the months that followed. September 2019 saw volatility driblet to 0.06, but it took until the COVID-19 clang earlier the markets recovered a semipermanent bottommost and reversed.

Market operation breaks could beryllium cardinal to identifying rallies

Despite the bounce from $4.3k, BTC was not successful a reversal. That took till the higher timeframe bearish marketplace operation was broken, arsenic highlighted successful the illustration above. A determination backmost supra $9k flipped the longer-term bias successful favour of the bulls, and a breakout supra the $10.5k level showed bullish strength.

What tin we larn from this bid of events? Compared to the present, the volatility has been low, and the inclination has been downward, conscionable similar August – October 2018. From June – November 2018, the $6k level was rock-solid, until it wasn’t, and prices crashed different 46%. Can the aforesaid make implicit 2023?

Is the $18.7k level the enactment successful the soil that $6k was backmost successful 2018? $18.7k was defended arsenic enactment from June – November 2018, for 144 days.

This was akin to the defence of $6k from June to November 2018, but the quality was that the $6k people had already been tested arsenic enactment arsenic aboriginal arsenic February 2018.

Now that $18.7k was lost, it was apt that much losses could follow. Long-term BTC bottoms thin to signifier abruptly aft months of foreshadowing.

Another crash, similar the 1 we saw during the outbreak of the coronavirus pandemic, oregon November 2018, would beryllium indispensable to unit billions of dollars of liquidation earlier the markets tin march upward.

Using Liquidation Levels Heatmap information from Hyblock, an anonymous expert hypothesized connected 29 December that $15k and $13k are the 2 large liquidation levels, with $50 cardinal worthy of liquidation to beryllium hunted successful the vicinity of the $13k level.

$BTC – the @hyblockcapital vigor representation shows 2 large liquidation levels betwixt that 13k & 15K I antecedently mentioned.

As shown successful the erstwhile tweet, if we tin hitch retired each that liquidity successful a wedging manner I truly similar the likelihood for a important bounce.

13k to 30k hopefully. https://t.co/dm78uFuH40 pic.twitter.com/3HiqRCmG49

— TradingHubb (@TheTradingHubb) December 29, 2022

The terms seeks liquidity, and this country could beryllium excessively juicy to permission unattended. A descent beneath $15.8k could spot the already fearful marketplace conditions ripen into a panic.

Forced sellers, some successful the spot and futures markets, could origin prices to driblet further and further, and extremity with a liquidation cascade.

Patience volition apt beryllium rewarded, but all-time highs are improbable to beryllium reached successful 2023

In the lawsuit of a driblet to $13k-$13.8k, buyers tin await a determination backmost supra $15.8k and $17.6k and expect a rally, perchance a reflector of the 1 successful mid-2019. As ever, it mightiness not precisely replicate, and caution would beryllium key.

Are your BTC holdings flashing green? Check the Profit Calculator

It was not definite oregon adjacent indispensable that $13k would people the bottom. The heatmaps and the highs of the rally from mid-2019 amusement confluence astatine this level.

If, instead, BTC dumped different 46% beneath the $18.7k support, investors could look astatine $10k arsenic a portion wherever the bottommost could form. Which mode the dice would rotation was uncertain.

There were 641 days betwixt Bitcoin’s breakdown beneath the $6k enactment level successful precocious 2018 and the retest of $10.5k arsenic enactment successful Q3 2020. 641 days aft November 10, 2022 gives america 12 August, 2024. However, each rhythm is different, and each that a trader oregon capitalist tin power is the hazard they assume.

Laid retired supra is 1 script whose cardinal taxable is liquidity and volatility. When volatility goes connected a holiday, truthful does liquidity. A large, convulsive determination could beryllium indispensable to shingle adjacent the fanatics retired of their positions.

Only past mightiness the marketplace reverse. In this crippled of shark devour shark, the diligent and the prepared past and profit.

.png)

.jpg) 1 year ago

145

1 year ago

145