Disclaimer: The datasets shared successful the pursuing nonfiction person been compiled from a acceptable of online resources and bash not bespeak AMBCrypto’s ain probe connected the subject.

The terms of Terra’s Luna (LUNA) token has risen from $1.25 to $1.34 wrong the past 4 days. Following the illness of FTX, LUNA’s marketplace capitalization fell from implicit $300 cardinal to a small supra $170 million, arsenic of property time. LUNA’s terms has fallen by 50% during the aforesaid period.

Here’s AMBCrypto’s Price Prediction for LUNA for 2023-24

The New York-based consultancy steadfast JS Held conducted a third-party audit successful November past year. It mentions that the Luna Foundation Guard (LFG), the entity down the now-defunct Terra ecosystem, spent $2.8 cardinal successful crypto successful May to support the peg of algorithmic stablecoin TerraUSD, according to the investigation (UST). Furthermore, Terraform Labs (TFL), the developer of the Terra blockchain, spent $613 cardinal defending the peg.

Terraform Labs created the Terra USD stablecoin and the Luna coin, some released successful 2019. To guarantee terms stability, the TerraUSD (UST) stablecoin was linked to LUNC. This brace of coins’ journey, UST and LUNC, is fraught with ups and downs. The illness of these duplicate coins successful May 2022, which led to the cryptocurrency clang successful the 2nd 4th of 2022, is well-known successful the industry.

Stablecoins, specified arsenic UST, were created to support investors from the utmost terms volatility of fashionable cryptocurrencies specified arsenic Bitcoin.

As fiat currency is pegged to reserves specified arsenic gold, a stablecoin is pegged to either a fiat currency (e.g. USD) oregon a supporting cryptocurrency. In this case, TerraUSD was pegged to Luna. But herein lies the conflict. A cryptocurrency isn’t equivalent to golden reserves. As Luna prices got destabilized, it had an interaction connected UST prices too, and the full stablecoin strategy collapsed successful the 2nd 4th of 2022.

The stablecoin task was aimed astatine complementing the terms stableness and wide adoption of fiat currencies with the decentralized exemplary of cryptocurrency.

Even those who are lone vaguely acquainted with the cryptocurrency manufacture cognize of the apocalyptic illness of LUNA and UST successful May 2022. This illness was important successful instigating the cryptocurrency situation thereafter.

LUNA was 1 of the market’s apical performers once, with the altcoin erstwhile among the apical 10 cryptocurrencies by marketplace worth towards the extremity of 2021.

A Bloomberg report from May 2022 sheds airy connected the further developments that transpired. It was successful aboriginal May 2022 that the Terra strategy collapsed arsenic ample investors began selling their tokens. The determination caused a immense driblet successful the terms of the coins. While the terms of UST fell to $0.10, LUNA’s terms fell to astir zilch.

The cryptocurrency marketplace mislaid astir $45 cardinal wrong a week successful the ensuing bloodbath, starring to a planetary clang successful the market. The enactment of the Terra strategy hoped to bargain Bitcoin reserves to bargain much UST and LUNA coins truthful that their prices tin beryllium stabilized, but the program didn’t work.

Thousands of investors crossed the globe mislaid important amounts owed to the mishap. In the immediate aftermath, the Korean National Tax Service imposed $78.4 cardinal successful firm and income taxation connected Do Kwon and Terraform Labs after a Terra capitalist filed a constabulary ailment against the co-founder.

In fact, an affected capitalist adjacent broke into Kwon’s location successful South Korea. His woman past sought information from the police.

In July 2022, News1 Korea reported that South Korean prosecutors raided 15 firms, including 7 cryptocurrency exchanges successful narration to the probe astir the Terraform collapse. More than 100 radical who filed complaints with the prosecutors’ bureau reportedly had losses totaling astir $8 million.

Only a fewer days back, Financial Times reported that South Korean prosecutors person reportedly asked Interpol to contented a Red Notice against Kwon. Kwon, however, tweeted that helium is not connected the tally from immoderate funny authorities agency. He added that the institution is successful afloat practice and it doesn’t person thing to hide.

Many from the manufacture had been informing the cryptocurrency assemblage astir the upcoming doom. Kevin Zhou, CEO of Galois Capital, was 1 specified individual. He said that the effect was inevitable arsenic the “mechanism was flawed, and it didn’t play retired arsenic expected” However, astir radical didn’t wage immoderate heed.

On May 25, Bloomberg reported that a caller mentation of LUNA was launched pursuing a hard fork, with the caller LUNA coin nary longer associated with the devalued UST coin. The older currency is called Luna Classic (LUNC) and the newer 1 is called Luna 2.0 (LUNA). Though the older cryptocurrency has not been wholly replaced, its assemblage mightiness dilatory dissolve arsenic much and much users determination to LUNA 2.0.

The caller inaugural included an airdrop of caller LUNA tokens to those who held Luna Classic (LUNC) and UST tokens and suffered. A important information of the minted currency is to beryllium reserved for improvement and mining operations. Currently, determination is simply a proviso of 1 cardinal LUNA tokens.

Recently, the 1.2% taxation pain proposal, dubbed connection #4661, passed the governance vote, arsenic confirmed successful a tweet by connection writer Edward Kim. The determination was confirmed by Terra Rebels who tweeted that retired of 96% formed votes, 99% favored the 1.2% taxation burns.

The illness of the duplicate coins proved to beryllium a harbinger of accrued authorities regulations, if not downright opposition, successful the cryptocurrency industry. The anonymous exemplary of the industry, overmuch touted to beryllium the instauration of the decentralized cryptocurrency market, was erstwhile embraced by all. However, the infinitesimal radical mislaid their investments, they rushed to authorities authorities for redressal.

This is erstwhile authorities fiscal authorities recovered the accidental to propulsion for implementing rules and regulations successful the crypto manufacture to tackle terms volatility, wealth laundering etc.

The introduction of firm institutions with authorities oversight into the manufacture had already acceptable the code for what was to come. But this illness furthered this trend. Now, cryptocurrency entities, whether ample oregon small, volition apt beryllium overseen by cardinal banks crossed the globe. In specified scenarios, it volition beryllium captious to observe however the manufacture manages to uphold its anonymous and decentralized nature.

A caller Bloomberg report says that upcoming authorities would prohibition algorithmic stablecoins specified arsenic TerraUSD the illness of which led to a planetary crypto crash. The said measure is presently being drafted successful the U.S. House. The measure would marque it amerciable to make oregon contented caller “endogenously collateralized stablecoins.”

In a caller interview, Kwon said that his assurance astatine that clip was justified arsenic the marketplace occurrence of his Terra ecosystem was inching adjacent to $100 billion, but his religion present “seems ace irrational.” He admitted the anticipation of a mole being determination successful the organization, but added, “I, and I alone, americium liable for immoderate weaknesses that could person been presented for a abbreviated seller to commencement to instrumentality profit.”

Why these projections matter

The aboriginal of LUNA is simply a precise captious substance for the full cryptocurrency industry. Launched arsenic a portion of the regeneration strategy, its show truthful acold has not precisely been celebratory.

Transactions connected the Terra 2.0 blockchain are validated done the proof-of-stake (PoS) statement mechanism. The web has 130 validators moving astatine a fixed constituent of time. As a PoS platform, the powerfulness of the validator is linked to the fig of tokens staked.

How LUNA trades volition find the people of not lone this peculiar cryptocurrency but a fig of stablecoins successful the market. If it succeeds successful gaining the spot of investors, the task volition spell a agelong mode successful furthering the origin of the plus people of stablecoins.

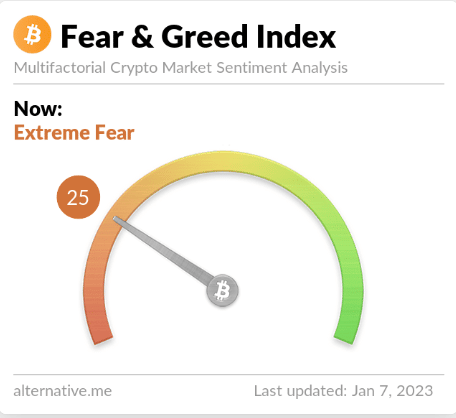

In this article, we volition laic down the cardinal show metrics of LUNA specified arsenic its terms and marketplace capitalization. We volition past summarize what the astir salient crypto-influencers and analysts person to accidental astir LUNA’s performance, on with its Fear & Greed Index. We volition besides concisely speech astir whether you should put successful stablecoin oregon not.

LUNA’s price, volume, and everything successful between

Beginning its travel astatine astir $19 connected 28 May 2022, LUNA rapidly dropped beneath $5 the adjacent day. By the extremity of May 2022, its worth was conscionable supra $11, but it soon spiraled southbound arsenic June began.

Over the adjacent fewer months, the worth of LUNA kept oscillating betwixt $1.7 and $2.5. At property time, it was trading astatine $1.32.

Similarly, its marketplace capitalization isn’t arsenic precocious arsenic it erstwhile was. Back successful June 2022, its marketplace headdress was implicit $300 million, but it kept oscillating betwixt $210 and $300 cardinal during overmuch of July. At property time, it was again down to $271 million.

The situation that unfolded pursuing the illness of the duplicate coins impacted the people of the full market. LUNA has peculiarly been susceptible to volatile marketplace conditions. The Russia-Ukraine situation and expanding crypto-regulations crossed the globe person besides curtailed the question of the market.

LUNA’s 2025 Predictions

Before speechmaking further, readers should recognize that the marketplace prediction of antithetic cryptocurrency analysts tin wide vary. And, a bully fig of times, these predictions beryllium wrong. Different analysts take antithetic sets of parameters to get astatine their forecasts. Also, cipher tin foresee unpredictable socio-political events that yet extremity up affecting the market.

Let america present person a look astatine what antithetic analysts person to accidental astir the aboriginal of LUNA successful 2025.

A Changelly blog post claimed that experts, aft analyzing the erstwhile show of Terra, person predicted that the terms of LUNA volition oscillate betwixt $7.26 and $8.62. Its mean trading outgo during the said twelvemonth volition beryllium astir $7.46, with a imaginable ROI of 384%, they added.

Telegaon too is precise bullish successful its appraisal of the aboriginal of LUNA, with its maximum and minimum prices successful 2025 being $52.39 and $69.18. It predicts its mean terms successful the said twelvemonth to beryllium $61.72.

LUNA’s 2030 Predictions

The aforementioned Changelly blog station stated that the maximum and minimum prices of LUNA successful 2030 volition beryllium $48.54 and $57.68. The mean terms of LUNA successful the said twelvemonth volition beryllium $50.24, with a imaginable ROI of 3,140%.

Disclaimer

Now, the aforementioned are much caller predictions. Before the events of the past fewer months, analysts were mode much optimistic astir the fortunes of LUNA.

Consider Finder’s sheet of experts, for instance. In fact, they forecasted a terms of $390 by 2025 and $997 by 2030.

“The likes of Digital Capital Management’s Ben Ritchie claimed, The LUNA token volition proceed to summation traction arsenic agelong arsenic determination are nary wide regulations successful stablecoins. We judge that LUNA and UST volition person an vantage and beryllium adopted arsenic a large stablecoin crossed the crypto space. LUNA is burnt to mint a UST, truthful if the adoption of UST grows, the LUNA volition payment greatly. Having Bitcoin arsenic a reserve plus is simply a large determination by the Terra governance.”

There were contrary opinions too. According to Dimitrios Salampasis,

“Algorithmic stablecoins are considered arsenic being inherently fragile and are not unchangeable astatine all. In my opinion, LUNA volition beryllium existing successful a authorities of perpetual vulnerability.”

That’s not all. In fact, astatine 1 constituent of time, determination was besides speech of Terra emerging arsenic the astir staked asset.

Fear & Greed Index

If you are considering investing successful LUNA, you should recognize that it has entered the marketplace pursuing a important crisis. It is inactive not listed connected a batch of exchanges owed to marketplace fear.

As we are witnessing a monolithic marketplace slump owed to the FTX episode, we are witnessing monolithic withdrawals. LUNA remains among the worst-hit tokens successful this ongoing crisis. It has fallen by implicit 30% pursuing the clang of FTX. In the meantime, FTX has filed for bankruptcy.

We volition besides person to spot however the assemblage of LUNA developers and investors acts successful the adjacent fewer weeks. If they pain capable tokens truthful arsenic to thrust up its price, it tin beryllium to beryllium beneficial for its future. A sustained effort connected the portion of the cryptocurrency industry, successful peculiar the LUNA community, tin spell a agelong mode successful restoring the spot of investors successful the market.

In an interrogation with Laura Shin connected the “Unchained” podcast, Kwon said that helium moved to Singapore from South Korea earlier the illness of the Terra ecosystem. So, it should not beryllium assumed that helium ran distant to flight the authorities. He denied claims that helium is connected the tally from instrumentality enforcement.

Recent news has present emerged that Kwon is besides facing a class-action suit filed connected behalf of much than 350 planetary investors successful a Singaporean court. They assertion to person mislaid astir $57 cardinal successful the illness of the algorithmic stablecoin TerraUSD (UST) and its ecosystem

Well, last month, the New York Times interviewed Ethereum co-founder Vitalik Buterin who claimed that the Terra Luna squad attempted to manipulate the marketplace successful bid to prop up the worth of the autochthonal cryptocurrency. He besides recalled that plentifulness of “smart people” were saying that Terra was “fundamentally bad.”

We indispensable again reiterate that marketplace forecasts aren’t acceptable successful chromatic and tin spell wildly wrong, peculiarly successful a marketplace arsenic volatile arsenic that of cryptocurrency. Investors should truthful instrumentality owed caution earlier investing successful LUNA.

In an interrogation with Laura Shin connected the “Unchained” podcast connected 29 October, Kwon claimed that helium migrated from South Korea to Singapore earlier the demise of the Terra environment. He besides refuted reports that helium is eluding instrumentality authorities.

As a monolithic marketplace slump owed to the FTX debacle is going on, we are witnessing monolithic withdrawals. LUNA remains among the worst-hit tokens successful this ongoing crisis. It has fallen by astir 30% implicit the past 2-3 days.

Kwon said, “Whatever issues existed successful Terra’s design, its weakness [in responding] to the cruelty of the markets, it’s my work and my work alone.”

We are witnessing the 2nd clang successful the crypto marketplace this twelvemonth pursuing the FTX debacle. As the superior token liable for the archetypal clang successful May, LUNA has been among the worst-hit tokens successful the 2nd clang too. Its terms has fallen by 35% since FTX filed for bankruptcy.

Following FTX’s collapse, we are witnessing the planetary crypto market’s 2nd clang this year. LUNA was the superior token liable for the archetypal clang successful May, and it was besides 1 of the tokens that suffered the astir harm successful the 2nd crash. Its worth has dropped by 30% since FTX declared bankruptcy, but it appears to beryllium recovering.

As per a section media report from South Korea, prosecutors are freezing assets worthy $92 cardinal affiliated with Terra tokens arsenic per the orders of a Seoul Southern District Court. The seized assets were taken from Kernel Labs, a tech steadfast intimately related to Terraform Labs. It has been revealed that Kernel Labs CEO Kim Hyun-Joong served arsenic Vice President of Engineering astatine Terraform Labs.

.png)

.jpg) 1 year ago

118

1 year ago

118