Disclaimer: The sentiment expressed present is not concern proposal – it is provided for informational purposes only. It does not needfully bespeak the sentiment of U.Today. Every concern and each trading involves risk, truthful you should ever execute your ain probe anterior to making decisions. We bash not urge investing wealth you cannot spend to lose.

Stablecoins oregon cryptocurrencies with rates pegged to fiat currencies should beryllium considered arsenic pivotal elements of the planetary integer assets ecosystem. For immoderate usage cases, they tin easy regenerate accepted currencies: radical usage them arsenic stores of value, mediums of speech and cross-border transportation instruments.

That is wherefore choosing the close stablecoin is simply a important measurement for each trader and investor. Holders of collapsed TerraUSD (UST), Fei (FEI) and Neutrino USD (USDN) mislaid millions arsenic their stablecoins de-pegged.

Top stablecoins to ticker successful 2023: Basics

In this review, U.Today is going to screen the astir important trends successful the stablecoin segments and item immoderate assets that are decidedly worthy noticing successful 2023. Here are immoderate tendencies that are expected to predominate the stablecoins conception successful the upcoming year:

- Top 3 centralized stablecoin bluish chips (U.S. Dollar Tether [USDT] by Tether Limited, USD Coin [USDC] by Circle Inc. and Binance USD [BUSD] by Binance and Paxos) volition stay unchallenged;

- Meanwhile, USDC tin surpass USDT by marketplace capitalization successful 2023;

- In the decentralized stablecoin sphere, turbulence is successful the cards: existent designs neglect to forestall assets from being de-pegged again and again: Maker’s DAI is the evident beneficiary of this process;

- The conception of Euro-pegged stablecoins volition summation traction arsenic the manufacture severely needs reliable regulated EUR-based unchangeable cryptocurrencies;

- Last but not the least, we should expect the emergence of caller stablecoins pegged to antithetic assets, including Offshore Yuan (CNH) and adjacent commodities similar Gold (XAU) and Silver (XAG).

In general, centralized stablecoins volition clasp their relation arsenic “fuel” for the upcoming bullish run. This sphere volition migrate to larger transparency, and much attestations and audits volition beryllium published.

However, it is inactive unclear whether large centralized stablecoins volition beryllium capable to scope caller capitalization highs successful 2023. The decentralized stablecoin conception volition stay fragile: much achy “de-pegs” should beryllium expected.

What are stablecoins

Stablecoins are cryptocurrencies that effort to support their terms pegged to assets from different classes: fiat currencies, commodities and truthful on. In this case, “stable” means that the stablecoins’ prices are acold much predictable than those of the bulk of cryptocurrencies.

As such, stablecoins code the large travel of cryptocurrencies, i.e., highly volatile prices. That is wherefore radical usage them to rebalance their portfolios arsenic good arsenic instruments of reliable worth retention and low-cost wealth transfers.

Centralized stablecoins

There are 2 large classes of stablecoins, centralized and decentralized oregon algorithmically backed ones. Centralized stablecoins are pegged to underlying assets (U.S. Dollar, Euro oregon Gold) protected by the issuer which, successful turn, is simply a centralized entity. Technically, it looks not dissimilar the cardinal bank, which releases banknotes backed by authorities reserves.

Mainly, сentralized stablecoins are backed by commercialized papers, 10-year U.S. treasuries, reserves successful currency and currency equivalents, and truthful on. Periodic audits oregon attestations by third-party services are designed to cheque whether the equilibrium of the centralized stablecoin is healthy.

Centralized stablecoins are the largest people of unchangeable assets; each 3 apical stablecoins by marketplace capitalization beryllium to this group.

Decentralized stablecoins

Decentralized stablecoins support their peg unchangeable via a blase architecture of astute contracts. These systems support the worth of decentralized stablecoins by periodic minting/destroying of reserve cryptocurrency assets.

Some decentralized stablecoins are governed by DAOs. As such, these systems are much aligned with the decentralization ethos of cryptocurrencies though being much susceptible to attacks. Decentralized stablecoins DAI and FRAX are liable for the lion’s stock of the segment’s capitalization.

Top stablecoins to ticker successful 2023: Majors

The close infinitesimal has travel to reappraisal each large centralized stablecoins, which are the backbone elements of the stablecoins sphere: combined, they are liable for 92.1% of stablecoins’ marketplace capitalization.

USDT

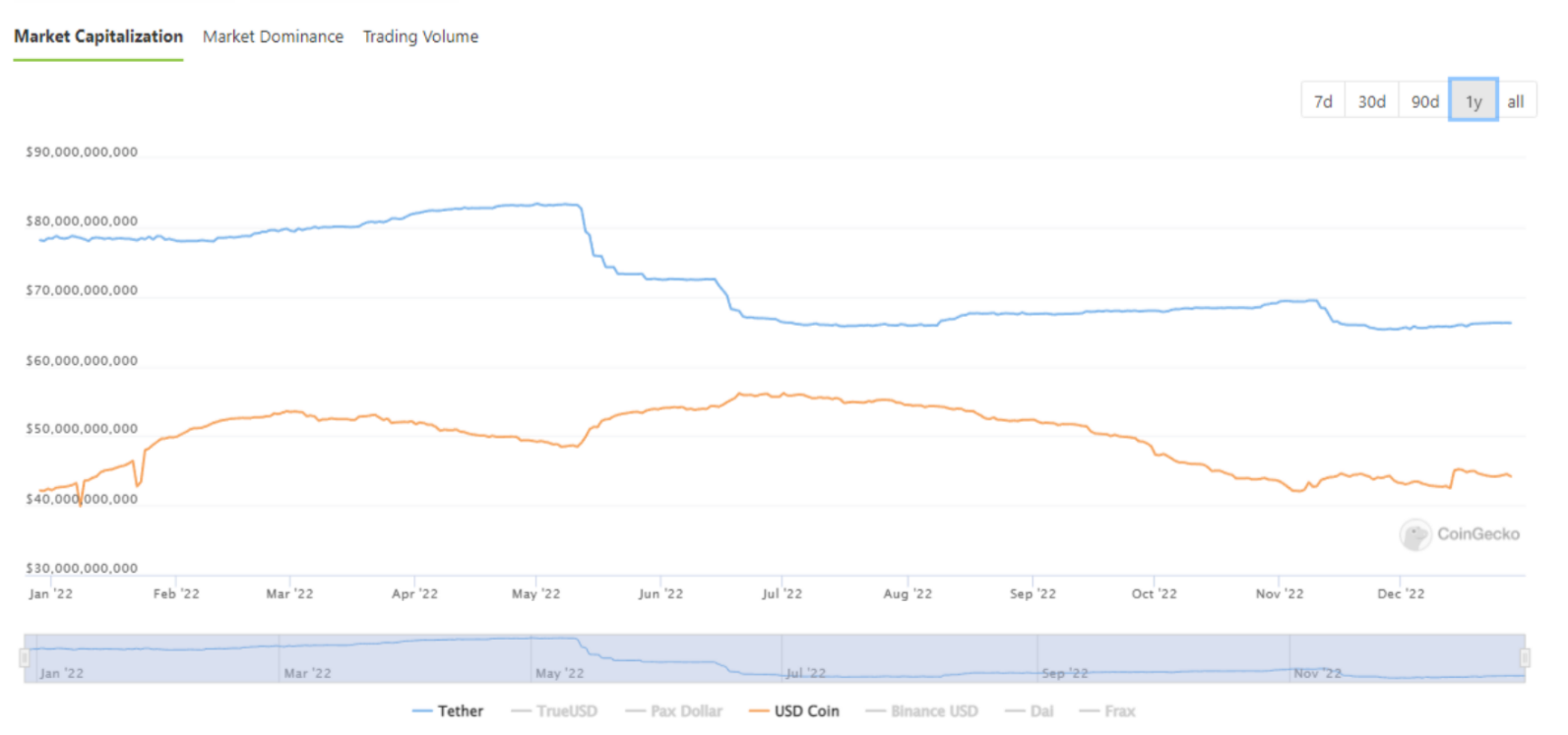

Launched by Tether Limited successful 2014, U.S. Dollar Tether (USDT oregon USD₮) is the largest stablecoin successful the satellite by trading measurement and marketplace capitalization. Its nett proviso peaked successful May 2022, erstwhile it exceeded $84 billion. By property time, the stablecoin keeps its capitalization astatine $65 billion.

Image by Tether Limited

Image by Tether LimitedIn 2022, Tether’s USDT proved itself arsenic a reliable store of worth and payments: erstwhile galore mainstream stablecoins mislaid their peg amid the Alameda/FTX collapse, USDT looked stronger than the others.

To beforehand the level of stableness of its peg, Tether (USDT) reduced USDT vulnerability to commercialized insubstantial and accrued the relation of U.S. bonds successful its basket.

USDC

USD Coin (USDC) was launched by Circle Inc. successful September 2018, arsenic Tether's competitor. This year, it was person to surpassing its rival than ever before: successful precocious June 2022, USDC capitalization peaked implicit $58 billion.

Image by CoinGecko

Image by CoinGeckoAs of Q3, 2022, its reserves were backed by short-dated U.S. Treasuries (80%) and currency Dollars (20%); some types of assets were stored successful U.S.-regulated institutions. Besides expanding the circulating USDC proviso — contempt terrible bearish recession, USDC capitalization added $4 cardinal since January 2022 — Circle enhanced its transparency and information toolkits.

Analysts noticed that successful 2022, USDC managed to surpass USDT by galore indicators, including usage among whales, proviso and regular transactions number connected Ethereum (ETH), and truthful on.

BUSD

The youngest plus successful the Big Three, Binance USD (BUSD), was launched successful collaboration betwixt Binance and Paxos successful September 2019. It is 1:1 collateralized by fiat USD held successful Paxos-owned slope accounts successful the U.S.

Binance USD (BUSD) is simply a autochthonal stablecoin of Binance, the world’s largest cryptocurrency ecosystem. It besides demonstrated important maturation successful 2022: its marketplace capitalization added astir 30% year-to-year, which is the astir awesome effect among each large stablecoins.

In Q4, 2022, the stablecoin expanded to Polygon Network (MATIC) and Avalanche (AVAX), 2 large high-performance astute contracts platforms.

Top stablecoins to ticker successful 2023: Decentralized stablecoins

While 2022 was achy for the bulk of cryptocurrency assets, decentralized stablecoins are among its worst sufferers. That is wherefore it would beryllium absorbing to cheque which decentralized stablecoin would beryllium capable to walk the exam successful 2023.

DAI

Dai (DAI), a seasoned decentralized stablecoin by Ethereum (ETH) vet Maker DAO, was launched successful September 2017. It is the lone illustration of a massively adopted decentralized concern (DeFi) protocol. It is collateralized by cryptocurrency itself: Ethers (ETH) and Maker (MKR) tokens play important roles successful their design.

In 2022, Dai (DAI) was utilized successful a compensation programme for holders of Fei (FEI), a now-defunct stablecoin. Also, the token expanded to Ethereum’s L2s Arbitrum and Optimism and accrued APYs for its built-in savings product.

FRAX

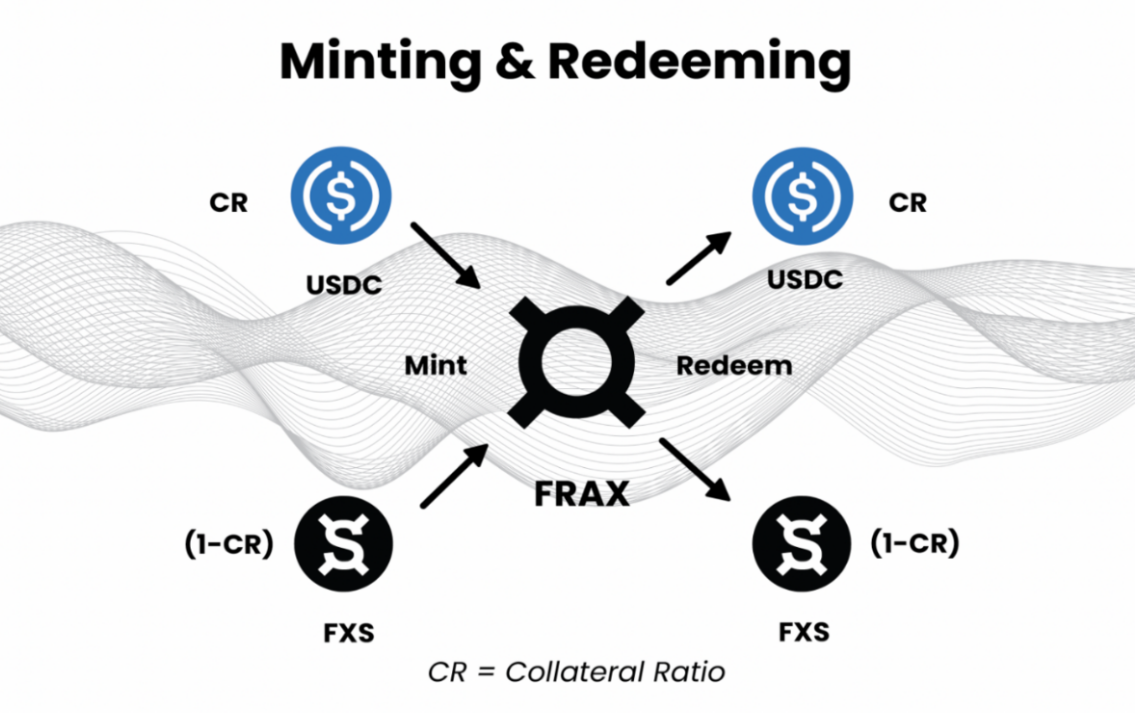

Launched successful December 2022 by Frax Finance, USD-pegged stablecoin FRAX pioneers the conception of a hybrid stablecoin arsenic it is partially backed by collateral and partially stabilized algorithmically. FRAX is simply a portion of Frax Protocol, which besides features a governance token, Frax Shares (FXS).

Image via Medium

Image via MediumFRAX is afloat on-chain: it leverages Chainlink oracles for amended sustainability of the FRAX/FXS system. Its collateral ratio is floating: if FRAX is changing hands nether $1, the protocol instantly raises the collateral ratio.

As covered by U.Today, successful December 2022, FRAX came to the BNB Chain.

USDD

USDD, an algorithmic crypto-collateralized stablecoin by TRON DAO ecosystem, was unveiled successful 2022. USDD is backed by an over-collateralized handbasket of assorted cryptocurrencies, including Bitcoin (BTC), Tronics (TRX) and USDT. As of precocious December 2022, USDD is 2x overcollateralized.

USDD is being promoted arsenic a blockchain-agnostic stablecoin that tin enactment connected the apical of Tron (TRX), Ethereum (ETH), BNB Chain and different networks. Its 1:1 peg to the terms of the U.S. Dollar is guaranteed by Peg Stability Module (PSM), a proprietary swap instrumentality by TRON DAO.

Top stablecoins to ticker successful 2023: EURO-pegged stablecoins

Stablecoins pegged to the Euro, the currency of the EU and immoderate different countries successful Europe, are inactive underrepresented successful the segment. Here’s however Web3 teams are addressing this discrepancy.

EUROC

Euro Coin (EUROC) by Circle Inc. was introduced successful Q3, 2022. As Circle is an issuer of large USD Coin (USDC) stablecoin, it expanded the 100% collateralization plan of its caller product. That being said, EUROC is afloat backed by Euros held successful Euro-denominated slope accounts successful regulated institutions.

Euro Coin (EUROC) is launched connected Ethereum (ETH) blockchain. By the extremity of 2022, it has already been integrated by large CEXes (Bitmart, BitPands), DEXes (Curve Finance, Uniswap), payments processors (BitPay) and on-chain wallets (Legder, MetaMask).

EURT

EURT (also EURt oregon Euro Tether) is simply a Euro-pegged stablecoin by Tether Limited, USDT’s creator. It was launched successful 2020. Meanwhile, it has not go mainstream yet: its proviso is capped astatine €400 cardinal connected Ethereum (ETH).

The stablecoin is backed by Tether Limited reserves successful its entirety. Currently, it is lone listed by Bitfinex exchange. At the aforesaid time, successful December 2022, Tether besides announced that EURt was coming to Huobi.

EUROe

Unveiled successful mid-December 2022, EUROe is the archetypal effort to make an EU-regulated stablecoin pegged to the Euro. EUROe is the brainchild of Helsinki-headquartered Web3 infrastructure steadfast Equilibrium Labs.

The stablecoin volition beryllium launched successful mainnet successful Q1, 2023. Once unrecorded successful mainnet, it volition beryllium afloat compliant with the much-criticized Markets successful Crypto Assets regularisation (MiCA), the strictest regulatory model for integer assets ever.

Top stablecoins to ticker successful 2023: Exotic assets

Wrapping up our review, let’s absorption connected 2 antithetic stablecoins that are not pegged to the U.S. Dollar oregon Euro.

XAUT

Tether Gold (XAUT) is simply a pioneering multi-purpose stablecoin that is backed by carnal Gold. Its issuer, Tether Limited, promotes this plus arsenic a “safe haven” amid the expanding marketplace volatility of some integer and fiat currencies:

From past civilizations, humans person utilized golden arsenic wealth and a store of value. Since then, and particularly successful times erstwhile the wide macro marketplace has been successful distress, golden has been utilized arsenic a hedge.

With its marketplace headdress of $443 cardinal successful equivalent, Tether Gold (XAUT) reserves see 611 Gold bars, oregon 7643.71 kilograms of carnal Gold.

TCNH

TrueUSD (issuer of TUSD stablecoin), unneurotic with TRON DAO, released TCNH, a stablecoin merchandise pegged to Offshore Chinese Yuan. CNH is an offshore "version" of the Chinese Yuan (renminbi) and, therefore, is not regulated by Chinese law.

¥>$. Few understand.

— H.E. Justin Sun🌞🇬🇩🇩🇲🔥 (@justinsuntron) December 15, 2022CNH is chiefly utilized connected offshore Asian forex markets, including Hong Kong and Singapore. Unlike “on-shore” Chinese Yuan (CNY), its terms is formed by demand/supply dynamics, not by authorities monetary policy.

Closing thoughts

In 2023, stablecoins volition stay the backbone of the planetary cryptocurrency remittances segment. Centralized stablecoins volition predominate portion decentralized stablecoin products volition present much and much archetypal method concepts.

.png)

1 year ago

119

1 year ago

119