The accusation presented does not represent financial, investment, trading, oregon different types of proposal and is solely the writer’s opinion

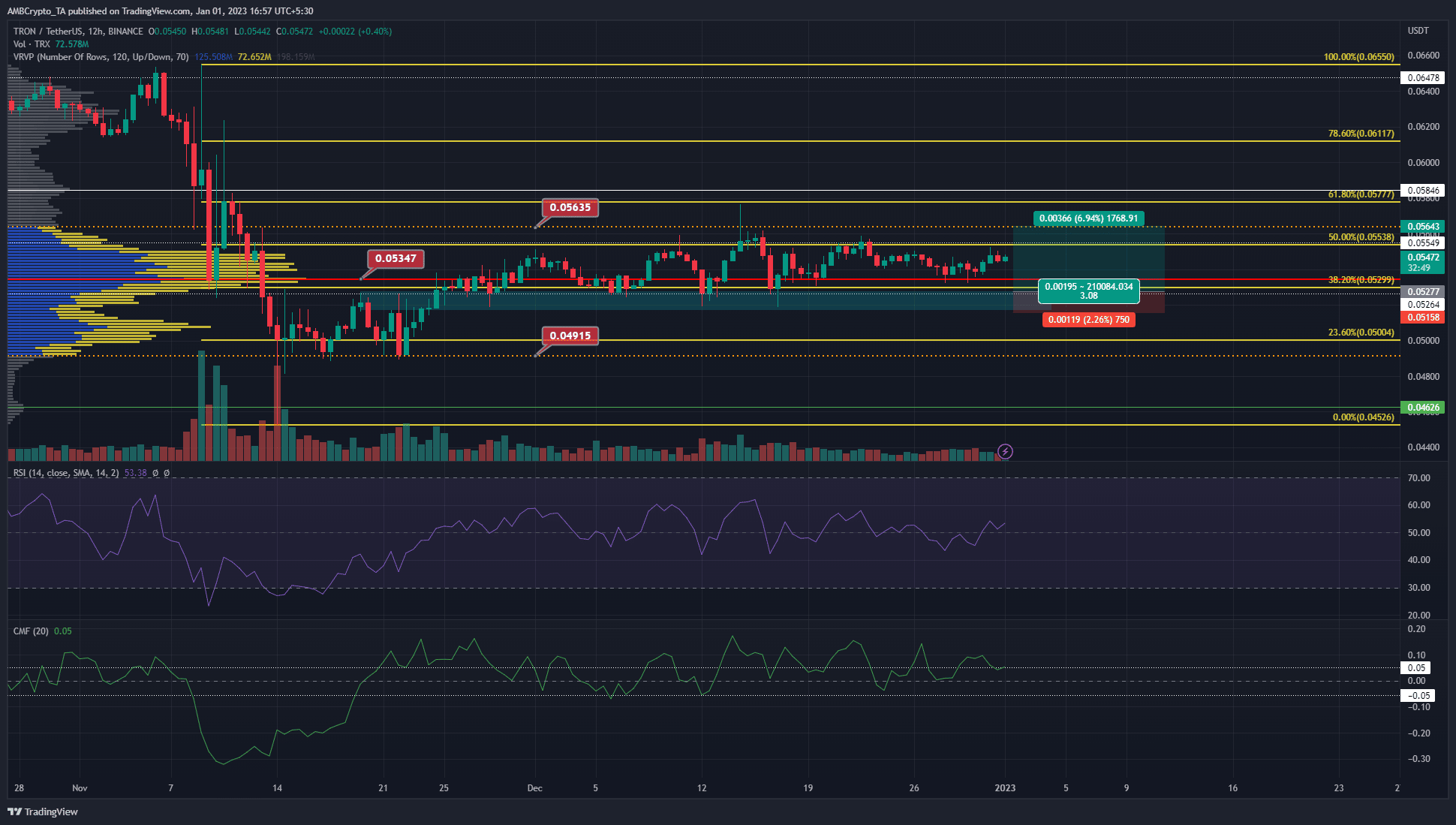

- The precocious measurement node astatine $0.053 has trapped TRON connected the terms charts since aboriginal December.

- A determination supra the Value Area High could initiate a rally.

Bitcoin continued to commercialized successful the vicinity of the $16.6k people and has seen a beardown determination successful caller weeks. A determination down to $16.2k enactment tin spot a dip for TRON arsenic well. This TRX dip tin beryllium bought aiming for a tiny determination upward.

Read TRON’s Price Prediction 2023-24

TRON has defended the $0.052 level of enactment since June. It dropped to $0.049 successful mid-November but was speedy to retrieve backmost supra this enactment level. It exhibited lowered volatility precocious arsenic it traded wrong a high-volume node.

The H12 bullish breaker has been defended since precocious November and could service arsenic enactment yet again

The Visible Range Volume Profile showed the Value Area Low and High to prevarication astatine $0.04915 and $0.05635 respectively. The Point of Control, the highest measurement node successful the disposable scope was astatine $0.05347. It represented a important level of enactment for TRX.

Throughout December, TRON has not done overmuch connected the terms charts successful presumption of mounting up a important trend. The remainder of the crypto marketplace has not seen a beardown inclination either, particularly Bitcoin and Ethereum which clung to their respective short-term enactment and absorption levels

How galore TRXs tin you get for $1?

Based connected the terms enactment we tin spot that the $0.051-$0.052 acts arsenic a enactment due to the fact that it is simply a bullish breaker connected the 12-hour chart. It besides has confluence with the horizontal level of enactment astatine $0.052, and the 38.2% Fibonacci retracement level. Hence, it could connection a buying accidental connected a dip. To the north, the absorption astatine $0.056 tin beryllium utilized by buyers to instrumentality profit.

Open Interest remains level but rising CVD meant buyers person their tails up

Coinalyze information showed that TRON was apt successful a signifier of accumulation. The Open Interest has been level since mid-December alongside the price. This was owed to the deficiency of a trend, with little timeframe scalpers apt being the ones who profited during the past 2 weeks trading TRON.

However, the spot CVD metric has been steadily rising since August. While the CVD changeable higher, the terms formed a bid of little highs. This indicated that buying unit was persistent, but the intermittent waves of selling and the wide sentiment successful the marketplace were not conducive to an uptrend. The backing complaint was besides antagonistic showing bearish sentiment successful caller weeks.

.png)

.jpg) 1 year ago

137

1 year ago

137