The accusation presented does not represent financial, investment, trading, oregon different types of proposal and is solely the writer’s opinion

- Until property time, the bulls had successfully defended Uniswap’s $4.95 enactment level.

- However, semipermanent investors should hold a portion earlier making their adjacent move.

Uniswap [UNI] did not person a bullish bias astatine the clip of writing. The bulls had valiantly defended the $5 enactment level. It was a important level from the intelligence position arsenic well.

How galore UNIs tin you get for $1?

Since the sellers had the precocious hand, traders could look for opportunities to travel the larger trend. A determination upward into the $5.3 portion could connection 1 specified opportunity.

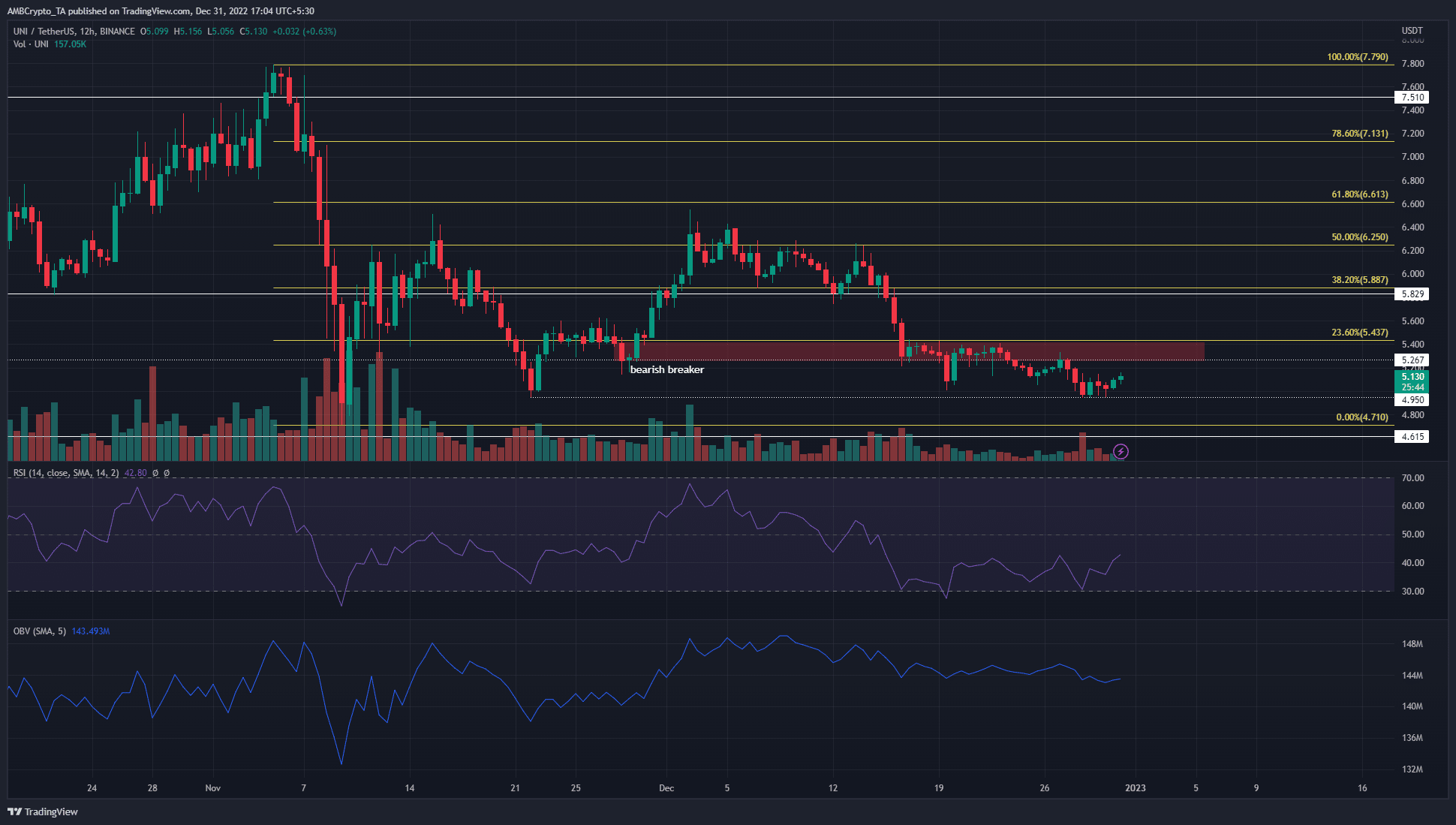

An H12 bearish breaker impedes progress, and buying unit is besides successful decline

The marketplace operation connected the 12-hour illustration was firmly bearish for Uniswap. This showed that traders tin look for shorting opportunities. The past 10 days person seen debased measurement traded, but the On-Balance Volume (OBV) showed that adjacent then, the sellers were the ascendant force.

The OBV had formed little highs successful the past 3 weeks. The Relative Strength Index (RSI) was besides moving beneath the neutral 50 marks to amusement bearish conditions. However, with the RSI threatening to signifier higher highs with the terms forming little highs since 19 December, a bearish divergence could make successful the coming days.

This would reenforce the bearish unit down UNI. It was already trading beneath the 12-hour timeframe bearish breaker successful the $5.26-$5.43 portion (highlighted successful red).

A retest of this portion could connection a bully risk-to-reward shorting opportunity. Meanwhile, a league adjacent supra $5.43 would bespeak that bulls tin propulsion toward the $5.82-$5.88 area.

A 80.66x hike connected the cards if Uniswap hits Bitcoin’s marketplace cap?

The Fibonacci retracement levels (yellow) showed that until the $6.6 level was broken, the higher timeframe inclination would stay bearish. Yet, this does not exclude insignificant moves upward. Long-term buyers tin hold for a determination backmost supra $6.6 earlier assessing the marketplace erstwhile more.

Mean coin property and MVRV ratio instrumentality a deed to item the spot of the sellers

Santiment’s information showed that Uniswap’s web maturation was quiescent passim the festive season. Nevertheless, it remained higher than the maturation witnessed successful October. The slump successful the 30-day Market Value to Realized Value (MVRV) ratio meant that shorter timescale holders took nett astatine the $6.3 mark. The plus was undervalued, according to the MVRV metric, but it does not warrant a bargain awesome by itself.

The 90-day mean coin property besides slumped during the question of selling earlier successful December. This outlined a flurry of question of the token betwixt addresses, and could person been owed to the enactment of sellers. In the past fewer days, adjacent though the metric climbed, it did not amusement a dependable uptrend astatine property time. Accumulation successful the adjacent week oregon 2 could precede a terms rally.

.png)

.jpg) 1 year ago

137

1 year ago

137