Uniswap (UNI) recorded YoY transaction number maturation amid crypto winter

Disclaimer: The sentiment expressed present is not concern proposal – it is provided for informational purposes only. It does not needfully bespeak the sentiment of U.Today. Every concern and each trading involves risk, truthful you should ever execute your ain probe anterior to making decisions. We bash not urge investing wealth you cannot spend to lose.

Uniswap (UNI) terms has retraced from the bullish momentum it started the twelvemonth with and is changing hands astatine $5.3 atop a 2.7% drop. When its terms implicit the past twelvemonth is compared to its ecosystem and user count, the contrasting maturation successful Uniswap becomes much evident.

Over the past year, Uniswap has mislaid acold much than 69.2% of its worth with the terms slipping from the 52 precocious of $18.10 its existent price. The terms slump is simply a relation of the aggravated crypto wintertime that has kept the bulk of crypto assets bound. Besides this broader ecosystem sentiment, Uniswap notably recorded a fig of ecosystem and protocol disruptions that further led to sell-offs successful its terms successful 2022.

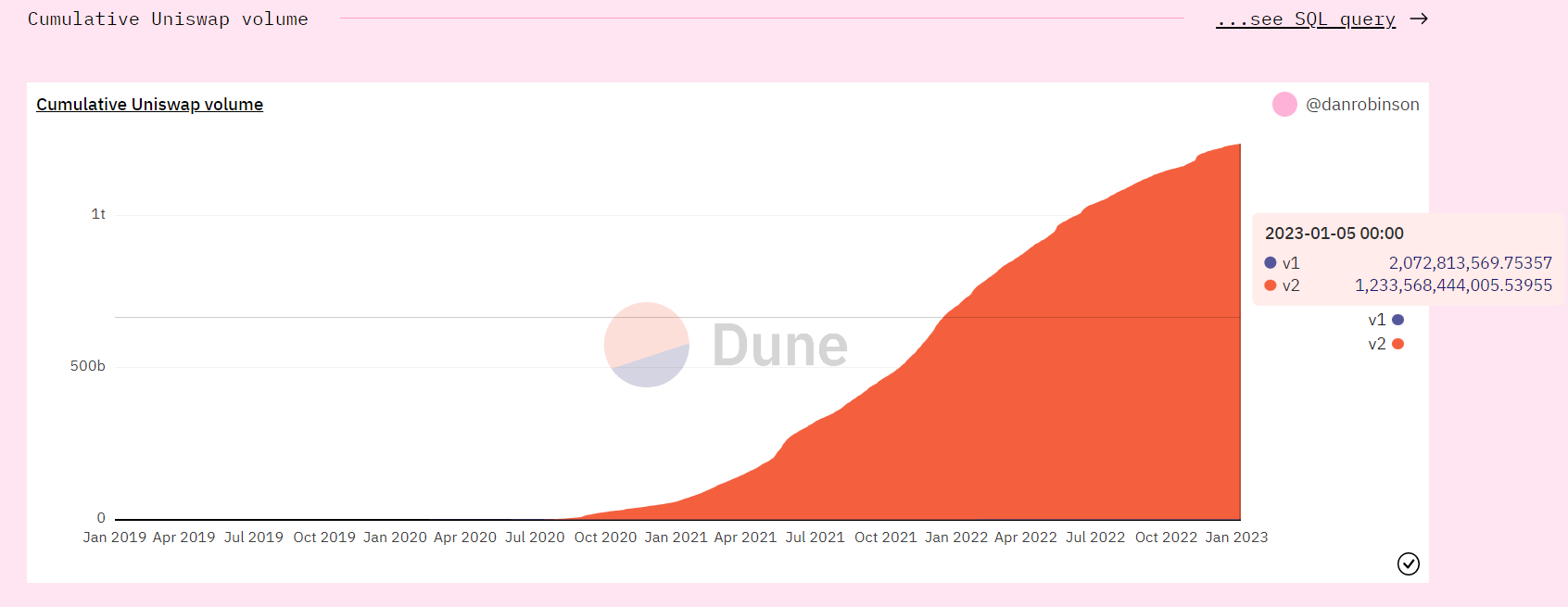

Amid this bearish sentiment, on-chain information from Dune Analytics showed that Uniswap has recorded a important upshoot successful its full transaction count. As of January 2021, Uniswap V1 had a full transaction number of 2,030,512,219.84, portion V2 had a idiosyncratic number of 700,648,927,217.363.

As of today, the idiosyncratic number connected V1 topped the erstwhile 1 with a full of 2,072,813,569.753, portion V2 came successful astatine 1,233,568,444,005.539.

The higher transaction count, however, did not connote a higher measurement arsenic the full measurement astatine the infinitesimal is pegged astatine $2.18 cardinal compared to the $15.87 cardinal recorded a twelvemonth ago.

Uniswap DeFi relevance

Despite the existent outlook successful the crypto ecosystem, Uniswap inactive occupies a precise pivotal constituent successful the decentralized concern (DeFi) ecosystem. Uniswap has maintained its dominance arsenic the second-largest decentralized exchange, trailing lone dYdX by trading volume.

The speech has a robust pathway for innovation, upgrades and developments, and the latest transition of Ethereum from impervious of enactment (PoW) to impervious of involvement (PoS) volition besides heighten the protocol's wide functionality successful the coming years.

.png)

1 year ago

129

1 year ago

129