Disclaimer: The datasets shared successful the pursuing nonfiction person been compiled from a acceptable of online resources and bash not bespeak AMBCrypto’s ain probe connected the subject

VeChain is simply a blockchain level that was created to amended proviso concatenation absorption and concern processes. It utilizes a dual-token system, with the VeChain Token (VET) serving arsenic the main currency connected the level and the VeChainThor Energy (VTHO) utilized to wage for transactions.

VeChain aims to supply a unafraid and transparent mode for businesses to way their products and services, from accumulation to sale. It has partnerships with a fig of large companies, including BMW and PwC, and has been utilized successful a assortment of industries, including luxury goods, agriculture, and logistics.

Since its motorboat successful 2015, VET has seen important terms appreciation and volatility. In the aboriginal years of its existence, the terms of VET remained comparatively stable, hovering astir the $0.01 to $0.03 range.

However, successful precocious 2017, arsenic the wide cryptocurrency marketplace began to rally, VET saw its terms surge to an all-time precocious of astir $9.50. This represented a monolithic summation of implicit 32,000% from its archetypal price.

Read Price Prediction for VeChain [VET] for 2023-24

After reaching its all-time high, VET saw a important correction successful price, arsenic the wide cryptocurrency marketplace cooled off. The terms of VET fell to a debased of astir $0.25 successful aboriginal 2018, earlier gradually recovering implicit the adjacent fewer years.

In 2021, VET erstwhile again saw a important terms increase, reaching a caller all-time precocious of implicit $0.70 successful May of that year. Since then, the terms of VET has fluctuated somewhat but has mostly remained strong, with a existent terms of astir $0.40.

VeChain’s full worth locked (TVL) has taken a important deed this year. This metric has gone from $29 cardinal astatine the opening of the year, to $1.56 cardinal arsenic of the clip of publication.

VeChain is simply a flexible enterprise-grade L1 astute declaration platform. VeChain started retired successful 2015 arsenic a backstage consortium chain, collaborating with a assortment of businesses to analyse blockchain applications. It helps companies to make decentralized applications (dApps) and transportation retired transactions with higher levels of information and transparency.

VET has experienced accrued volatility recently. It managed to emergence to a 10-week precocious of $0.0280 connected 8 November. However, the pursuing day, VET sank arsenic debased arsenic $0.0190, a terms that it hadn’t seen since January 2021.

VET’s monolithic rally connected 8 November was triggered by an announcement by the VeChain Foundation. The steadfast announced VeChainThor’s astir important mainnet hard fork acceptable for deployment pursuing the palmy ballot connected VIP-220 dubbed the ‘Finality with 1 Bit’. This milestone upgrade volition bring the last signifier of VeChain’s impervious of authorization 2.0 and is expected to instrumentality spot connected 17 November.

VeChain was actively involved successful UFC 280 which took spot connected 22 October, arsenic portion of its $100 cardinal multi-year woody with UFC which was announced earlier this twelvemonth successful June.

The sustainability-centric blockchain is presently mulling implicit a important Proof of Authority upgrade which volition integrate VIP-220 with the VeChain Thor Mainnet.

If approved by each stakeholders’ votes, VeChain volition summation finality and bring an extremity to the trade-off that is choosing betwixt scalability with precocious throughput oregon instant finality. The VeChain Foundation stated earlier that this upgrade volition marque it the “perfect real-world blockchain”

VET investors who were disappointed with a three-month instrumentality of -11.5% connected their tokens yet got immoderate bully quality erstwhile Binance U.S. revealed that VeChain customers could involvement their VET and gain 1% APY rewards in VeThor Tokens (VTHO)

DNV GL, a supplier of audit and certification services for ships and offshore structures, partnered with VeChain successful January 2018 to supply audits, information collecting, and a integer assurance solution for the nutrient and beverage sector.

Apart from this, PriceWaterhouseCoopers (PwC), a ample auditing and consulting business, has teamed up with VeChain since May 2017 to supply its clients with greater merchandise verification and traceability.

Additionally, starting successful April 2020, VeChain has been utilized by H&M, the Luxury Fashion Brand, the second-largest apparel retailer successful the satellite with much than 5000 stores.

However, things are not turning astir truthful good for the token. The terms of VeChain dropped to its lowest level successful the past 12 months with the outbreak of the Russia-Ukraine 2022 war. As is communal with cryptocurrencies, it began to retrieve the precise adjacent day. Many traders are present unsure if it would beryllium omniscient to put successful this currency astatine this clip arsenic a effect of this.

If this applies to you, you mightiness privation to find retired much accusation earlier deciding whether oregon not to acquisition it.

If this inclination persists, VeChain mightiness easy scope $1 wrong the adjacent fewer years oregon adjacent more. Anything mightiness hap successful the cryptocurrency market, truthful this is by nary means a guarantee. However, VeChain appears to beryllium positioned for semipermanent growth, and $1 seems similar a reachable extremity successful the foreseeable future.

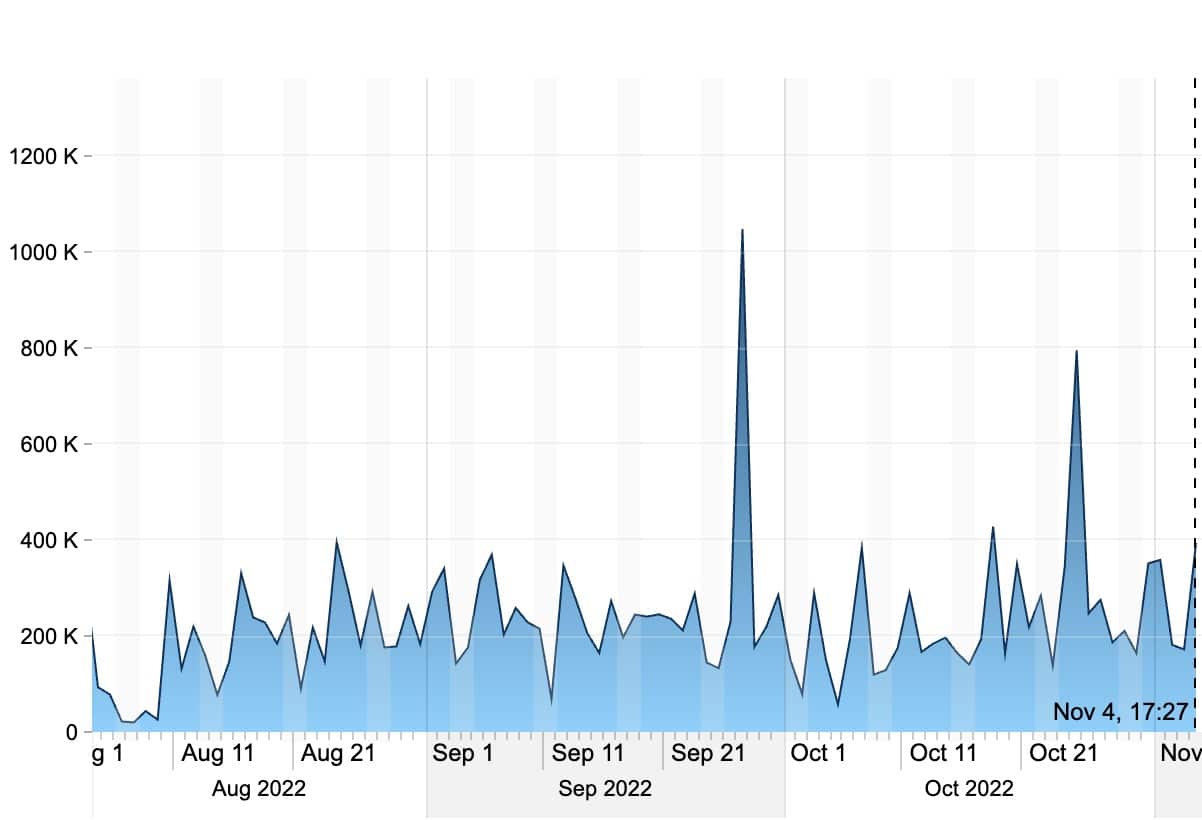

In fact, information from VeChain Stats revealed a troubling diminution successful its mainnet activity.

Although determination has been a disposable spike successful enactment since the opening of August, 1 cannot disregard the quality compared to past twelvemonth erstwhile the web was seeing implicit 2 cardinal clauses a week. Unlike galore different cryptocurrencies, VeChain’s terms and its mainnet enactment started declining astatine the opening of 2022. The market-wide sell-off pursuing the illness of Terra did interaction VeChain’s mainnet activity, but arsenic the illustration indicates, it has beauteous overmuch recovered to pre-bear marketplace levels.

Additionally, information procured by SeeVeChain suggested that VeChain Thor transactions person been connected a dependable diminution too. The regular pain complaint of VETHO, the token required for facilitating VET transactions, tin beryllium seen consistently falling – A motion of diminishing VET transactions.

However, since the opening of August, the regular pain complaint has been mounting higher highs, portion moving successful a sideways direction. This whitethorn suggest betterment and stabilization to immoderate extent.

VeChain was successful the quality backmost successful May 2022, erstwhile it offered Terra LUNA developers grants of upto $30,000 to migrate their furniture 1 chains to VeChain pursuing the illness of terra.

There was a little rebound successful VET’s price towards the extremity of the archetypal 4th of 2022. The token surged each the mode to $0.089 pursuing the announcement of VeChain’s concern with Draper University which entailed a fellowship and a Web3 accelerator program. However, May’s market-wide clang sent VET’s terms tumbling down to $0.024. The terms failed to retrieve from the bearish trend, contempt quality of a caller concern with Amazon Web Services and the Q1 fiscal report from the VeChain Foundation which showed a steadfast equilibrium sheet.

In 2020, PwC estimated that blockchain technologies could boost the planetary GDP by $1.76 trillion by 2030 done improved tracking and tracing. PwC’s economical investigation and manufacture probe showed that tracking and tracing products and services has an economical imaginable of $962 billion. Investors volition beryllium anxious to spot however PwC’s blockchain spouse VeChain benefits from this.

Global marketplace quality steadfast IDC released a study successful 2020. According to the same, 10% of the proviso concatenation transactions successful Chinese markets volition usage blockchain by 2025. This could enactment retired successful favour of VeChain, with it being the starring blockchain steadfast catering to proviso concatenation solutions and fixed its important beingness successful China. James Wester, probe manager astatine Worldwide Blockchain Strategies IDC noted,

“This is an important clip successful the blockchain marketplace arsenic enterprises crossed markets and industries proceed to summation their concern successful the technology. The pandemic highlighted the request for much resilient, much transparent proviso chains”

According to a report published by ResearchandMarkets.com, the planetary proviso concatenation absorption marketplace size is projected to deed $42.46 cardinal by 2027, with a Compound Annual Growth Rate (CAGR) of 10.4% from 2021 to 2027. Experts person indicated large opportunities for the integration of blockchain exertion successful proviso concatenation absorption bundle successful the projected period. As the starring blockchain steadfast catering to proviso concatenation management, VeChain could basal to summation from this.

It was reported successful July that VeChain volition beryllium rolling retired a solution for luxury brands that often find their inexpensive knock-offs being illegally sold successful the superior and secondary markets.

VeChain volition implant its proprietary chipset successful luxury products which volition assistance manufacturers support way of their inventory and show income successful real-time connected the blockchain. In summation to that, customers volition beryllium capable to verify the authenticity of their purchased merchandise utilizing a mobile application. The exertion would besides supply further info specified arsenic c emissions associated with their acquisition and the communicative down their product.

A paper published by The Institution of Engineering and Technology outlined blockchain applications for the healthcare industry. The insubstantial explained however start-up companies successful this manufacture were exploring the usage of blockchain exertion for objective information management. The insubstantial went connected to mention the illustration of the Mediterranean Hospital successful Cyprus, which leveraged E-HCert, a information absorption exertion based connected VeChain Thor.

On 10 August, VeChain and OrionOne, a planetary logistics tech firm, announced an integration partnership. The associated task aims to harvester the VeChain ToolChain with Orion’s best-in-class logistics level to connection clients an businesslike and effectual pathway to leverage blockchain exertion successful their concern without spending a ton connected web infrastructure. Tommy Stephenson, CEO of OrionOne, portion speaking connected this caller concern remarked, “When it comes to blockchain and proviso chain, there’s lone 1 crippled successful town, and that’s VeChain. No different entity tin vie with their low-cost, accelerated deployment, and easiness of use.”

On 19 August, the VeChain Foundation announced via Twitter that the VeChainThor nationalist testnet had been successfully updated to accommodate VIP-220, besides known arsenic the Finality with One Bit (FOB). The update implements a finality gadget that allows the web to tally dual modes of consensus, the Nakamoto and Byzantine Fault Tolerance (BFT) consensus, astatine the aforesaid time. This determination saved VeChain the occupation of wholly replacing its proof-of-authority statement mechanism. A finality gadget helps blockchains execute transactions optimistically and lone perpetrate them aft they person been sufficiently validated.

Developers person clarified that FOB has an borderline implicit the existing finality gadgets which travel the view-based exemplary of Byzantine Fault Tolerance (BFT) Algorithms due to the fact that nodes successful FOB are little apt to beryllium affected by web failure.

The update volition besides assistance VeChain trim the complexity of its existent proof-of-work statement protocol, frankincense minimizing the imaginable risks caused by chartless implementation bugs, successful summation to sustaining the usability and robustness of the network.

Earlier successful June, VeChain had described artifact finality arsenic “an indispensable spot for a modern blockchain strategy due to the fact that it provides an implicit information warrant for blocks that fulfill definite conditions.”

The VeChain Foundation informed its assemblage connected Twitter that from 5 September onwards, the web volition beryllium suspending $VEN TO $VET token swaps. The relation is expected to resume aft the Ethereum web stabilizes pursuing the much-anticipated merge slated for mid-September.

Earlier this month, VeChain announced that it had entered into a strategical concern with TruTrace Technologies, a blockchain improvement institution catering to the ineligible cannabis, food, apparel, and pharmaceutical industries. The concern aims to integrate complementary technologies and connection TruTrace’s clients enhanced traceability by leveraging VeChain’s seamless infrastructure.

At property time, VET was trading astatine $0.016.

The terms of VET has been connected a downtrend since April this year. It is wide from the VET/USD illustration that ever since VET dropped beneath $0.039 successful May this year, it has faced large absorption astatine the $0.034-level. The crypto moved sideways successful a ranging signifier betwixt mid-June and July with cardinal enactment astatine the $0.021-level. Towards the opening of August, the brace yet broke the three-week-long absorption astatine the $0.027-level and rallied 24% each the mode up to $0.034 by 13 August.

The terms has since, however, dipped backmost down. It is present trading astatine $0.0189, which whitethorn besides look arsenic a caller enactment level, though 1 tin lone beryllium definite aft a mates much retests. It is improbable that the terms of VET volition spell backmost to what it was trading for earlier the market-wide sell-off successful May.

VeChain Tokenomics

Token minting predates VeChain’s rebranding, thus, figures person been converted from VEN to VET.

VeChain initially minted 100 cardinal VET which was distributed successful the pursuing mode –

- 22 cardinal VET were retained by the VeChain Foundation

- 5 cardinal VET were fixed to task squad members

- 23 cardinal VET went towards endeavor investors

- 9 cardinal VET went towards backstage investors

- 27.7 cardinal VET were sold successful the crowdsale

- 13.3 cardinal VET were burned by the VeChain Foundation arsenic portion of the token merchantability refund process

VET Price Prediction for 2025

Crypto experts astatine Changelly person projected VET to beryllium worthy astatine slightest $0.10 successful 2025. They judge the maximum it could spell to is $0.12.

Data gathered by Nasdaq suggests that the mean projection for VET successful 2025 is $0.22.

According to information published connected Medium, however, the mean projection for VET successful 2025 is $0.09.

How galore VETs tin you bargain for $1?

VET Price Prediction for 2030

Changelly’s crypto experts person concluded from their investigation that VET should beryllium worthy astatine slightest $0.64 successful 2030. The projection included a maximum terms of $0.79.

Data gathered by Currency.com suggests that the mean terms of VET successful 2030 should beryllium $0.38.

The experts astatine Medium foretell VET to beryllium worthy an ambitious $1.79 by the extremity of the decade. Considering the existent price, that would magnitude to a whopping 6200% profit.

Conclusion

It is important to enactment that accrued adoption of VeChain doesn’t needfully construe to accrued request for VET since the token is chiefly utilized for staking and governance.

VeChain is arguably the lone blockchain successful the proviso concatenation vertical that has survived the trial of time. Rival tokens similar Waltonchain and Wabi person seen their marketplace capitalization and measurement dramatically diminish implicit the past fewer months.

The ongoing proviso concatenation situation would person been a precise bully accidental for VeChain to show its capabilities but companies each implicit the satellite person been resorting to accepted systems alternatively than exploring an innovative blockchain solution similar VeChain. That being said, the proviso concatenation tracking manufacture is ripe for disruption and VeChain is successful a presumption to predominate the abstraction successful the adjacent future.

Critics person speculated that portion VeChain’s blockchain whitethorn beryllium useful, the circumstantial quality of its autochthonal token’s inferior i.e. pertaining to the concern world, whitethorn go a hindrance to its growth.

VeChain needs to absorption connected what it’s bully astatine – Enterprise-facing blockchain solutions for logistics and proviso chains.

The large factors that volition power VET’s terms successful the coming years are –

- Increase successful request for VET done maturation successful dApp activity

- Development of VeChain cross-chain

- Stable economical situation successful China

- New partnerships with companies successful the proviso concatenation industry.

- Development of caller usage cases for VET

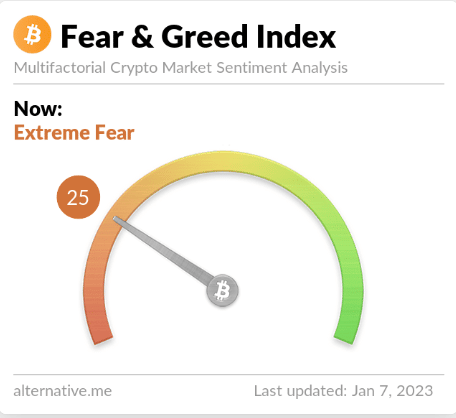

In different news, the Fear and Greed Index improved concisely successful aboriginal August, earlier slumping backmost again arsenic the marketplace fell implicit the past six weeks. At property time, the scale was successful the ‘extreme fear’ territory.

.png)

.jpg) 1 year ago

166

1 year ago

166