- Interest successful Bitcoin ETFs had grown arsenic ETF volumes reached caller highs.

- Whale involvement besides surged, however, BTC’s terms remained stagnant.

Bitcoin [BTC] has deed a slump implicit the past fewer days arsenic the terms has remained astir the $64,000 level for rather immoderate time.

Institutional interest

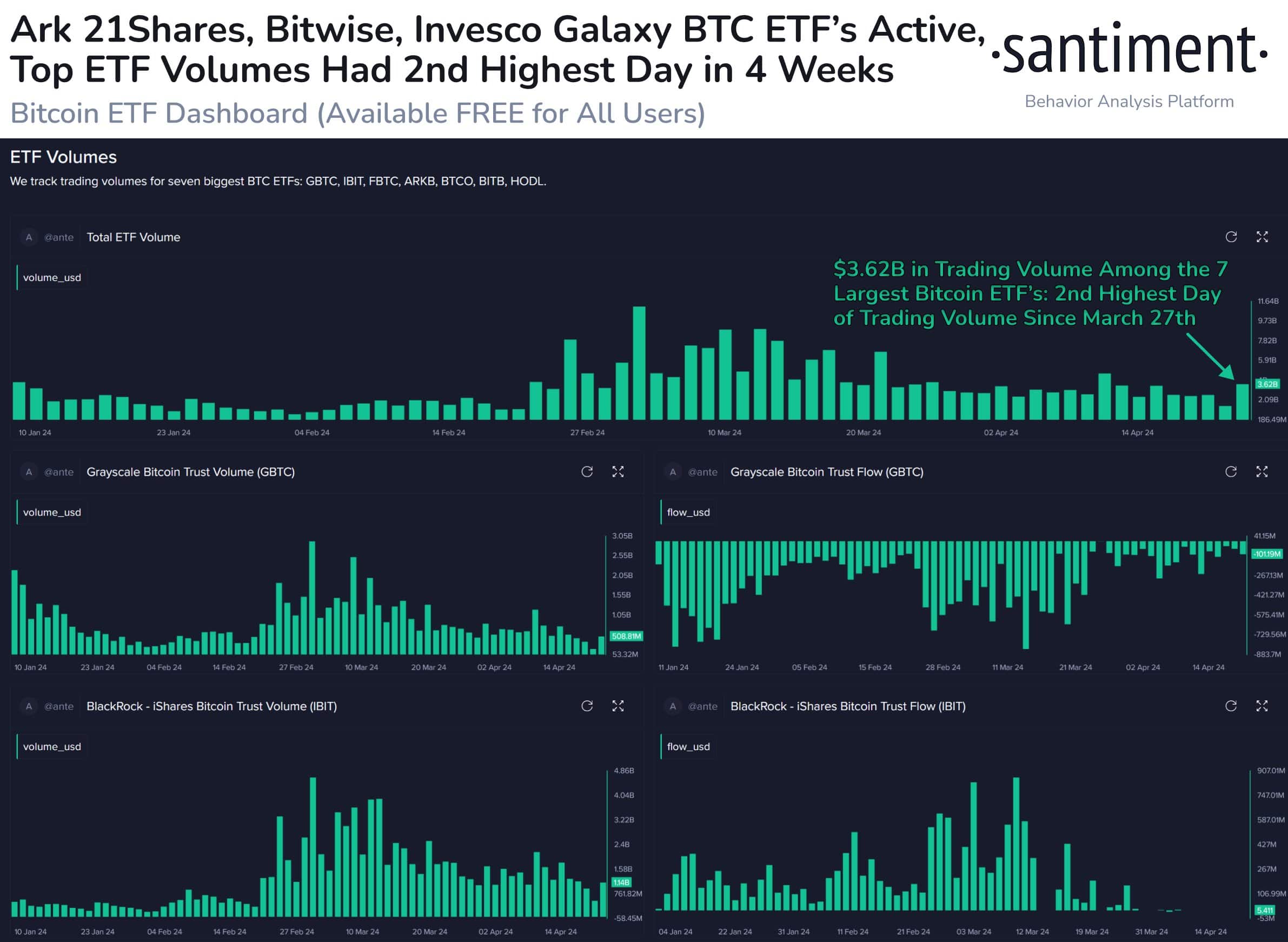

According to Santiment’s data, there’s immoderate for affirmative question for BTC successful the future. The combined regular trading measurement of Bitcoin ETFs precocious reached its highest constituent successful 4 weeks, reaching $3.62 billion.

This surge successful enactment includes starring Bitcoin ETFs similar GBTC, IBIT, FBTC, ARKB, BTCO, and HODL.

This comes amidst a five-week play of unpredictable sideways question successful the broader cryptocurrency market.

In airy of this stagnation, the steadfast trading enactment successful Bitcoin ETFs could beryllium considered arsenic a bullish sign.

It suggested that investors stay assured successful the semipermanent imaginable of Bitcoin, and are utilizing ETFs arsenic a mode to summation vulnerability to the cryptocurrency.

The precocious trading measurement successful Bitcoin ETFs highlights their increasing popularity arsenic an easier introduction constituent for investors unfamiliar with cryptocurrencies.

This could awesome broader adoption of Bitcoin arsenic ETFs region the hurdles of straight buying and holding the integer asset.

Furthermore, this bullish sentiment is echoed by on-chain data, which reveals a monolithic spike successful the fig of whales accumulating Bitcoin implicit the past 2 months.

This suggested that not lone were caller investors entering the space, but established players were besides expanding their exposure, perchance anticipating aboriginal terms appreciation.

How are investors holding up?

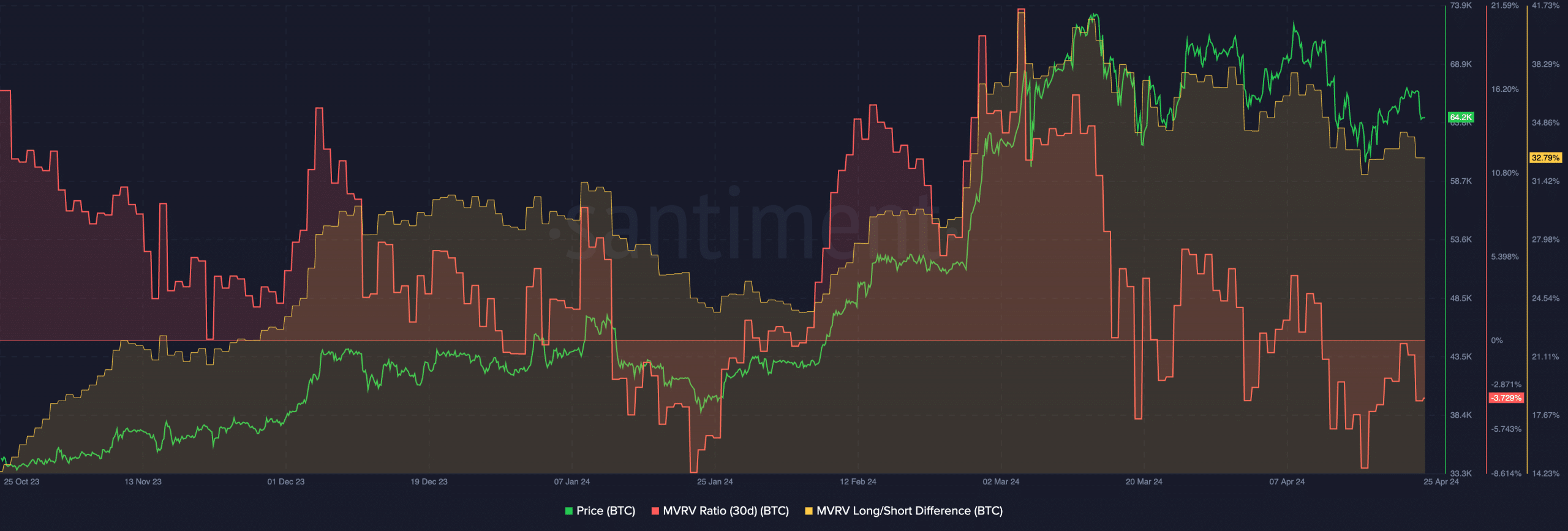

At property time, BTC was trading astatine $64,334.93 and its terms had declined by 3.44% successful the past 24 hours. The MVRV ratio had besides declined during this period, indicating that astir addresses were not profitable.

Additionally, the Long/Short quality had grown contempt the declining prices.

A falling Long/Short quality indicated that the fig of semipermanent holders had outnumbered the short-term holders successful the past fewer days.

These holders are little apt to merchantability their holdings and tin assistance BTC clasp its existent terms levels.

Read Bitcoin’s [BTC] Price Prediction 2024-25

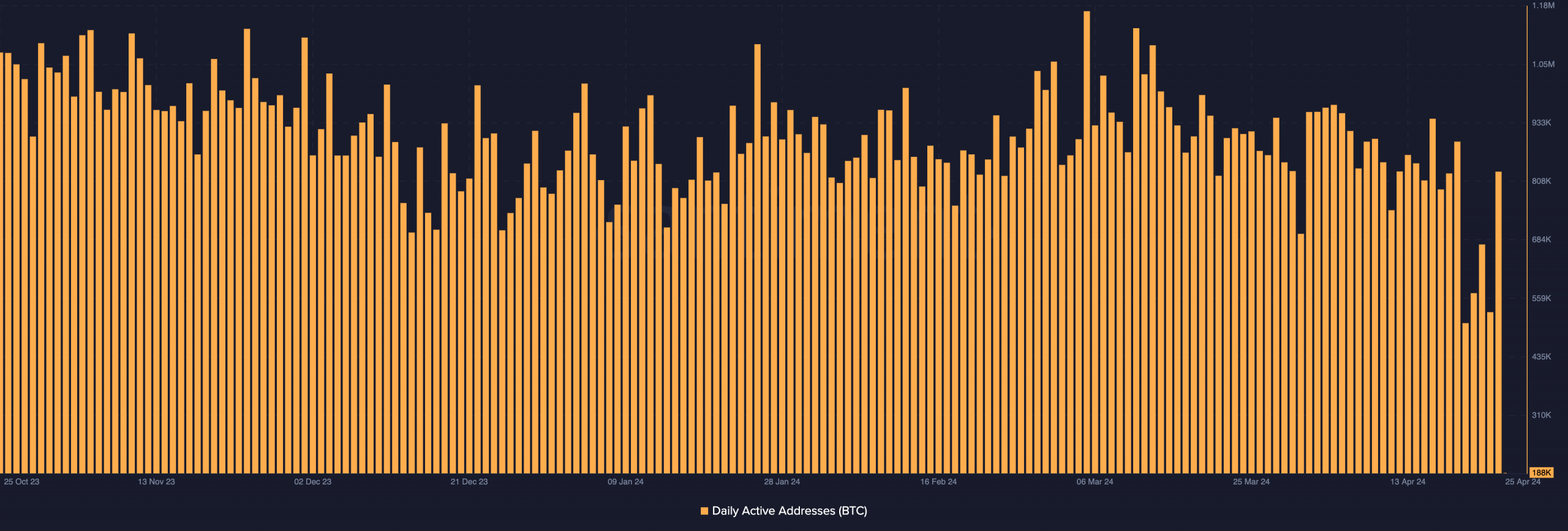

The wide involvement successful Bitcoin’s ecosystem would besides play a large relation successful the king coin’s growth.

Notably, successful the past fewer days, the fig of regular progressive addresses connected the web declined importantly during this period.

.png)

.jpg) 3 weeks ago

55

3 weeks ago

55