- More than 70% Ethereum stakes were underwater astatine property time

- The Shanghai upgrade would alteration unstaking erstwhile deployed

Staking Ethereum [ETH], peculiarly aft the Merge, prompted respective conversations. The topics of discussion ranged from ascendant staking pools to OFAC-compliant blocks, arsenic good arsenic the threats that a operation of the 2 posed to Ethereum and the transactions that utilized ETH.

Read Ethereum’s [ETH] Price Prediction 2025-2030

However, immoderate groups of stakers tin beryllium acrophobic astir thing wholly antithetic successful narration to staking: the magnitude of nett their investments generated.

Stake astatine a loss?

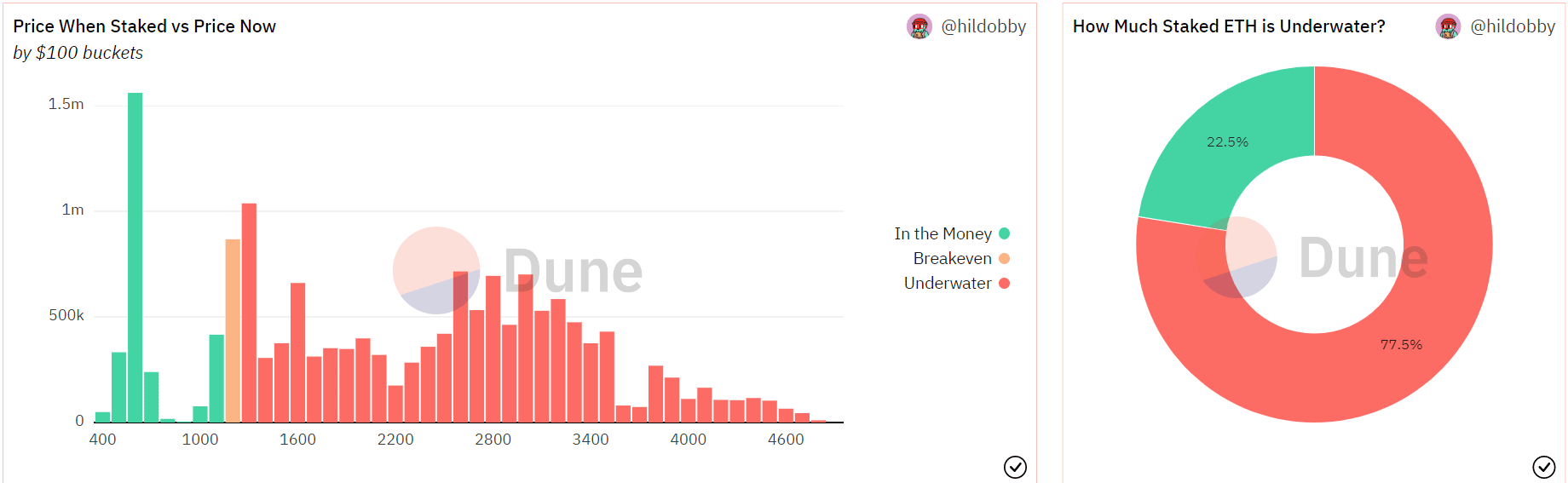

According to Hildobby’s data from Dune Analytics, immoderate ETH stakers were presently making a profit, portion others were astatine the breakeven threshold. Yet, others were experiencing a loss. According to Dune Analytics, 77.5% stakers were astatine a nonaccomplishment astatine property time, portion lone 22.5% were successful profit.

According to the chart, the assorted phases of nett were decided by the terms of Ethereum astatine assorted stages of introduction into antithetic staking pools by stakers.

According to the supra data, determination were presently implicit 15k ETH staked, and the full staked magnitude equaled 13.18% of ETH’s full supply.

Fears of a immense sell-off pursuing the Shanghai upgrade person been popular. This is due to the fact that of the proportionality of ETH that was presently locked successful staking pools and the existent nonaccomplishment that a larger proportionality of stakers were experiencing.

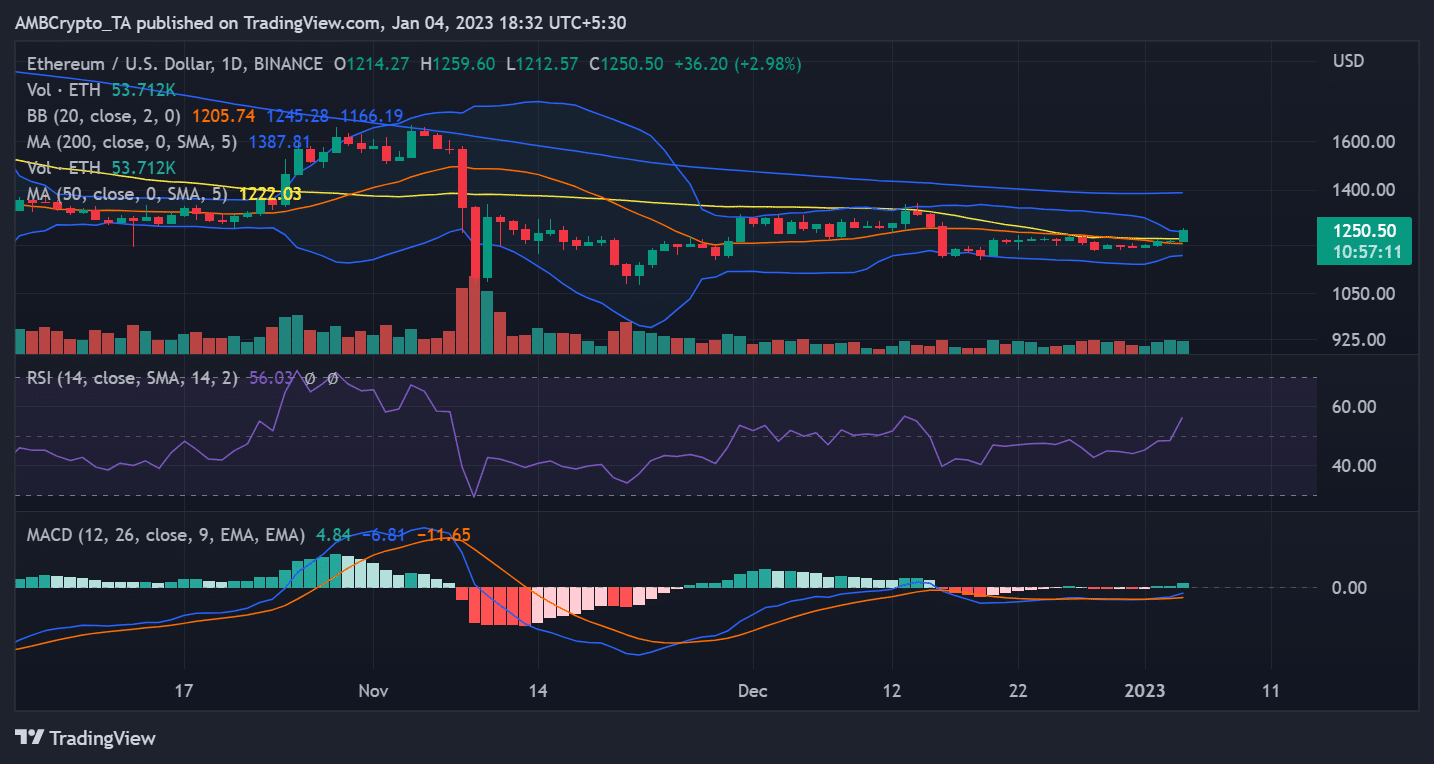

ETH successful a regular timeframe

According to the regular timeframe illustration shown, ETH’s terms question was comparatively flat. As of this writing, the terms was seen to person accrued by implicit 3% implicit the erstwhile 48 hours, bringing it to astir $1,253. The token had made immoderate advancement successful bouncing back, according to the Relative Strength Index metric (RSI).

Indicating a affirmative trend, the RSI enactment was shown to beryllium supra the neutral zone. If the property clip upward momentum continues, the determination of the RSI enactment could fortify the bullish trend.

A sustained upward propulsion mightiness origin ETH to flooded antithetic resistances and retake the $2,000 area, turning astir of the staked ETH into profit.

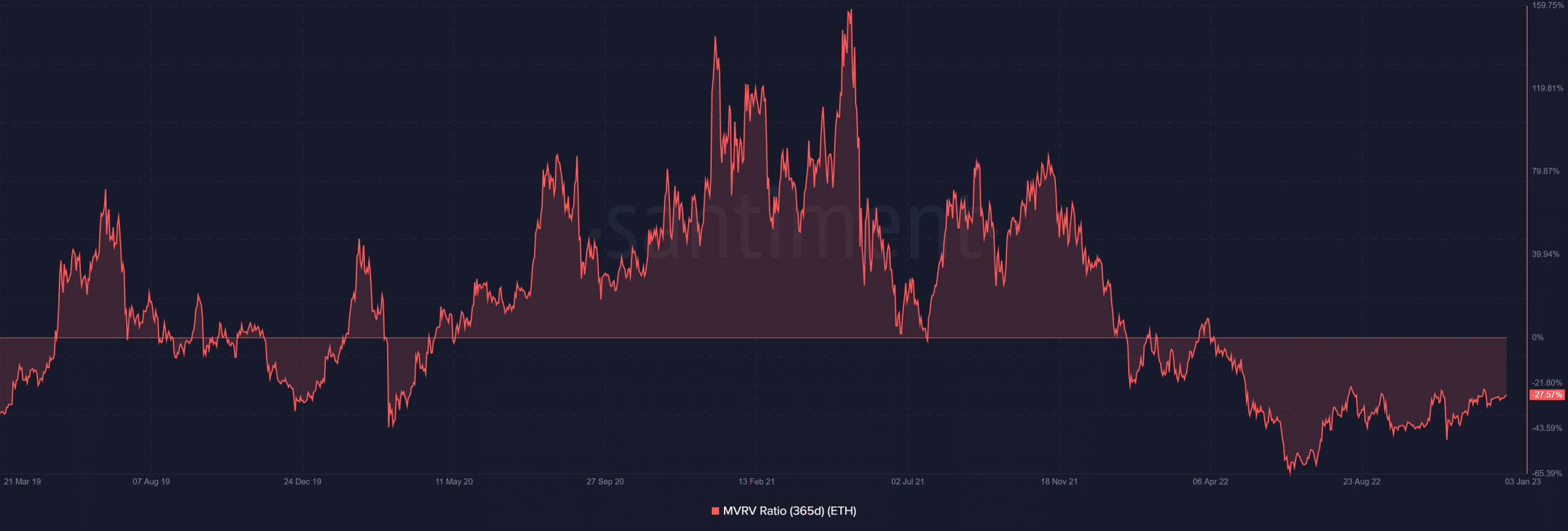

Long-term Ethereum holders astatine a loss…

The Market Value to Realized Value (MVRV) Ratio for ETH implicit the past 365 days revealed that holders were holding astatine a nonaccomplishment passim that time. Given the challenging twelvemonth that cryptocurrencies experienced, ETH holders were holding astatine a nonaccomplishment of 27.57% arsenic of this writing, which seemed similar a minimal loss.

.png)

.jpg) 1 year ago

144

1 year ago

144