CoinShares, a salient European alternate plus manager with a absorption connected integer assets, released its latest Digital Asset Fund Manager Survey connected April 24, 2024. This variation is peculiarly notable arsenic it follows the caller support of U.S. spot Bitcoin ETFs, providing caller insights into capitalist attitudes and allocations wrong the integer plus space.

The survey gathered information from 64 respondents who collectively negociate $600 cardinal successful assets, offering a important look into the trends and shifts successful integer plus concern strategies among organization players.

Key Findings from the CoinShares Digital Asset Fund Manager Survey

Bitcoin Retains Its Leading Position

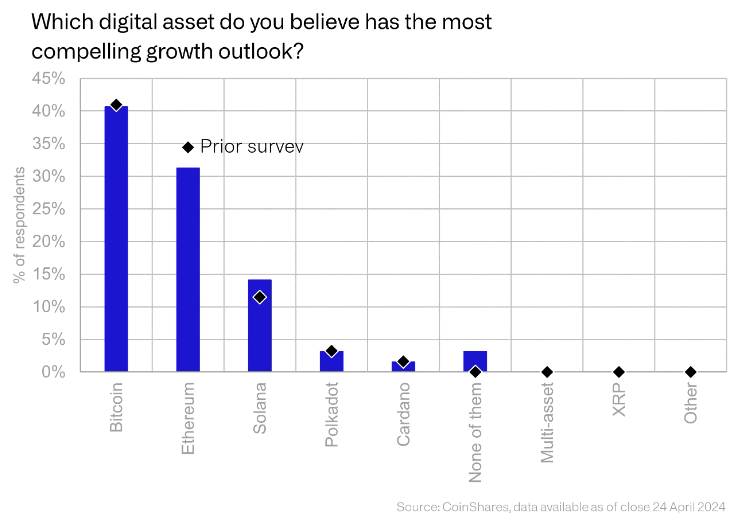

Bitcoin continues to beryllium the astir favored integer plus among the surveyed investors. According to the survey, 41% of respondents judge Bitcoin offers the astir compelling maturation outlook.

Increased Digital Asset Weightings successful Portfolios

The survey indicated a important emergence successful the allocation of integer assets successful capitalist portfolios, expanding from 1.3% to 3%. This is the highest level since the survey’s inception successful 2021, with the erstwhile highest being 1.7% successful November 2021. The summation is mostly attributed to organization investors who person begun incorporating Bitcoin into their portfolios done the recently disposable U.S. ETFs.

Diversifying into Altcoins

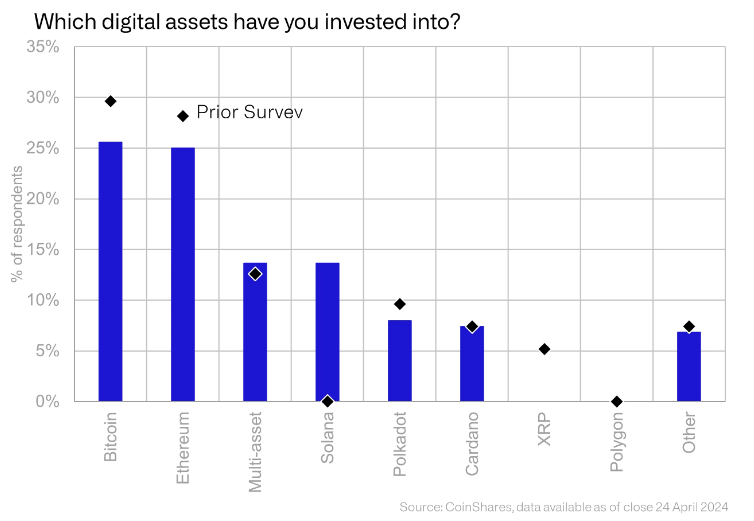

Investors are not conscionable sticking to Bitcoin and Ethereum; there’s a notable displacement towards diversifying into altcoins. Solana, successful particular, has seen a singular summation successful allocations, apt driven by ample investments from a fewer cardinal players.

In opposition to the increasing involvement successful immoderate altcoins, XRP has experienced a important downturn, with nary of the respondents presently holding this asset. This displacement could bespeak broader marketplace sentiments oregon reactions to regulatory uncertainties surrounding XRP.

The Draw of DeFi and Distributed Ledger Technology

When asked astir their reasons for adding integer assets to their portfolios, galore investors cited the entreaty of distributed ledger technology. Despite the terms increases since January, an expanding fig of investors presumption integer assets arsenic bully value, driven by lawsuit request and affirmative terms momentum. However, the absorption connected investing solely for diversification purposes has seen a decline.

Barriers and Risks successful Digital Asset Investment

Despite the increasing involvement and accrued allocations, important barriers stay for definite capitalist cohorts, particularly wrong the wealthiness absorption and organization spaces. Regulatory concerns proceed to beryllium a large hurdle, arsenic firm restrictions and the mentation of regulatory guidelines restrict broader adoption.

Moreover, portion issues similar volatility and custody concerns are decreasing, regulatory and governmental risks inactive predominate the landscape, posing challenges for some imaginable and existent investors.

Featured Image via Pixabay

CoinShares Survey: Bitcoin Leads arsenic Solana Rises and XRP Declines Among Crypto Fund Manager

/latest/2024/04/xrp-holdings-drop-to-zero-among-surveyed-digital-asset-fund-managers-coinshares-report/

/latest/2024/04/fintech-firm-stripe-announces-return-to-crypto-payments-with-usdc-support-on-ethereum-and-solana/

Disclaimer

The views and opinions expressed by the author, oregon immoderate radical mentioned successful this article, are for informational purposes only, and they bash not represent financial, investment, oregon different advice. Investing successful oregon trading cryptoassets comes with a hazard of fiscal loss.

.png)

3 weeks ago

48

3 weeks ago

48