- BTC’s cardinal on-chain metric hinted astatine terms volatility.

- However, method indicators connected a terms illustration refuted that claim.

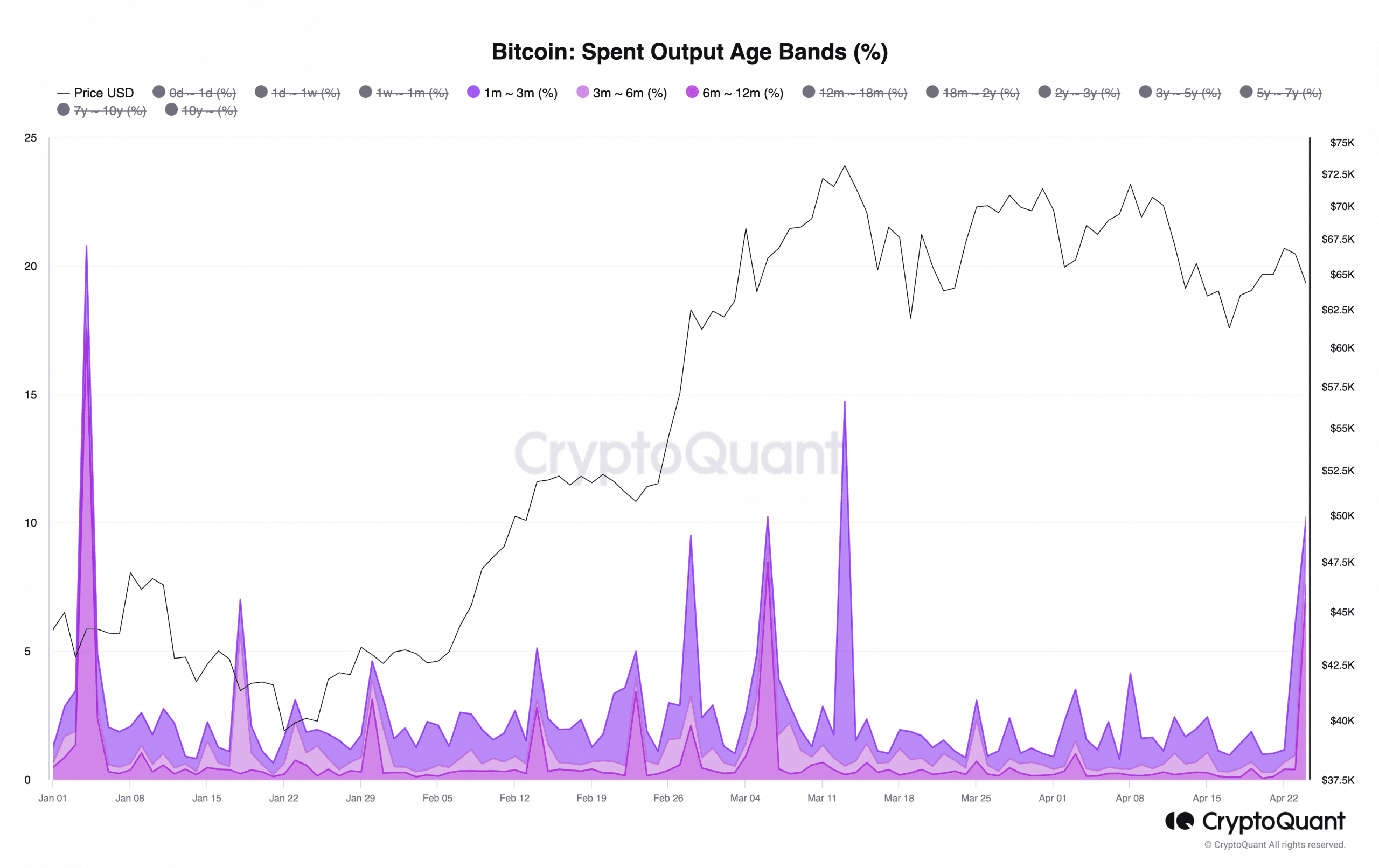

Bitcoin’s [BTC] spent outputs for investors that person held their coins for 1 to 12 months person witnessed a spike, hinting astatine the anticipation of a terms swing, according to CryptoQuant’s data.

BTC’s spent outputs for antithetic property bands of investors connection insights into coin holders’ spending behavior.

For example, it tin way whether coins held by short-term holders are being moved, indicating an uptick successful profit-taking activity.

Volatility successful the BTC market?

When the magnitude of spent output for short-term BTC holders increases, it often suggests a rally successful marketplace volatility.

In a caller report, pseudonymous CryptoQuant expert Mignolet said,

“Movement of this entity tin beryllium seen arsenic information for volatility confirmation alternatively than for terms increases oregon decreases. It appears that volatility is apt to look soon.”

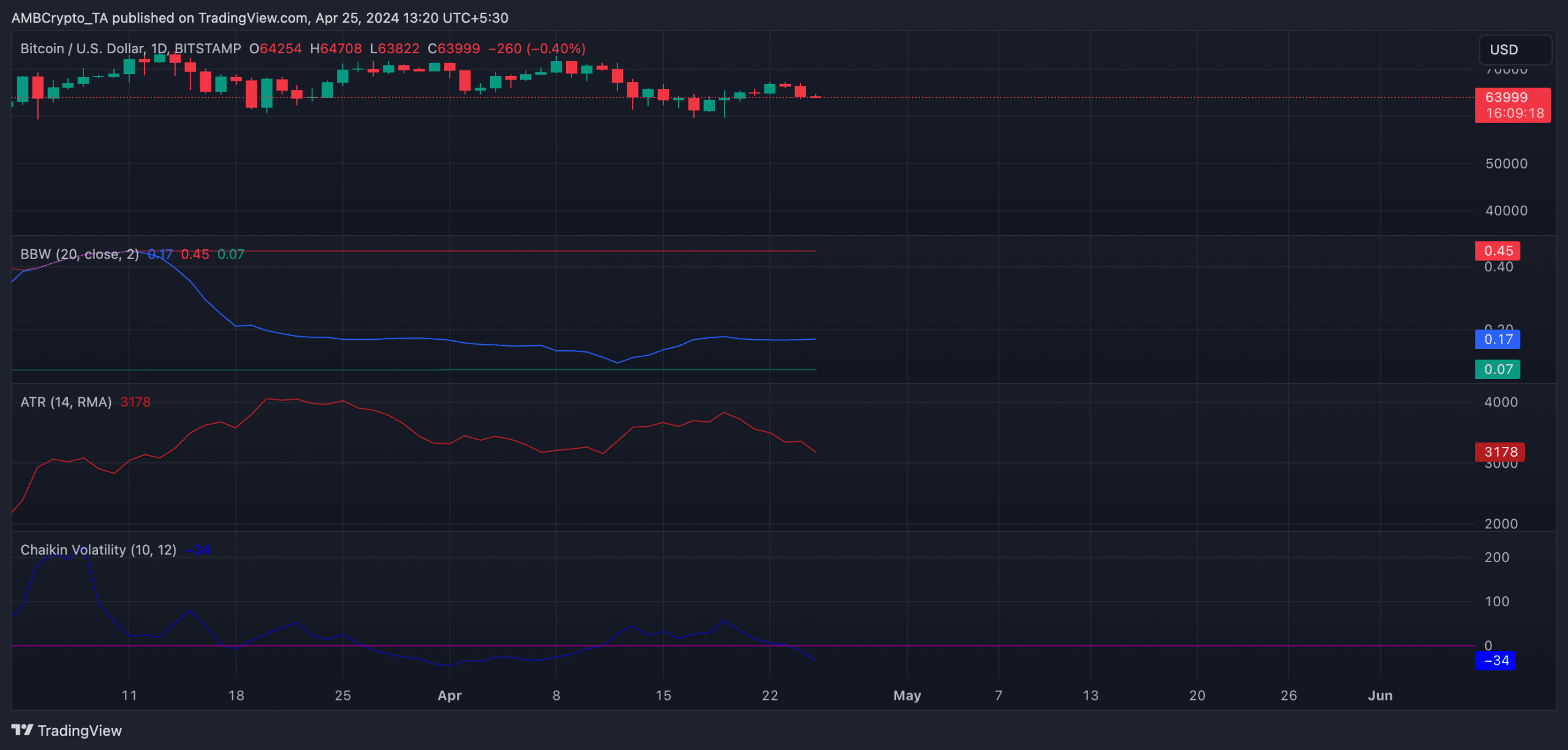

However, an appraisal of the coin’s cardinal volatility markers connected a regular illustration suggested minimal hazard of immoderate important short-term terms swings.

Readings from the BTC’s Average True Range (ATR) showed that it has steadily declined since the 19th of April.

This indicator measures the mean scope of terms movements implicit a specified period. When it falls, it indicates a simplification successful marketplace volatility.

Confirming the diminution successful marketplace volatility, BTC’s Chaikin Volatility was spotted successful a downtrend astatine property time. Since the 19th of April, the worth of the indicator has dropped by 162%.

This indicator measures an asset’s terms volatility by comparing the existent scope betwixt the precocious and debased prices to a erstwhile scope implicit a circumstantial play of time.

When it declines this way, it suggests that an asset’s marketplace is becoming little volatile due to the fact that the scope betwixt its precocious and debased prices is contracting.

Further, BTC’s level Bollinger Bandwidth (BBW) lent credence to the debased volatility successful the coin’s market.

Read Bitcoin [BTC] terms prediction 2024 -2025

When an plus witnesses a level BBW, it suggests that its terms is experiencing debased volatility and its movements are comparatively unchangeable and confined to a constrictive range.

At property time, the starring crypto plus exchanged hands astatine $64,241. According to CoinMarketCap’s data, its worth has climbed by 5% successful the past 7 days.

.png)

.jpg) 3 weeks ago

68

3 weeks ago

68