Journalist

- Whales continued to stockpile ETH contempt being nether water.

- Majority of whale positions were longing ETH successful derivatives markets.

Ethereum [ETH] sank 4.73% implicit the past 24 hours of trading, reversing the bullish momentum which it gathered pursuing Bitcoin’s halving. The second-largest cryptocurrency was exchanging hands astatine $3,125 arsenic of this writing, according to CoinMarketCap.

The slump however, failed to power the marketplace behaviour of whale investors, arsenic the second inactive seemed bullish connected ETH’s prospects.

Whales bargain ETH’s dip

According to on-chain tracking level Spot On Chain, whales accumulated hefty magnitude of ETH successful the past 24 hours.

A peculiar wallet with code 0xe0b snapped 1,524 stETH astatine an mean terms of $3,159. With this grab, the wallet proprietor pushed their full stETH holdings beyond $10 million, earning an estimated 3.42% profit.

In a bigger purchase, a whale amassed 7,128 ETH, worthy $22 cardinal astatine prevailing prices, astatine $3,111. The affluent capitalist reportedly sat connected a immense $482 cardinal worthy of ETH stash.

As of this writing, the holder was successful a authorities of unrealized loss.

Supply held by apical addresses increase

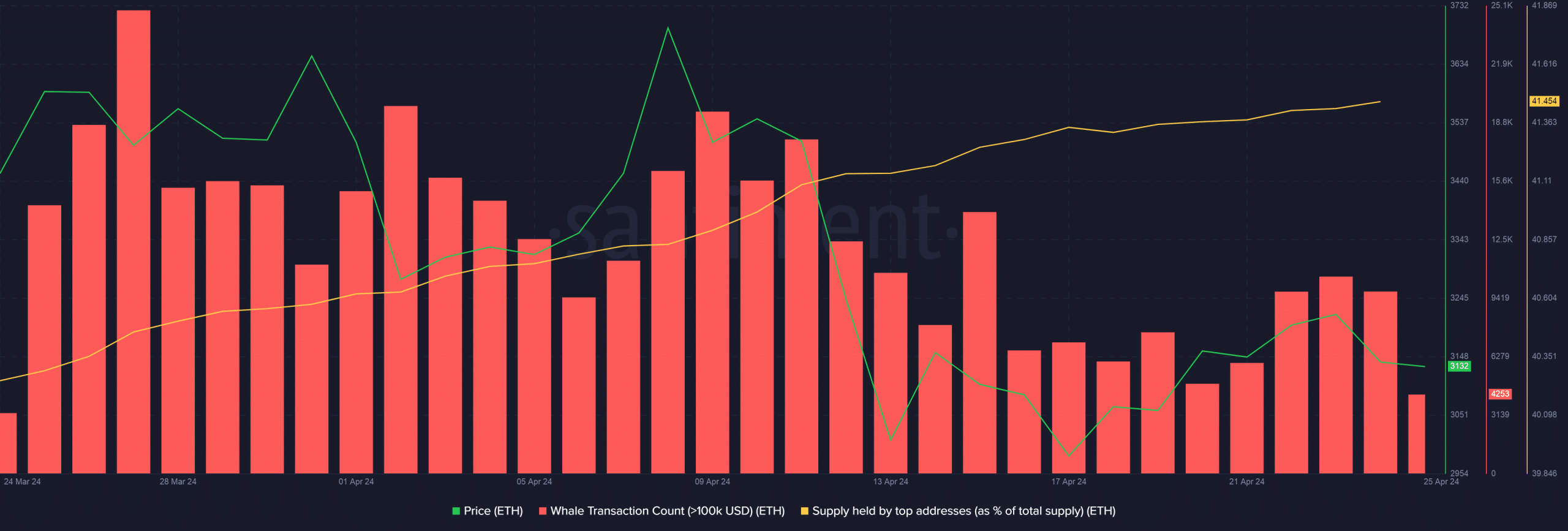

These were not isolated developments though. According to AMBCrypto’s investigation of Santiment’s data, ETH whales upped their transaction enactment successful the past 2-3 days, arsenic seen by the leap successful ample transfers exceeding $100k.

Moreover, the stock of full proviso held by apical addresses roseate from 41.37% connected the halving time to 41.45% connected the 24th of April, suggesting accumulation by whales.

Whales inactive betting connected ETH’s rise

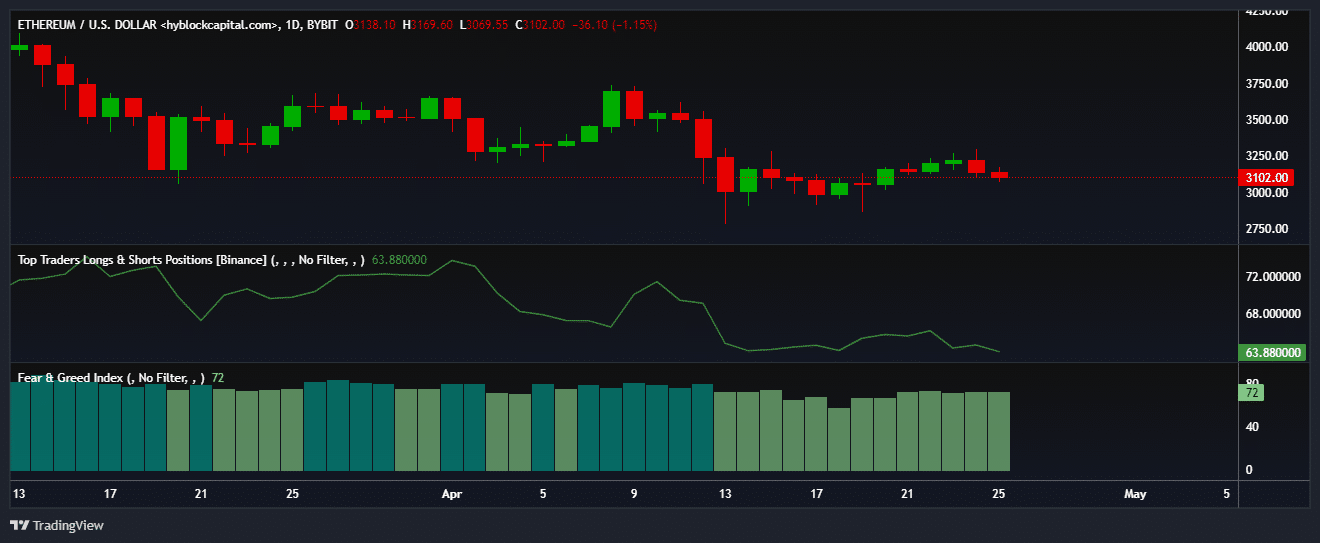

On the derivatives markets too, bulk of the whales were bullishly positioned. About 63% of the full whale positions connected Binance were agelong connected ETH, arsenic per AMBCrypto’s investigation of Hyblock Capital data.

Is your portfolio green? Check retired the ETH Profit Calculator

Though, it was worthy mentioning that the agelong vulnerability came down aft the halving.

The marketplace sentiment leaned towards greed, indicating the anticipation of summation successful buying unit successful the days to come. This could enactment ETH’s rebound successful the days ahead.

.png)

.jpg) 3 weeks ago

38

3 weeks ago

38